Buccaneer Energy: Growing Oil & Gas Producer planning to turn stranded gas into Strategic Value

Buccaneer Energy is at an intriguing juncture. With new wells in the pipeline, potential significant uplift in free cash flows, and a bold pivot into Bitcoin mining, there's clear speculative upside.

Buccaneer has just completed a £600,000 fundraise to fund its share of two new development wells in the Fouke area (East Texas). The company are also implementing a ‘Gas Monetization Strategy’ turning waste gas into strategic value by way of Bitcoin mining. At under £2M Market Cap, could this be one of the cheapest London listed Oil & Gas Producers?

Buccaneer is an onshore Oil & Gas Development and Production company with producing assets in East Texas, USA.

Pine Mills is the company's core asset and is a shallow, long-life conventional oil-producing asset with high-quality producing horizons. It covers an area of approximately 2,400 acres and has been developed through a series of production and injection wells, establishing an efficient waterflood program. The field is covered in modern 3D seismic, and the Company has an extensive technical program underway to map and develop the remaining fault blocks.

The company currently produces 120 barrels of oil per day and its assets are low OPEX, high netback, with the company currently generating some c.US$45-50k per month.

Two Well Development Programme

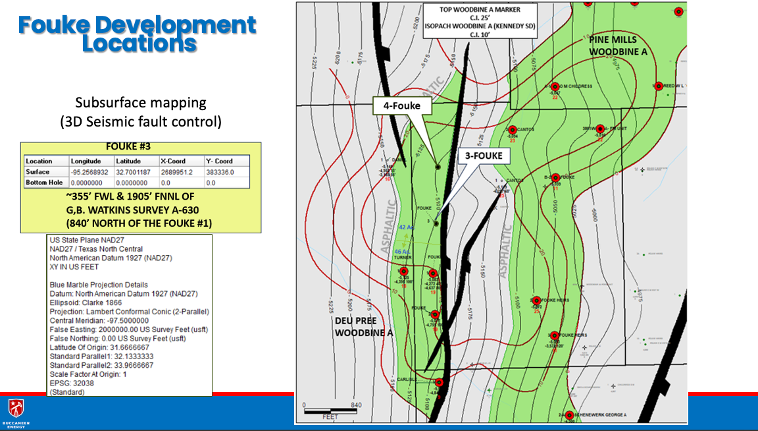

Proceeds from the fundraise mentioned earlier will be used to complete the development of the Fouke 3 & 4 wells. In 2018, 3D seismic was shot over the Pine Mills field and after interpretation revealed an isolated barrier of fault block that separated the Fouke area from the main part of the field.

Isolated fault block where Fouke wells 3 & 4 will be drilled

Isolated fault block where Fouke wells 3 & 4 will be drilled

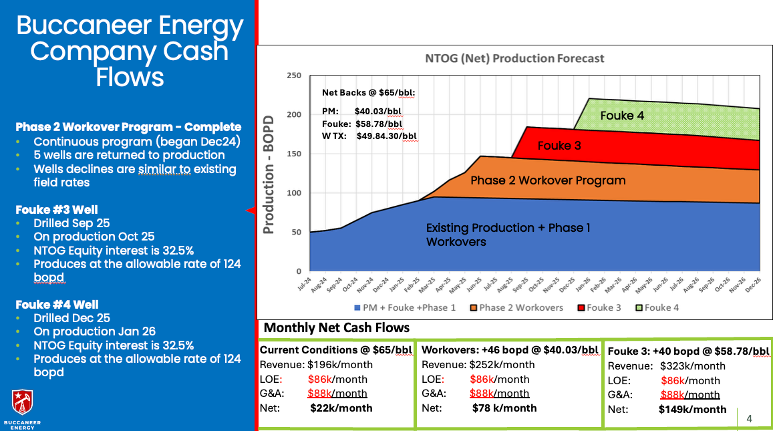

The well development programme is scheduled to start imminently with the two wells planned to be drilled in September and December 2025.

Significant uplift in FCF Generation

The addition of the Fouke 3 and 4 wells should add a significant uplift in the company's Free Cash Flow generation—given the two new wells have an extremely low OPEX of just $5 a barrel due to no water, mimicking original reservoir conditions.

Once the new wells come online, the company expects monthly FCF generation to jump up to c.US$200k a month, a significant uplift in monthly FCF. A successful well development programme and resultant uplift in FCF generation, clearly demonstrates the potential value on offer in further development of Pine Mills.

Acquisition Strategy

The company has set itself a bold strategic target of achieving 5000 bpd over the next 3-5 years which if achieved would be transformational given the company's current market cap of just under £2M. It's worth noting however that even at production rates of c.200bopd (post Fouke 3&4) the company would be generating c$US2.4M (£1.8M) in annual FCF, close to its current Market Cap!

The company's ambitious growth strategy will largely be dependent on further development of existing assets like Fouke and in making further acquisitions.

Paul Welch, CEO says that they'll be looking for value accretive assets to add to the portfolio where for example existing owners haven't spent the capital developing assets they could have or other opportunities where Buccaneer see a technical opportunity to develop an asset, especially given the development path to production is straight forwards and the infrastructure and operating environment in place, in the region.

Essentially a strategy of picking up smaller but high margin assets that can be developed which wouldn't necessarily mean much to larger operators in the region but provide material upside to a junior like Buccaneer.

Gas Monetization Strategy > Bitcoin Mining

The Fouke wells produce associated gas that’s too modest to justify a pipeline. Instead of flaring it and hurting the company's ESG credentials, Buccaneer is exploring using the gas to power on-site Bitcoin mining—a growing trend across Texas oilfields. To support this venture, the company has appointed Appold, a blockchain and digital asset advisory firm, to shape its strategy and oversee governance, risk, and potential partnership structures.

Implementing such a strategy would be a win-win for the company dealing with the issue of essentially waste gas that can be monetized.

The company will implement a Bitcoin treasury to manage its holdings which could also provide financial leverage in the future as its digital assets' holdings increase.

Bottom Line

Buccaneer Energy is indeed at an intriguing juncture. With new wells in the pipeline, potential significant uplift in free cash flows, and a bold pivot into Bitcoin mining. Whilst it's taken some time, the company have a clear path to growth and potentially achieving its target of 5000 bopd over the next 3-5 years by way of further developments and potential acquisitions.

Obviosly there are risks considering, Oil & Gas development itself can be challenging, however the Pine Mills fields are mature, and the company are operating in a well-established low-risk jurisdiction.

The company has some c.£3M of debt which it is servicing however a significant uplift in FCF generation post development and a potential move to profit in 2026 should lower its gearing and reflect positively on the share price.

In fact, If the Fouke wells deliver and the digital asset strategy materialises, this could position Buccaneer as a 'stand-out' growth opportunity in the junior Oil & Gas business and a small-cap innovator in the energy-to-blockchain space—when you consider the company's current Market Cap of just £1.9M

You can hear more about the company's strategy and its growth plans in our SmallCapPix interview with CEO, Paul Welch below.