Is this mining junior a potential take-over target?

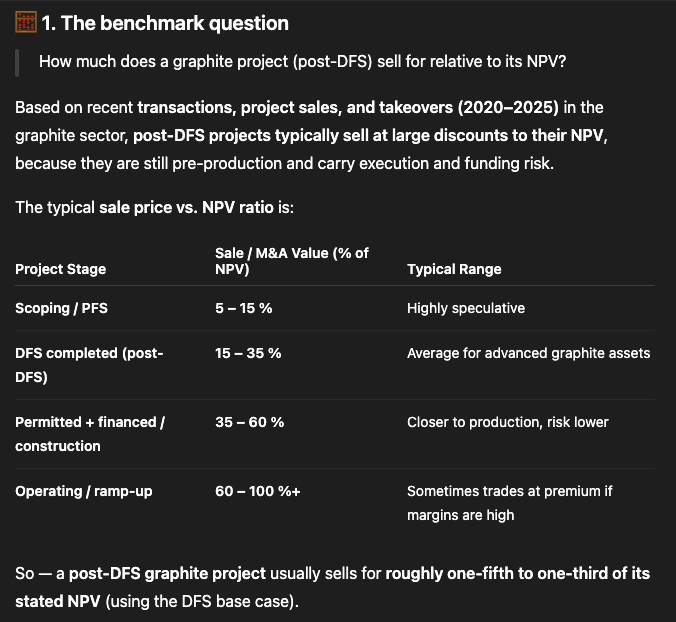

Blencowe is close to arriving at a major milestone namely its Orom-Cross graphite project DFS which could show a material uplift in its PFS NPV of $482M. With post DFS Graphite projects typically valued anywhere between 15 and 35% of the project NPV, could Blencowe and Orom-Cross be a take-over target?

Product Testing in flight

As part of the DFS programme, Blencowe has completed a significant amount of product testing with potential off takers—building on an earlier 100 tonne bulk testing programme.

Product testing in the graphite space is critical as the quality and purity of graphite can vary and off takers need to test the product before committing to binding offtake agreements

More recently, Blencowe has reported successful testing by Apollo Energy Systems Inc. showing that Orom-Cross natural flake graphite delivers 12% enhanced performance in lead-acid batteries.

This follows earlier testing by American Energy Technologies ("AETC") under the EU-funded SAFELOOP programme, where Orom-Cross graphite achieved 99.98 wt%C purity and was used to produce EV anode materials containing over 68% natural graphite—delivering exceptional performance consistency.

Blencowe's Orom-Cross Graphite Excels in SAFELOOP Product Testing

Under the SAFELOOP programme, Blencowe will enjoy an exclusive supplier role supplying natural flake graphite concentrate for all anodes used in SAFELOOP Gen3 Li-Ion batteries to be used in EV busses.

In our recent Live Spaces with CEO, Mike Ralston, Mike also mentioned Orom-Cross graphite testing is also in progress with NASA, link to recording below.

Drill Programme Results Landing

Alongside extensive product testing, Blencowe has just completed a further in-fill and step-out drilling programme to increase reserves including some exploration drilling at Camp Lode and Beehive

Results and assays are now feeding through and are providing increased confidence in the size and scale of Orom-Cross. Importantly, recent results are showing high-grade graphite near surface (up to 18.98% TGC) which will be ideal for Phase 1 production lowering early-stage production costs.

Drilling Results Summary

· Hole CLGT03: 27.54m @ 8.68% TGC, including 1.3m @ 18.98% TGC and 1.3m @ 13.46%TGC

· Hole CLGT02: 3.96m @ 9.08% TGC at depth.

· Hole L1602: 27.49m @ 8.18% TGC; including 6.4m @ 10.19% TGC and 10.95m @ 11.13%TGC

· Hole L1703: 25.39m @ 7.34% TGC, including 10.41m @ 11.27% TGC.

· Hole: L1803: 27.75m @ 5.41% TGC, including 10.89m @ 9.73%TGC from surface to 12m.

· Hole L1502: 16.26m(TW) @ 7.37% TGC from surface to 17m in depth.

· Hole L1601: 13.63m @ 6.18% TGC.

· Hole L1703: 27.49m @ 8.18% TGC, including 6.4m @ 10.19% TGC and 10.95m @ 11.13%TGC

Results confirm high-grade extensions to the orebody to the south-east.

Shallow intersections in CLGT01 and CLGT04 confirm near-surface mineralisation and potential to extend the pit to the north.

The results to date are described by the company as excellent, with further assays to come.

The results will feed into the mine planning and design allowing the company to optimise the early-stage production and reduce costs as the company then plans its ramp-up to Phase 2.

Results of the drilling will also be used to upgrade the companies JORC resource expected shortly.

DFS Completion

As mentioned in previous articles, Blencowe has spent a significant amount of money on its DFS which was partially funded by way of a grant from the US development Finance Corporation (“DFC”) to the tune of $US5M a non-dilutive funding mechanism and a first for a UK listed junior mining company, reflecting the US’s focus on critical minerals such as graphite in Africa.

It's worth noting that unlike other junior graphite mining development companies—Blencowe has performed extensive work programmes within its DFS such as critical product testing by potential end offtakers, as previously mentioned.

Any credible graphite mining company looking to secure finance and off takes will have to demonstrate product quality, scale and economics that stack up which is exactly why Blencowe have diligently paid attention to the quality of the DFS.

The DFS is expected to be complete by year-end, currently targeted early December.

This should be a truly defining moment for the company and a significant value and derisking event that opens the door to early-stage finance and production.

Offtakes

Blencowe has now signed four individual offtake MOUs for a variety of its natural flake graphite concentrate as follows:

Large Flake

Jilin New Technology Graphite Co. ("Jilin"), a prominent global graphite consumer

- MOU to supply 15,000t/annum of blended large flake graphite, covering 66% of Orom-Cross initial large flake production for up to three years from start.

- Jilin is a leading processor of battery anode materials and expandable graphite based in northeast China.

Small Flake

Apollo Energy Systems Inc. ("Apollo") based in the US, specialising in advanced lead acid battery storage systems to complement the renewable energy sector

- Initial agreement for 250 tonnes per annum of purified small flake graphite

- High Margin Product: Similar purified graphite products to what will be sold to Apollo sell in the region of US$8,000/t, highlighting substantial profitability on these sales over and above typical sale of concentrates.

Fine Flake

Qingdao TaiDa Carbon Co Ltd ("TaiDa") based in China TaiDa is one of the largest producers of Uncoated Spheronised Purified Graphite in the world.

- Supply for an initial 5,000t per year of 96% graphite concentrate for three years, with potential extension and expansion thereafter.

- Substantial Coverage of Phase 1 Production: This agreement covers 50% of initial Phase 1 of production of 10,000tpa targeted from 2026

Perpetuus Advanced Materials (PAM), based in UK

Additionally, Blencowe has signed a non-binding offtake agreement with UK graphene processor Perpetuus Advanced Materials (PAM).

The deal covers 19,000 tonnes of +97% fine flake graphite concentrate over an initial five-year term—significantly aligning with Phase 1 output plans and paving the way for ramp-up in later years.

Blencowe is also positioned to supply natural flake graphite in Europe under the SAFELOOP programme which would be transformational for Blencowe in terms of scale of offtake size.

- Exclusive Supplier Role: Orom-Cross to exclusively supply natural flake graphite concentrate for all anodes used in SAFELOOP Gen3 Li-Ion batteries, providing a high-quality source for this critical component.

- Premium Pricing: SAFELOOP pricing expected to be significantly higher for graphite than for similar concentrate sold into Asian markets.

- Large-Scale Offtakes: The programme targets up to 100,000 tonnes annually of small flake graphite at full ramp-up, providing a valuable long-term annuity income stream for Blencowe.

- Strategic Partners: Close collaboration with a European Gigafactory, EV bus OEM, and other key partners and potential funding parties, all present further opportunities for Orom-Cross.

- Green Credentials: Orom-Cross graphite to undergo EU Green Passport evaluation, enhancing other future offtake opportunities within the European and North American markets.

Significant Value Event

As mentioned earlier, the DFS should be delivered by year-end. The PFS already exhibits very attractive economics (US$482M NPV, 49% IRR, US$62M Capex) but the DFS is expected to build on this with the inclusion of an SPG processing facility (in country refining), that means Blencowe can produce “Spheronized Purified Graphite” which will offer much higher margins and should dramatically improve overall economics.

This is over and above other optimisation including enhanced mine planning to process higher grade ore and the company increasing the sale price for waste products.

Going back to the title of this blog "Is this mining junior a potential take-over target?", well quite possibly—so what could a reasonable valuation look like?

The following is AI generated and gives a guide to potential valuations:

Based upon these results and the existing PFS NPV numbers, the above suggests that post DFS—Orom-Cross could be worth anywhere between US$72-US$168M to a potential suitor.

This is based solely on the PFS numbers, with a material uplift in NPV expected in the DFS for reasons explained earlier, the higher end of the PFS valuation above could be achievable.

This could be c.5 times the value of the company today based on its current £25M market cap.

Should the DFS deliver a material uplift and the company secure early-stage finance and move towards Phase 1 production (given a 21-year production mining license already in place), any potential acquisition price could move into the next bracket (anywhere between 35-60% of project NPV)

It’s worth noting that the company has already received funding interest from the likes of the DFC and AFC (“African Finance Corporation”) along with possible funding lines coming from the likes of UK Export Finance given Blencowe’s offtake MOU with UK graphene processor Perpetuus Advanced Materials (PAM).

Blencowe Resources Inks Major UK-Based Graphite Offtake Deal

Conclusion

Blencowe has reached a value-inflection point having navigated difficult capital markets conditions over the last few years and progressed from the exploration to development stage (often a dormant period for a company and its share-price).

The DFS due to be delivered shortly is not a conclusion but rather a beginning.

Assuming the DFS delivers a positive outcome, the company is well set, with key relationships in place to secure initial finance and progress to Phase 1 production.

If the company achieves this, they will be one of a few junior listed mining companies to go ‘all the way’ and the company will be well positioned to execute its Phase 2 production ramp-up that ties in nicely with the likes of SAFELOOP and ultimately achieve its Phase 3 plan to produce high-margin SPG.

That is of course if the company has not been subject to a take-over or offer for Orom-Cross prior!

Listen to the latest X Spaces Q&A with Blencowe CEO, Mike Ralston, here