Blencowe delivers ‘Outstanding’ DFS and gears up for Phase 1 Financing

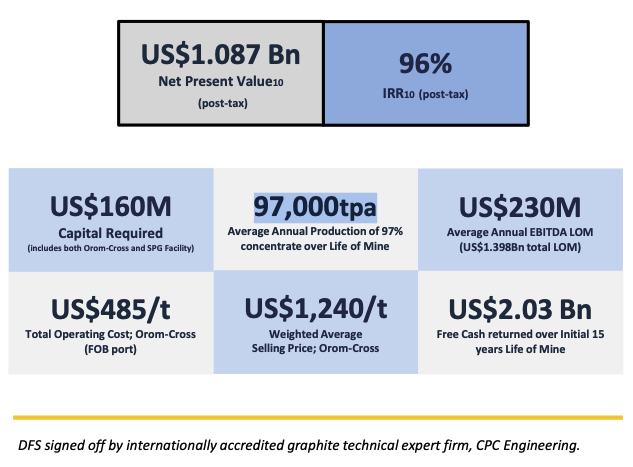

Blencowe Resources has reached a pivotal moment in its journey to becoming the next major producer of graphite worldwide with the delivery of its project DFS demonstraing outstanding economics including an NPV of nearly $1.1Bn, an IRR10 of 96% and low Capital Cost of $160M. With a phased production plan, attention now turns to phase 1 financing with multiple parties at the table.

If you’ve followed our blogs and interviews on Blencowe Resources the last couple of years, you should be well up to speed with how Blencowe is positioning itself as the next globally significant producer of graphite—notably, outside of China.

If you want to catch-up on any previous articles where we discuss the various partnerships and other news, click here to visit the SmallCapPix document library and company information page.

The last two years or so have seen Blencowe deliver all the key sub-components that form the “DFS” (Definitive Feasibility Study).

The DFS is a major milestone and importantly a major derisking step that will allow Blencowe to transition from a Developer to a Producer—a feat that not many junior mining companies achieve, for various reasons.

For those that don’t know, a DFS, (sometimes called a BFS), is the final, highest-confidence technical and economic study carried out before a mining project is funded and constructed.

The DFS allows potential financiers and/or project partners to scrutinise the project and decide on funding.

The DFS

Blencowe has delivered a truly exceptional DFS when you consider the key economics—which have been bolstered by intelligently incorporating a Micronisation process and an in-country “SPG” (Spheronised Purified Graphite) beneficiation facility.

This will be one of few facilities outside of China, and the first in Africa, creating a new supply channel for this critical mineral to Western markets.

Highlights:

- NPV10 US$1.087 Bn - lifted by 225% from PFS (NPV8 US$482M)

- Ratio of NPV to Capex is high, underlining significant returns on capital invested.

- 15-year initial life of mine with substantial upside

- Capital and Operating costs both in the lowest percentile for graphite projects worldwide

- Signed Offtake Agreements

- SPG Facility will be a nearby life of mine off taker for Orom-Cross.

- Project now significantly de-risked.

The DFS incorporates strategies that differentiate Blencowe from its peers such as Micronisation and a Downstream SPG Beneficiation facility.

Most graphite projects that produce concentrate only, will receive much lower pricing for their product and can even be sub-economic—making it near impossible to finance and move to a decision to mine.

Blencowe realised this early on in the development process and have formulated a strategy that sets them apart from peers.

Micronisation

Blencowe will further grind produced concentrate, delivering 5 niche micronized products (45/25/15/10 and 5 Microns)

This product can sell anywhere between 2-10x that of the basic concentrate with a low capital cost vs higher achieved price.

Blencowe has incorporated this process within their DFS as test-work already completed to date, has proven Orom-Cross graphite can deliver these products.

Downstream Beneficiation

Blencowe is planning to establish one of the first substantial SPG processing plants outside of China and it will be in Uganda, close to Orom-Cross.

This is only possible due to Blencowe having secured a leading Asian anode-material partner who have the expertise to implement and operate such a facility. The partner will be a 50% JV partner.

The combination of mining and operating an SPG facility in-country will deliver substantial cost savings to Orom-Cross and provide an off-take partner for some of the product, for life.

The sales price for uncoated SPG can be upwards of $2,500+/t as opposed to a basic concentrate price of c.$500/t

So, Blencowe, through extensive testing of its product and the establishment of several key relationships in the sector, has managed to extract maximum value from its DFS that would have otherwise not been possible. This is a testament to the Management team.

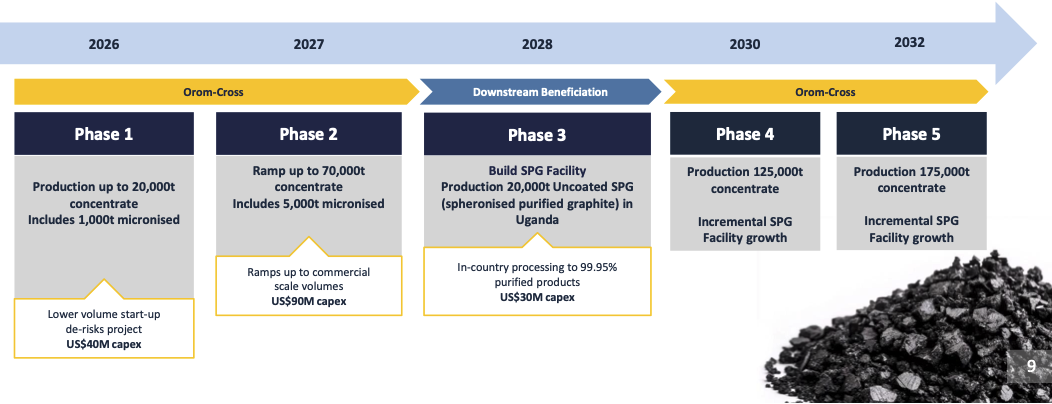

Phased Plan

Blencowe has sensibly opted for a phased production plan allowing the company to “step de-risk” the project, secure incremental finance and start generating cash-flow with later phases funded entirely from its own cash-flow.

Financing

Blencowe has already secured United States Government support via the Development Finance Corporation (“DFC”) in the form a $5M Technical Assistance grant which has been instrumental in allowing Blencowe to deliver the DFS and importantly limit equity dilution whilst doing so.

In fact, Orom-Cross is the first pre-production graphite project to be funded by the US DFC and reflects the US’s interest in securing Critical Minerals, of which graphite is one.

Under the agreement, the DFC has first rights to provide debt finance for Orom-Cross and with the DFS now in place, these discussions can commence.

Blencowe, as they have stated in their latest RNS, are now progressing funding discussions with the aim to secure Phase 1 funding by the end of Q1/2026.

As per the incremental production ramp-up plan, Blencowe will need to secure further additional debt-funding tranches and there are a number of options on the table including the DFC itself, the African Finance Corporation who have also expressed interest in funding the project, UK Export Finance given Blencowe has links to the UK with a potential graphene partner—and possibly off-take finance given the number of off-take MOU’s already in place.

Roadmap

Unlike some traditional Mining projects whereby post DFS, a mining company may have to secure full Capex of 100’s of millions in funding to build a mine giving a significant time lag from DFS to finance and production, Blencowe are executing a phased approach that not only helps further de-risk the overall project in stages but will deliver continuous milestones and news-flow to investors.

The focus now shifts to Phase 1 financing and “build”, with a view to achieving first production in H1/2027. Accompanying this, investors can expect to hear about funding partners for future phases, work on the ground, conversion of MOU’s into binding off-takes and formalisation of any of the partnerships already mentioned.

Summary

Blencowe has been ‘walking the walk’ through difficult markets, remaining focused on its goal of delivering its DFS—a major de-risking milestone that paves the way for the company to become the next major producer of graphite and related products globally.

With a project NPV of nearly $1.1Bn, an IRR10 of 96% and low Capital Cost of $160M, the project economics by any comparison are exceptional and with mining projects attracting valuations of anywhere between 15-25% post DFS, the current £35M Market Cap of Blencowe is more than compelling.

The company’s Management team has continued to deliver and the DFS now marks the start of a new era for Blencowe and its shareholders as the company look to secure Phase 1 finance, formalise partnerships and offtakes—all against the global backdrop of nations scrambling to secure supply chains of critical minerals including graphite.