From neighbour to necessity: could Alphamin need Rome?

As base and precious metals hit all-time highs, Rome Resources has commenced its second drill programme having published a Maiden Resource Estimate in late 2025 which confirms Bisie North hosts a large polymetallic system with significant tin, copper, zinc and silver

As base and precious metals hit all-time highs, Rome Resources has commenced its second drill programme having published a Maiden Resource Estimate in late 2025 which confirms Bisie North hosts a large polymetallic system with significant tin, copper, zinc and silver.

The company are targeting wider tin zones following the proven Alphamin style model. In fact, Rome is operating on the doorstep of neighbour Alphaminin—the largest high-grade tin producer globally, in the DRC.

Maiden Resource Delivered

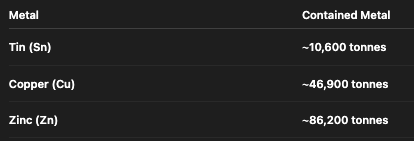

Rome delivered its Maiden Resource Estimate (MRE) late last year following its initial drilling campaign at Kalayi and Mont Agoma, part of the Bisie North Project.

Maiden Resource Estimate (MRE)

This maiden estimate confirms that Bisie North hosts a large, polymetallic system with significant tin, copper, zinc and silver — reflecting early drilling at the Kalayi and Mont Agoma prospects and supporting further drilling to expand the resource.

Second Drill Programme to Increase Resource

Drilling Deeper at Kalayi

Rome's second drill programme (2000 meters +) is now underway with the aim to drill deeper at both prospects. At Mont Agoma, the polymetallic system, the plan is to drill deeper below the copper to hit the expected tin zone. At Kalayi, Rome's pure tin-play prospect, initial drilling has already encountered high grade tin intercepts, and the plan is to also go deeper looking for wider intercepts, representative of the Geology at Alphamin’s high grade tin projects.

Drilling is expected to be completed towards the end of March with assays to follow approximately one month later at which point the company can update the sub-surface model and resource estimate, expected around May 2026.

In parallel, the company will be doing metallurgical test work to determine the best route for processing—given Mont Agoma is a polymetallic system with distinct metals such as Copper, Tin, Zinc and Silver. The overarching aim of the test-work is to show a route to monetising these discrete metals individually.

Next Steps

As the company progress the drilling and complete metallurgical test-work, they'll be having discussions with potential offtake partners and strategic investors.

The company expect that following the drill programme, metallurgical test-work, delivery of assays and an updated resource estimate— slated for late summer, it should be able to determine the next steps strategically—which could result in strategic investment, JV/Partnership or even outright sale of one or both of the projects. All options are on the table.

When it comes to deal-making, It's also worth noting, Non-Executive Chairman, Klaus Eckhof's position on the board of Rome.

Klaus is a geologist with more than 30 year’s experience identifying, exploring and developing mineral deposits around the world. Klaus also has extensive experience of the DRC where he founded, in late 2003, Moto Goldmines, which acquired the Moto Gold Project in the DRC. Moto Goldmines was subsequently acquired by Randgold Resources for $488m!.

Klaus was also instrumental in, facilitating the acquisition of the Bisie Tin Project in the DRC by Alphamin Resources, now the highest-grade producing tin mine in the world with Alphamin capped at over $1bn.

Tailwinds

As mentioned at the start of the article, base and precious metals have had a sterling run largely based upon a weakening dollar but importantly for the likes of copper and tin, a structural supply and demand imbalance driven by years of under investment in mining and the concerns around sourcing critical minerals.

In fact, the US just recently declared the sourcing of processed minerals a National Security issue. Will the run continue, who knows? but junior miners and explorers like Rome are now sitting on much higher valuations of metal in the ground,—at today’s prices, Rome's suite of metals equate to c.$1.5 billion of value in the ground, with an increased resource likely to substantially increase that figure.

Final Thoughts

Going back to the title of this article, could Alphamin need Rome? Well maybe not right now, but if they want to keep shareholders happy and maintain long-term dividends then they'll need to look at extending their mine life which is c.7-8 years.

With Rome right on their doorstep and in the early stages of defining a significant Tin resource—that could possibly be put through Alphamin's plant, a joint venture between Alphamin and Rome could well suit both parties and certainly provide an uplift in Rome's share price given the company is currently capped at just £17M

Regardless, there is plenty of news flow to come now the company has started its latest fully funded drill programme with results expected near-term and an all-important updated MRE that paves the way to finalising discussions with potential partners.

Listen to our latest interview with CEO, Paul Barrett below