Helium: An increasingly rare commodity with limited investment options – here’s three UK plays.

Helium, the only element on earth that is completely non-renewable is becoming increasingly scarce, here are three UK market listed options that can provide exposure to this niche and potentially lucrative market.

Helium – Why do we need it ?

If you asked someone what helium was they’d probably tell you its that stuff you put in balloons and makes your voice go funny if you inhale it! That’s true! But helium has many more uses some which are critical to you an I.

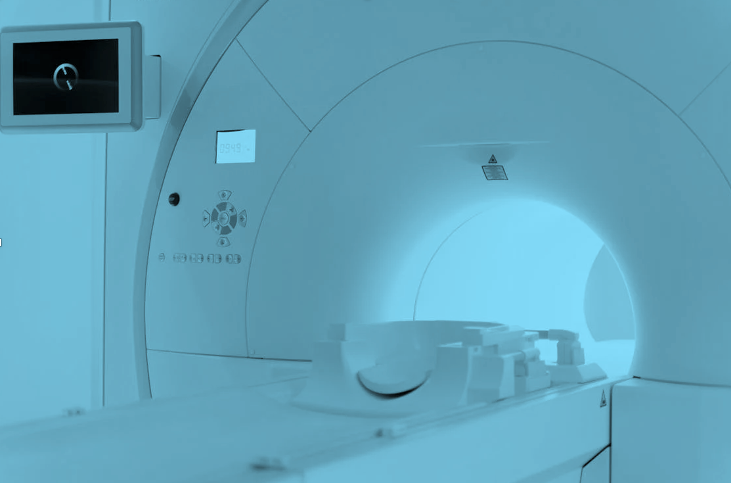

Helium has numerous applications. It’s widely used in cryogenics for cooling superconducting magnets in MRI machines and other medical equipment. It’s also used in the aerospace industry for purging and pressurizing fuel tanks, in electronics manufacturing for cooling semiconductors, in welding processes, and even in scientific research.

Its use in MRI Scanners and Cryogenics accounts for some 30% of its overall usage. Helium can be ‘super cooled’ to -269 Celsius — almost 500 degrees below zero Fahrenheit — making it a critical tool for lowering the temperature of wires and magnets to the point where they become superconductors. It’s this that allows MRI scanners to produce imaging to a level that X-Rays and CT scanners can’t.

The above usage alone is enough to create a cause for concern over the future supply of helium. As I said before, it’s a non-renewable element and with global reserves rapidly depleting it will rely upon further discoveries whereby it’s commonly extracted as a by-product of natural gas extraction.

Helium is challenging to extract and transport (‘the escape artist’) and is commonly converted into liquid form however there is a time-frame of some c.30 days or so, whereby if it’s not delivered can evaporate if not insulated sufficiently to prevent ‘boil-off’

So with global reserves depleting (the US, Qatar and Russia controlling the largest reserves) and with political tensions further impacting supply concerns, Helium Exploration and Development companies look to be a good place to get some exposure.

Helium Market

Significant market changes, including the shutdown of the U.S. Helium Reserve and the geopolitical risk to the producers in eastern parts of the globe, have driven an explosion of interest in exploring for and developing helium reserves (three of which we’ll talk briefly about shortly).

Due to its unique properties and the rapidly expanding uses, the demand for helium is continuing to grow. The global market for this non-renewable resource is set to increase, even by a conservative estimate, at a compound annual growth rate (CAGR) of over 6.5 percent by 2025 (source: Eight Capital & USGS)

Pricing

I’ve written a few blogs on the graphite market and much like graphite, helium pricing is not particularly transparent with most pricing contracts negotiated individually and subject to NDA’s.

The United States Geological Survey (USGS) estimates however recent pricing contracts for helium of anywhere between $300/mcf to $800/mcf, much depends on individual circumstances such as extraction, logistics and storage but pricing can typically be around 100x current US natural gas pricing.

So we know we need helium and the market demand is growing YoY, the supply has flat-lined and bar a trip to the moon to extract more helium (no joke, the moon has an abundance of it) how will the demand/supply gap be met? We’ll need to discover more of it so let’s look at three UK listed options at slightly different stages for possible ways to get exposure to the niche commodity.

Helium 1 (LSE:HE1) – Market Cap (£50M)

Helium 1 are an AIM UK listed Helium exploration company with their main operations in Tanzania. The Rukwa project (within the Rukwa Rift Basin) is their primary focus with the company holding 12 prospecting licenses covering an area of approx.1,899km2.

According to the company, Rukwa hosts independently verified (SRK-2020) Best-Estimate Unrisked Prospective Recoverable Helium Resource (2U/P50) of 138Bcf, this may not seem a particularly large resource to O&G investors but for helium it is. Furthermore, Helium 1 report that the helium/gas mix is helium/nitrogen, this makes for cleaner extraction.

The company commenced their initial drilling at the Tai-3 well late 2023. Whilst helium shows were present the company weren’t able to run the wireline tools deeper into the prospect where they believe larger concentrations of helium exist and as such the existing well was cased and suspended with a view to returning at a later date and do further drilling.

Fortunes have take a turn for the better since initial drilling at Tai-3 with a discovery at their second well Itumbula. The company reported helium concentrations of 4.7% flowing to surface. Whilst early days, the company believe work at both wells and the success at Itumbula confirm the presence of a producing helium province at Rukuwa.

The company have raised a hefty chunk of cash over the last 6 months (around £10m) via two discounted placements which might be why the share price is close to lows despite the apparent success. That said the dilution effect still leaves them at c.£50M cap which is probably fair.

The company is planning a further drilling campaign for early Q3/2024 which will be an extended well test on Itumbula so this should create some excitement around the company in the build-up to drilling.

Helix Exploration (LSE:HEX) – Market Cap £12M

Helix is a particularly exciting Helium play for a number of reasons.

The company are a relatively new entrant to the market having IPO’d this year. The company initially sought £7.5m but this was well over-subscribed to the tune of a potential £22 Million on offer, however the company stuck with the initial amount sought to minimise dilution and keep a ‘tight’ book, especially give the current market back-drop. The company has a post IPO Market Cap of around £12M.

Helix are arguably a more advanced play than Helium 1 in that their projects are in development stage (with plenty of further exploration opportunity also I must add). The Helium projects are located in Montana, USA along the ‘Montana Helium Fairway’. This is a fantastic location in terms of risk profile and locality to end consumers with a substantial un-risked prospective P50 helium resource base of 2.3bcf.

Historic drilling/testing has identified gas in all target reservoirs and the company are planning an appraisal drilling campaign for Q3/2024 on stacked reservoir targets.

Should the appraisal drilling campaign be a success, the company have plans to take the project to production building a local processing plant delivering -55,000Mcf per annum. As I mentioned earlier, Helium can sell for up to $800Mcf, although bulk supply pricing can exceed this. Helix will target sales to Tier2 distributors by-passing industrial majors to ensure best pricing for Helix.

The company estimate a timeline of just 12 months from appraisal success to first gas production. As investors that’s a huge re-rate potential in a very short timeframe!

Lastly, it’s worth mentioning the Management Team, the team is very strong with a wealth of experience within the Helium space from Chairman David Minchin to CEO, Bo Sears who lead the Mankota Project, Canada’s first Grade A helium Operation.

Georgina Energy (IPO) £8.5 Million (estimated)

Last but not least there is Georgina Energy. Georgina is currently a private company that will list on the junior London market by way of an RTO (Reverse Take Over) shortly.

Georgina is focused on two helium/hydrogen projects in Australia, Mount Winter and Hussar. Both projects have been drilled and confirmed hydrocarbon shows. Georgina’s plan is to further drill these targets looking at the potential for re-entry and deeper drilling along with seismic acquisition to better understand the prospects and drilling options.

Mt Winter project (right to earn up to 90% interest)

The interest here is for Georgina to extend drilling beneath the sub-salt reservoir. The area above this encountered hydrocarbons but the real prize could be what’s underneath given Mt Kitty within the same basin encountered 9% He (possibly the highest known concentration of helium in an exploration well to date) and Magee-1 (6.2%) in the sub-salt reservoir, Georgina will be targeting. Very high concentrations of Hydrogen have also been encountered in the same target area.

Independent consultants have estimated un-risked 2U Prospective (Recoverable) Resources of 148 BCFG (148 million MCF) of Helium and 135 BCFG (135 million MCF) of Hydrogen, and 1.22 TCFGE (Trillion Cubic Feet Equivalent) of gaseous Hydrocarbons in the Mt Winter Prospect within the sub-salt reservoir targeted. So this is a potentially HUGE prize.

Hussar Project (100% interest)

Located in the ‘Officer’ basin, Western Australia, a previous exploration well here drilled into the thick salt seal above the reservoir showing high gas readings and oil shows confirming the presence of a working petroleum system.

Independent consultants have estimated un-risked 2U Prospective (Recoverable) Resources of 155 BCFG (155 million MCF) of Helium and 173 BCFG (173 million MCF) of Hydrogen, and 1.75 TCFGE (Trillion Cubic Feet Equivalent) of gaseous Hydrocarbons in the Hussar Prospect within the sub-salt reservoir target, another potentially huge prize.

Again, the interest here is further drilling with the possibility of a side-track or deepening of the well.

The work planned by Georgina is akin to Helix in that the planned activities are well development, with the hope of confirming and exploiting a significant helium/hydrogen resource.

Conclusion

In this blog, I’ve highlighted three UK listed Helium plays at different stages with each having a different risk profile. Helium One was first to the party and has generated a lot of interest in the Market. My guess is the likes of Helix and Georgina will generate similar levels of interest especially given they are both operating in much more stable jurisdictions and both have potentially huge resources.

Helix seems a stand-out opportunity as I write given the resource, near-term production potential and strong Management team with Georgina also looking like an interesting opportunity being the lower capped of the three.

Upside potential for both Helix and Georgina could be significant from current levels given other market peer valuations including Helium One and the fact both will be embarking on high-impact drilling programmes in 2024.

Helium looks to be a great space to be investing in going forwards due to the market supply and demand dynamics and the premium pricing helium commands against its other Oil & Gas counterparts.