Goldstone: Recovery play in a rising gold market?

It’s been a torrid time for Goldstone investors over the last few years with the company in a period of suspension, but they’ve come out the other side so at a beaten down market cap that traded 14x higher, high quality gold assets is this gold producer a potential recovery play?

Since I wrote my original research note on Goldstone Resources, it’s been nothing short of a rollercoaster ride for investors. The share-price as they entered production rose from c.1p to a high of around 14.5p. That’s a huge return from the lows when I first picked up on the company.

Sadly the stock trades today at sub 1p, however early investors would have had the opportunity to get their initial investment out and a healthy return on top with a free-ride.

Much the same can be said about many other stocks I have covered and 100’s of other AIM listed companies I haven’t. This is why its important to protect capital, take profit and then evaluate whether you should continue holding a stock that is facing headwinds or wait for a moment that looks right to re-invest or increase your holding.

The reason for this blog, since I haven’t covered the company in over a year is that Goldstone may just now be at this point. I’ll explain the history, where the company is now and what the future might look like.

Before I do, I’d point out that what first attracted me to the company is their assets and this holds true, even more so now with the current gold price where it is, than it did back then.

They have two quality gold assets in Ghana, Homase and Akrokeri, Homase being the current focus and producing mine with Akrokeri as the potential elephant in the room which I’ll explain more on later, so here goes, I’ll get you up to speed with things based on recent conversations I have had with the board and information in the public domain and then you can decide if there is some potential from what looks like, ground floor entry…

History – What went wrong?

Rewinding back a few years to 2021, Goldstone were approaching the stage where they were about to start production having built the mine, procured equipment, developed the mining flow-sheets and readying the ship to start gold production.

This whole year was a challenge for Goldstone as we were in the midst of the Covid pandemic which had dramatically slowed things down, however, the company pushed on to finally achieve first gold pour in November 2021.

The company had intended to lease an elution and smelt facility however they were let down on this and actually had to construct their own, which they did and in just 6 weeks. This was quite a remarkable achievement and meant they could start pouring gold.

Throughout the remainder of 2022 and into 2023 it became apparent that their were issues with gold recoveries. I won’t bore you with in depth details but I understand the crux of the issue was with the mineralogy, the agglomeration and not having the right equipment for the heap leach processing approach designed by the engineering company involved.

With much lower recoveries than expected and astronomically high-costs due to Covid (things like the cost of energy and chemicals/materials etc) the company could not produce enough FCF without increasing debt, and debt they already had in the form of a gold loan that had provided the Capex required to bring the mine on-line.

So since, 2022 the company had been struggling to keep their head above water until they could find a solution to increase recoveries, pay off the debt and become self-sufficient. Luckily for the company, a key investor AIMS has continually extended the gold loan terms and even provided further cash to the company to avoid default and ultimately de-listing which would have been the end-game for shareholders.

In summary, the company could not have tried to bring a gold mine into production at a worse time given the pandemic and Russia invading Ukraine causing serious headwinds that would have affected any company in a similar situation. That said, mistakes were made, the mine process wasn’t right adding to a big miss on gold production estimates. The company acknowledges this and has been working on a plan to put this right and protect shareholders and hopefully given the current gold market, turn the ship around.

Where are they Now?

After a long period of suspension, the company have just recently announced a fundraise of just shy of £1m that can allow the company to remain listed under FCA rules, maintain current production and meet current creditor obligations.

This is good news for shareholders, obviously many have seen a huge loss in their holdings over the last year or two but the fact the company remains listed and has a turn-around plan means investors (like me) haven’t lost everything. The crux though is can the company turn this around and if so, does this make Goldstone now trading at just £4.5m Market Cap an interesting turn-around play, given their assets including the licenses, the gold mines (600Koz JORC Resource), equipment, gold production and a credible plan for increasing production?

The Plan and Way Forwards

This is the critical part of this blog and why I am writing it, If I didn’t believe there was a way forwards I wouldn’t be writing it. I could well be wrong, but here is the plan as I understand it and I factor this in with gold being in a bull market, the fact the company are a producer and that the assets offer huge upside potential, always have!

In fact, not many know this but Anglo Gold Ashanti previously owned Homase and left it when gold was trading at just $275oz – them giving up the asset back in 2003 was like selling your countries gold reserves at the bottom of the market – now do we know anyone who did that !

Obviously with gold now trading around $2,300oz these assets are hugely commercial even at just 1g/t

Risks

The key risk of course is the company remaining solvent. They have debts that need to be paid (not huge, amounting to approx £6m) however creditors have been supportive up until now and Goldstone believe that with funds raised and production these obligations can be met.

Production

The company this year have produced over 1000oz of gold (including whilst being in the period of suspension) and expect to produce at least 230oz of gold per month at current run rate, however they plan to steadily increase this by bringing on-line an additional plant supported by the fundraise and cash-flow generation.

The important point to note is that recoveries have improved, up to around 65% from the lows of 35% and with an additional plant coming on-line should further increase gold recoveries and production. At this stage it’s a case of ‘baby-steps’ but reaching self-sufficiency and lowering costs would mark a turn-around.

The immediate focus then from here-on is on expansion.

Expansion

There is plenty of gold at Homase waiting to be mined and processed and lessons learned mean that Goldstone can now start better exploiting this. The key for the company will be to increase throughput to lower AISC and increase production therefore increasing FCF.

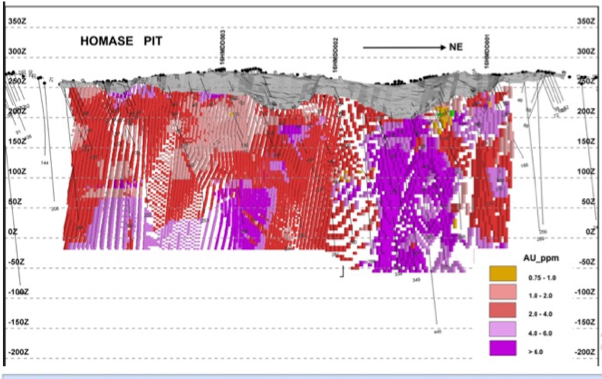

The interesting angle here is that Goldstone plan to exploit the fresh-ore below the oxide cap they are currently mining, why, well because the gold here grades at more than 6g/t and tapping into that would dramatically increase production and lower cost. The image below shows the target ore which can be accessed by pit widening or going in under-ground, this approach is yet to be determined.

Purple areas show target gold with grades >6g/t

Gold at 6g/t is considered very high grade so if Goldstone can get into this area and start mining the higher grade (non refractory ore) the company should be able to quickly increase FCF which then allows for even more organic growth and the potential to re-visit Akrokeri where the board believe the historic head grade mined was an average of 24g/t.

Exploration

As well as being a producer with the capability to expand production, Goldstone is also a brownfield exploration play with plenty of scope to expand the current 600Koz JORC Resource.

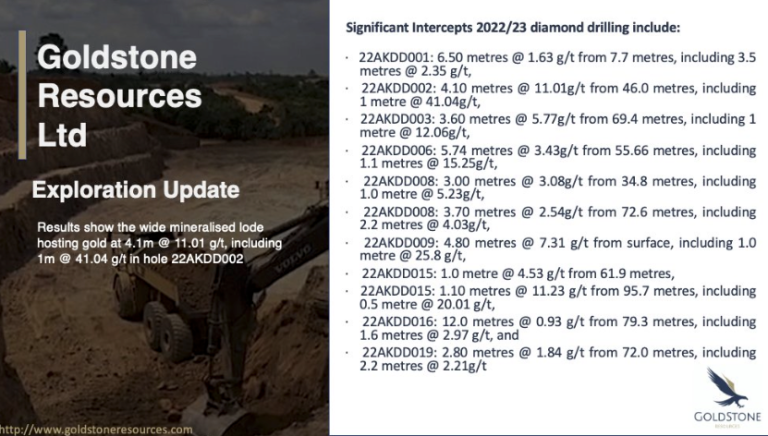

In fact the company started re-drilling Akrokeri early 2023 with some outstanding results (below). So, if Goldstone can get back into Akrokeri there may be an option to start mining Akrokeri in the the not too distant future. I would however expect Goldstone to partner up with someone to do this if they wanted to expedite this.

Summary

So, I’ve done a fair bit of digging into the what, why and how of what’s been going on at Goldstone. Some of the problems have been self inflicted but many have not. What I do believe though is that the company could have easily of gone to the wall but it hasn’t and I believe that’s because the assets Goldstone have are hugely valuable and it seems the largest shareholder who has been continually backing the company does too.

Having had regular contact with the company I have certainly sensed political under-currents which now seem to be resolved by way of recent Directorate changes.

The investment case here is that you can invest in a producing gold company that have a lot of gold and high grade gold at that for just £4.5m Market Cap. So if the company can extract that gold in inefficient manner, divert their FCF into expansion and exploration whilst steadily increasing production then it could well be buy of the century given gold is trading at highs and looking to be in a bull market.

If you are interested in Goldstone it’s worth following the twitter account where information on Homase/Akrokeri and operations is regularly posted https://twitter.com/GoldstoneRes