Goldstone: Further Progress at Homase with ramp-up plan to achieve 1,000oz of gold pcm by 2025

Goldstone continue the turn-around at its Homase gold project in Ghana with the development of additional heap leach pads. In addition, the company have announced the issue of Director Options based on key milestones and further progress

In my last blog on Goldstone, I outlined how the company could be an interesting recovery play from its current valuation given the company now has a clear plan to ramp up production at its producing Homase mine, whilst offering investors further expansion and significant exploration upside. The share-price has since more than doubled but I reckon that’s just the start.

To quickly re-cap, the company have two gold projects in Ghana, the first Homase which is currently producing and the second Akrokeri where re-drilling in early 2023 produced some outstanding results showing very high grades at depth. In fact, Akrokeri produced 75,000oz of gold at an average recovered grade of 24g/t back in the early 1900’s

Progress

Following difficulties for the company over the last year or so (as detailed in my last blog) and lessons learned, the company are now rapidly progressing their turn-around plan at Homase having sorted out recovery rates that are now yielding progressively larger gold pours.

In addition, the company have announced ‘solid progress’ with development of additional heap leach pads with pad 4 now complete and pads 5,6 and 7 advancing on schedule and within budget.

The development of the additional leach pads is essential to the company achieving its target of stacking and agglomerating the 50,000/t of ore to support the target 1,000oz of gold production pcm.

This is great progress given the company were ‘stuck’ this time last year having to sort out recoveries before they could ramp-up production.

Director Alignment

The company have also recently announced an Options package for Directors and Senior Managers. I see this as a huge plus for a couple of reasons.

Firstly, Goldstone have had limited cash so have had to keep a ‘lean machine’ in terms of remuneration, however that is a double edged sword if you want to retain the right people.

Secondly, the Options package is milestone aligned.

This means, the company can reward its Board and Management team whilst directing cash to the right place (expansion of Homase). The options as I said are also milestone aligned so only vest when the company hits certain milestones such as when gold production increases to over 650oz per month and when the company reduces its AISC to the target level.

I like this approach and that it further aligns the Board with shareholders, not forgetting Management have a significant holding in the company anyway!

Expansion Upside

There is plenty of gold at Homase waiting to be mined and processed and lessons learned mean that Goldstone can now start better exploiting this.

On that note, CEO, Emma Priestley has mentioned plans to exploit the fresh-ore below the oxide cap they are currently mining. Why? well because the gold here grades at more than 6g/t and tapping into that would dramatically increase production and lower overall cost.

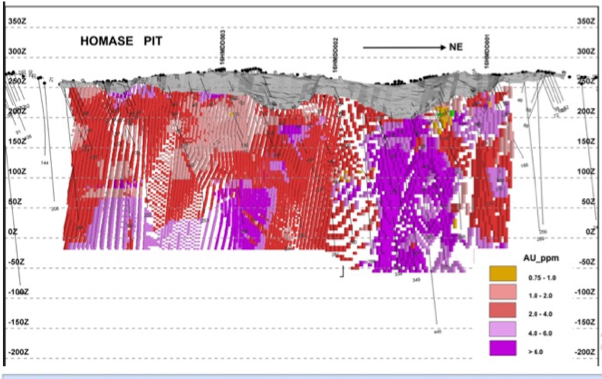

The image below shows the target ore which can be accessed by pit widening or going in under-ground, this approach is yet to be determined but the company are working on this and hopefully we’ll get to hear what the plan is shortly.

Purple areas show target gold with grades >6g/t

Gold at 6g/t is considered very high grade so if Goldstone can get into this area and start mining the higher grade (non refractory ore) the company should be able to quickly increase FCF which then allows for even more organic growth and the potential to re-visit Akrokeri where the board believe the historic head grade mined was an average of 24g/t.

Summary

Given the history and problems with recoveries at Homase, the share price has been hammered over the last year or two. Investors often remember the problems rather than the opportunity should those problems be dealt with.

Goldstone are clearly ‘turning the ship around’ . Recoveries have been dealt with which now opens the door for expansion and the company are making sterling progress in this regard bringing another 4 heap leach pads on-line. This in turn will allow them to achieve their initial target of 1,000oz pcm.

If you then consider the plan to go into the fresh ore below the oxide cap that grades at 6g/t the company could be producing considerably more than this and at a much lower cost.

Goldstone as well as being a producer is a brownfield exploration play too with additional targets on the Homase trend and of course Akrokeri.

Eagle-eyed investors may also have spotted that in the last two RNS the company have stated their intention being: ‘it is the Company’s intention to build a portfolio of high-quality gold projects in Ghana, with a particular focus on the highly prospective Ashanti Gold Belt.‘ – perhaps we could see further company expansion by way of acquisitions of partnerships say on Akrokeri?

If you are interested in Goldstone it’s worth following the twitter account where information on Homase/Akrokeri and operations is regularly posted https://twitter.com/GoldstoneRes