Firering Strategic Minerals

With a strategic shift toward quicklime production, guided by a strong copper-aligned market, Firering is set to supply Zambia’s booming copperbelt this quarter.

For the past few years, Firering Strategic Minerals (FRG) have primarily been known for their exploration activities at the Atex Lithium & Tantalum Project in Cote d'Ivoire. However, with faltering Lithium prices, last summer they pulled off a deal that went relatively unnoticed, but would change the trajectory, and fortunes of the company, immeasurably. The acquisition in question was for a 20.5% stake in Limeco, Zambia.

Limeco, Zambia – An Overview

Limeco, an ex-Glencore Quicklime project, was initially built to supply Quicklime to their nearby copper plant. However, having moved out of Zambia with the closure of the Copper plant, Glencore only fired up one of the eight fully constructed kilns before suspending operations and divesting to a local vendor, now Firering's counterparty. FRG has taken a 20.5% stake in the project but has an SPA & option agreement in place to acquire 45%.

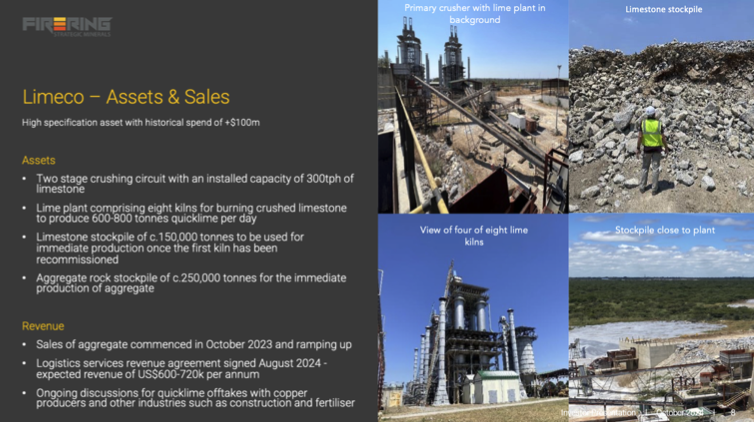

Limeco is a fully constructed, fully permitted, near-term plant made up of eight kilns for burning crushed limestone to produce 600-800 tonnes of Quicklime per day. Situated next to the kiln complex is a Limestone stockpile of c.150,000 tonnes for immediate production once the first kiln has been recommissioned. This stockpile has in itself a value of $33-35m once processed. In addition, there is an aggregate rock stockpile of c.250,000 tonnes for at “the gate sales” (recent re-appraisal has upgraded this from a waste pile to one of significant material quality & value).

Adjacent to the main plant is a quarry with an in situ mineral resource of 73.7Mt @ 95.3% CaCO and a 30-year lifespan. Although, as per the RNS dated 3rd September 2024 an additional license area has been permitted and has the potential to upgrade and double the resource to a 60-year lifespan and the MRE by an extra 60-70mt of similar-grade material.

There is also scope for significant increases to the resource estimates with further mining activity, as the primary asset has only been quarried to a depth of 80 metres. A ballpark NPV of $100-150m has been floated but has to be firmed up with pricing from upcoming offtake agreements. It’s worth noting that the offtake partners have confirmed the commercial quality of the material they’ve assessed and negotiations are in advanced stages.

At full capacity, FRG is set to produce 600-800 tonnes of quicklime daily by Q3 2025. To contextualise, quicklime prices have ranged from US$160 to US$218 per tonne over the past 2 years, so at a mid-forecast price of $180 p/t and production of 700 tonnes per day revenues of $46,000,000 pa could be achievable from Quicklime production alone.

Limeco, Zambia - Commissioning and Production Timeline:

Since the acquisition, FRG has worked steadily and efficiently to commission the plant with the aim of going into Quicklime production by the end of 2024. A year on, that timeline hasn’t changed. Primary commissioning of the two-stage crushers was completed toward the end of last year, and further modifications to the crushing plant to enhance the correct limestone size fraction for the kilns and the production of aggregate from its waste stream were concluded this summer.

Other key improvements have been added throughout the year, but the most ambitious and time-consuming task has been to transition the plant away from its reliance on heavy fuel oil to the far greener and more economical power source of coal gasification. With groundworks completed and much of the equipment on site, the final stage before production can begin is the commissioning of the coal gasifier. With this completed, FRG should be on track to fire up the first kilns later this quarter.

Atex Project, North-West Cote d'Ivoire

It is worthwhile to note FRG’s other key asset, of which they hold a 90% interest in the licence, focussing on both lithium & tantalum-niobium.

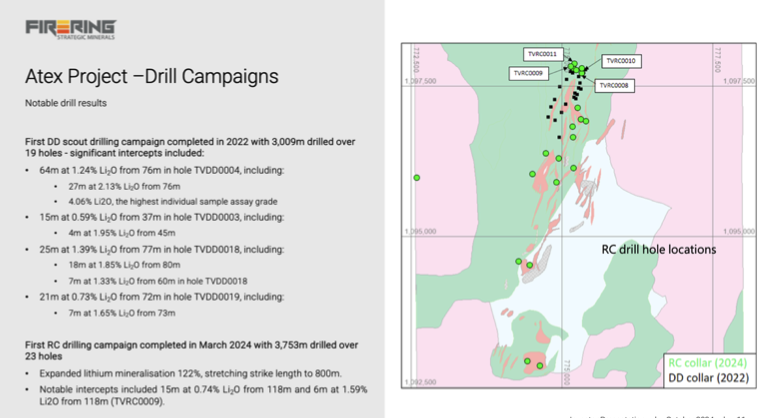

The site is well positioned with access by air, high-quality road and rail, as well as by the Ports of San Pedro & Abidjan. The first DD scout drilling campaign was completed in 2022 with 3,009m drilled over 19 holes. The first RC drilling campaign was completed in March 2024 with 8,753m drilled over 23 holes (See accompanying slide for grades)

FRG – Generating Revenues:

Operationally FRG are already cashflow positive even before the first kilns are fired up, and they have done this in a very astute manner.

With aggregate stockpiles of some 250,000 tonnes and more produced during the commissioning of the crushers, FRG has been selling aggregate “at the gate” for the best part of a year and has aggregate offtake agreements drawn up.

Aside from this, the recently redundant heavy fuel tanks have been leased and equipment from Glencore’s historical $104m spend is currently generating revenue. As per the RNS Aug 2024, FRG has entered into a 2-year agreement providing expected revenue of $600,000- $720,000 per annum. It is also worth noting that due to the Limeco acquisition, FRG has a significant tax umbrella in place.

Why Quicklime? Why FRG?

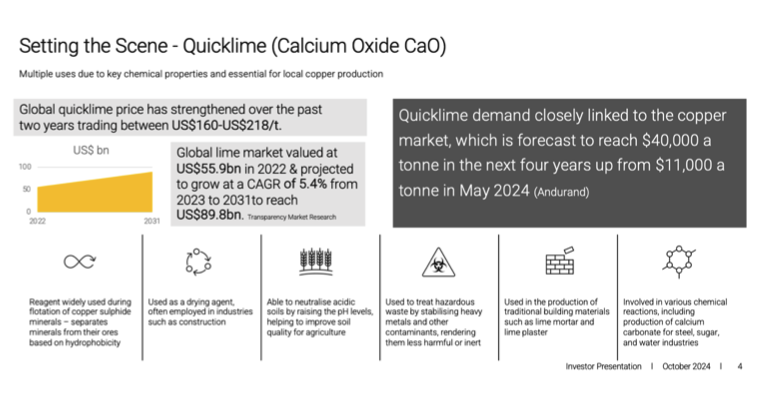

Quicklime has a wide range of applications, as an agricultural fertiliser, in the chemical industry & crucially it has key chemical properties that make it essential for copper production. Lime is used to adjust the pH of ore processing solutions, optimising conditions for copper extraction and is also a tremendous remover of impurities, therefore improving the quality and purity of extracted copper.

The global quicklime price has strengthened over the past 2 years, trading between $160-$218/tonne, and the global lime market, valued at $55.9bn in 2022, is projected to grow at a CAGR of 5.4% from 2023 to 2031 to reach $89.8bn. Quicklime demand and pricing are closely linked to the copper market, which is forecast to reach $40,000 a tonne in the next 4 years, up from $11,000 a tonne in May 2024.

FRG already has direct & extensive experience in Quicklime production due to strong BOD connections with NEGEV Minerals (one of Israel's largest Quicklime producers). CEO Yuval Cohen is highly experienced boots on the ground in Zambia, and they have a small but focused team in place.

Risk Factors:

Normally this is a much lengthier section to any investment case, however, the fast-tracked nature of the project, the fact the plant is fully constructed, permitted and funded, and the relatively simple process of Quicklime production make FRG all rather low-risk.

The primary pitfalls appear to sit with Quicklime prices and potentially unforeseen geopolitical events in Zambia and the surrounding jurisdictions. However, with lime prices heavily influenced by the copper market and Zambia a relatively safe jurisdiction focused on developing its copper industry, I’d say these risks are manageable.

Investors have expressed concerns about further fundraises to fulfil the necessary payments to increase the FRG stake in Limeco to 45%, however, as production ramps up and revenue increases, so does the access to debt facilities, and in my opinion, this rules out further large dilutive placings.

Other Points of Interest:

Concrete Processing Plant: Part of the historic Glencore spend was on a concrete processing facility, which is currently stored, ready for assembly, in containers on site. Once the eight kilns are fully up and running, FRG plans to build and commission the concrete plant to further monetise the waste aggregate generated from quicklime production. Once operational, the concrete processing plant has the potential to generate an additional $20m per annum, subject to the outcome of the offtake agreement.

Recent Capital Raise: The recent placing on 28th June 2024 generated £2.13m to progress the Limeco plant to revenue-generating production by the end of the year. A target that appears to be on schedule and on budget. It is worth noting that in this fundraise, the BOD bought £230,000 of FRG stock, a significant vote of confidence for investors. Also, during the placing, well-regarded Fund Manager Nick Grace bought a 4.96% stake in the company. With nearly 50% of the issued shares not in public hands, the share price tends to move rather nimbly even on low volumes.

Zambia and the Copperbelt Boom: Limeco is situated 20km west of Lusaka, with existing infrastructure in place, including main access roads, power and water. As one of the most stable political environments in Africa, Zambia is pro-mining and committed to boosting the copper industry by 2-3x, as it makes up 70% of the nation’s revenues. This means that domestic demand is and will continue to be high, and it is anticipated that little, if any, FRG quicklime will need to be exported.

Conclusion

With a strategic shift towards quicklime production, guided by a strong Copper-aligned market, FRG has shown itself to be focused, on time and on budget in recommissioning the Limeco Plant.

FRG have made some astute decisions, such as early revenue generation from the Logistics Service Agreement and aggregate sales, as well as the idea to utilise coal gasification to improve cost efficiency and environmental impact.

They are also proactive on social media, and many investors have been impressed with their investor relations and PR offering.

Critically, they have extensive experience in the Quicklime industry through their ties and contacts with NEGEV Israel, and the BOD have significant skin in the game with £230,000 of buying in the last placing.

Also, with shows of confidence from the likes of Nick Grace and nearly 50% of the issued shares not in public hands, the price tends to move rather well even on low volumes.

Content Contributed by Thom Hudson