Is it time to look at United Oil & Gas Again?

United Oil & Gas today announced they had completed the withdrawal from Egypt allowing the company to now focus on the potentially huge 7 Billion Barrel Jamaica opportunity with strategic farm-in discussions progressing well

It could be time to look at United Oil & Gas again following the company's withdrawal for its Abu Sennan interest in Egypt which has quite frankly been a 'thorn in the side' for the company given an un-favourable exchange rate environment.

Under the withdrawal agreement, United should receive US$620,000 which added to existing cash should give them a healthy cash balance as their attention turns to Jamaica.

United also hold a 26.25% working interest in the Waddock Cross Oil field which had a five year license extended back in April of this year.

Egdon Resources, the licence operator, previously co-ordinated the completion of reservoir modelling work on Waddock Cross. From this work, the Egdon estimates that Waddock Cross contains a significant Stock Tank Oil Initially in Place (STOIIP) volume of 57 million barrels of oil, and that a new horizontal well could yield commercial oil production of 500-800 barrels of oil per day (gross) and c.1 million barrels (gross) of gross recoverable oil.

Jamaica Though, that's another ball-game!

In January, United received confirmation that their Jamaican licence had been extended for two years, until 31 January 2026.

To strengthen the team, the company appointed Herona Thompson as Jamaican Country Manager to oversee the agreed work programme with the Ministry of Science, Energy, Telecommunication, and Transport (MSETT).

Jamaica will now be the company's primary driver for growth, with the licence offering significant exploration potential. The focus will now be firmly on advancing the project and progressing the ongoing farmout process to unlock its value. In fact the company signalled today that the farmout discussions have been progressing well.

The Size of the Prize - It's BIG

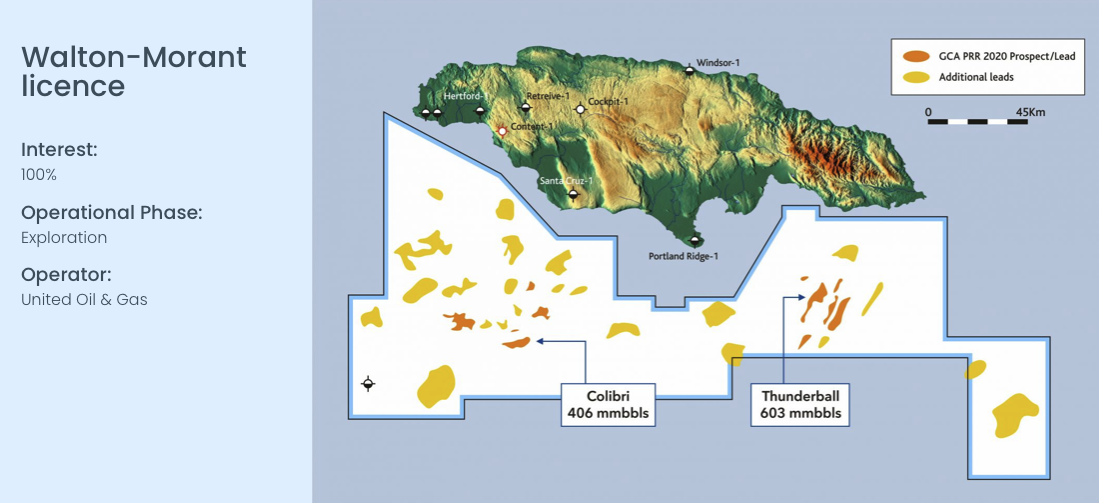

Overall, the Walton Morant license in Jamaica sports some mouth-watering numbers uncluding 7 Billion Barrels mean/mid case of un-risked prospective resources with 21 prospects/leads of over 100 MMBO with the company having shot over 2,250km2 of 3D seismic data. It's worth also noting that several of the potential resources exceed 500 million barrels each!

A single 400 MMBO prospect development would demonstrate NPV10 after tax of $4.6B & IRR of 45% (source:United)

Having followed the company for a long-time, Jamaica for me has always been the prize and historically I was dissapointed the company had not progressed this sooner. It seems however that the company are now fully focused on Jamaica with it looking like they could be close to announcing a strategic partner for this truly exciting exploration programme.

At just £1.8M Market Cap and cash in the bank the shares could see a strong re-rate just on news of a strategic partnership. Of course down the line, should any one of those Jamaican propects hit the black gold the shares would be trading hundreds of times the share price today!

It's a risk-reward play, with the potential opportunity to de-risk along the way so manage your risk appropriately !