10 Reasons to buy Blencowe Resources

Blencowe Resources (LON: BRES) has long been on the watchlist but it was clear to everyone involved that there was a funding gap that needed rectifying. With this now sorted, the company has the capital it needs - and it may well be time to invest in the dip.

Good Morning Team.

Blencowe Resources (LON: BRES) has long been on the watchlist but it was clear to everyone involved that there was a funding gap that needed rectifying. With this now sorted, the company has the capital it needs - and it may well be time to invest in the dip.

With no further ado, let’s dive in.

10 reasons to buy #BRES

-

£1.5 million is being raised, primarily to fund a 6,000m drilling programme to enhance the existing JORC Resource of 24.5Mt at 6.0% for the flagship Orom-Cross Graphite Project in Uganda. Management accounts for a chunky £500,000 of this placing, with major shareholder RAB Capital also taking part. The drilling programme is described as ‘one of the final major workstreams under the DFS,’ which is the key commercial milestone.

-

Donald Trump has won the US election, and the last thing on Earth he wants is to be reliant on China in any way whatsoever. You can (and doubtless, will) argue about whether the US electorate has made a good decision - but the President will doubtless be happy to continue supporting ex-China sources of critical minerals.

As will his No1 supporter Elon Musk, who has argued that lithium-ion batteries should instead be called ‘nickel-graphite’ batteries given the relative weights of the elements within. Regardless, there is strong bipartisan support to help develop ex-China supply, with the country having imposed exports bans on most forms of graphite in 2023.

-

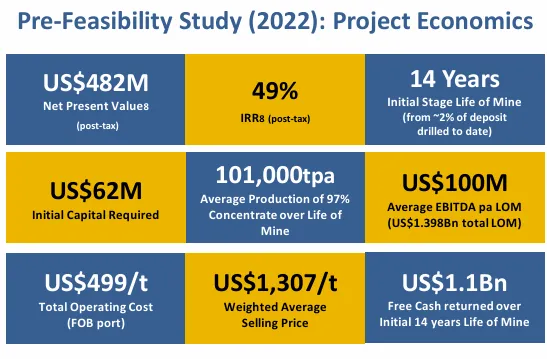

The flagship Orom-Cross asset boasts very high quality graphite (there appears to be a larger proportion of jumbo flakes than normal), and a pre-feasibility study with rock solid numbers, including very low opex/capex. Perhaps most importantly, the current JORC Resource of 24.5Mt at 6.0% is based on just 2% of the licence area currently drilled - there is substantial potential upside here. Blencowe owns a 21 year Mining License, awarded in 2019 - and has all the usual permits in place.

-

Blencowe has been awarded $5 million in grant funding by the US government through DFC, the US International Development Finance Corporation, to be used to help fund the DFS - and the institution will also arguably help with the development pathway further ahead.

-

BRES has deftly played the US against China, with the US putting up substantial capital, and China apparently reaping the benefits. In June, the company signed an offtake MoU for 15,000tpa of large flake with Jilin, covering 66% of Orom Cross initial large flake production for up to three years from start-up (and circa 50% of total Orom-Cross revenue).

-

In early September, Blencowe saw the successful completion of the last internal stage of the graphite pre-qualification test program, being the upgrading of 600 tonnes of small flake concentrate into battery ready 99.95% uncoated SPG by Chinese SPG producer Qingdao TaiDa Carbon. This material has now been sent for testing by potential tier one Asian customers. Micronisation testing has also been completed at AETC in Chicago, producing all five key product ranges.

-

Days later, Blencowe signed a MoU with Singaporean graphite sales specialist Triessence, and a leading Asian SPG and Anode material producer. The partnership is designed to establish a Joint Venture for a graphite beneficiation facility in Uganda, producing 99.95% purified graphite for lithium-ion batteries. It also provides a life-of-mine offtake partner near the Orom-Cross Project, offering significant commercial advantages.

Blencowe and Triessence will each hold a 50% stake in in the SPG facility, and Triessence will fund 50% of capital costs and purchase all end product, ensuring consistent revenue and premium pricing for some of the first 99.95% SPG produced ex-China. SPG product will ultimately to be sold to OEMs outside China via Triessence, providing powerful political, commercial and funding advantages.

-

Orom-Cross graphite has received full Mineral Services Partnership (MSP) accreditation, via unanimous approval. The MSP, a global initiative backed by 14 countries and the EU, promotes public and private investment in responsible critical minerals supply chains worldwide. Chair South Korea championed the asset, and Blencowe will now ‘work closely’ with the Government of South Korea, to explore new funding avenues, offtake agreements, and additional opportunities.

Executive Chairman Cameron Pearce enthused ‘Achieving MSP accreditation is a huge step milestone for Blencowe, further differentiating Orom-Cross as one of only a select few top tier critical minerals projects worldwide to have received this rare MSP status. We are excited and honoured at this recognition.’

-

BRES shares at 4p leaves the company with a market capitalisation of circa £9 million. On a fundamental basis, Orom-Cross enjoys a post-tax NPV of $482 million, based on the (relative to asset size) tiny amount of exploration done thus far. With this new capital to get to DFS status and globally renowned partners, the future is bright. And in a ‘fire sale’ situation post-DFS, the company will certainly get more than £9 million!

-

Management will get some heat for this placing (and warrants). But they have done everything right thus far in a difficult market - and the bottom line remains that you need capital to develop an asset. It was clear that funding was needed; now this has been sorted, the share price should take off with news flow.

That’s all from me for now, but if you want a comprehensive investment case let me know and I will endeavour to get it out to you!

Content Contributed by Charles Archer

Source Article: 10 Reasons to Consider Blencowe

Article Date: NOV 06, 2024