Mosman Oil and Gas - fully funded, five-well US drilling campaign scheduled to begin this quarter.

Ushering in a meteoric rise from 0.012p to 0.08p this summer, MSMN has seen a transformational BOD overhaul, rebrand, and a pivot toward the in-demand and in-vogue Helium sector. It’s now time for the company to shine with a fully funded five-well US drilling campaign scheduled to begin this quarter.

Only 12 months ago, Mosman Oil and Gas (Ticker: MSMN) was a deeply unloved stock. With a set of labouring oil and gas assets in the States and a somewhat controversial CEO in John Barr, the share price slumped in tune with faltering investor sentiment.

Change was very much needed and came in the form of a new CEO Andy Carroll, who oversaw a BOD overhaul, implemented strict cost- cutting measures, set in motion an ambitious rebrand and steered the company in a new direction, away from Oil and Gas and to the newly booming helium sector.

Currently, MSMN has a significant amount of news flow waiting in the wings across a variety of projects in Australia and the USA. Let’s take a closer look at their current stable of assets.

The Vecta Helium Project, Las Animas. USA

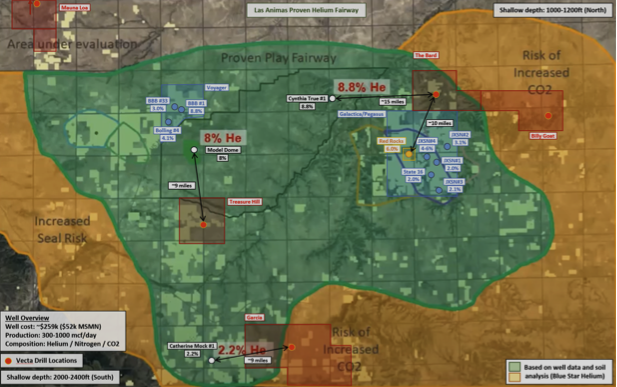

In June 2024, Mosman acquired a 10% stake in the Vecta Helium Project in Las Animas, Colorado. This was increased to a 20% interest in July. The asset consists of a circa 51,000- acre lease with five identified helium prospects in the area. Three of these are sitting within the “proven helium fairway” (See map below. Credit Mike Stallard).

The initial 10% deal was agreed for a sum of $500,000, with the following 10% being paid in shares to that same value. MSMN would also be liable for a proportionate percentage contribution to the drilling costs. Due to the shallow water well drilling required, the drill costs are a fraction of comparable peer drills at $259,000 each. Therefore, MSMN will only need to cover an additional $259,000 for all five drills. This, according to the company, is fully funded through the recent sale of the Stanley oil asset and oil revenues.

Partnering Mosman in this endeavour is Vecta Oil and Gas Ltd. Vecta are a private company that has explored, drilled and is also producing helium in Colorado. Vecta has been active in the area and drilled the Sammons exploration well last year in an AMI arrangement with Blue Star Helium, where they discovered helium and carbon dioxide. In the area, other companies are actively progressing helium projects, including Desert Eagle, producing helium at Red Rocks, and Blue Star, developing helium discoveries at Voyager and most notably, Galactica/Pegasus, which they are drilling with Helium One this quarter.

The project area is a proven helium zone with several proven helium discoveries including Model Dome 8% He and Cynthia True 8.8% He.

The Vecta Helium Project consists of five targeted drill sites:

Treasure Hill: In the Centre of the ‘Proven Helium Fairway’ and 9 miles away from the Model Dome 8% Helium Discovery and under 20 miles from Blue Star Helium’s Voyager Discovery, showing grades of 3%, 4.1% and 8.8%.

The Bard: On the Eastern edge of the Proven Fairway and 15 miles from the Cynthia True 8.8% Discovery. Also, 10 miles from the Red Rock 6.6% Helium well and Blue Star’s Galactica/Pegasus Helium acreage with which they have a joint venture agreement with Helium One.

Garcia: Edging the southern range of the Proven Fairway and 9 miles from the Catherine Mock 2.2% Helium Discovery.

Billy Goat & Mauna Loa: Both located just outside of the Proven Fairway

Infrastructure

It is one thing to discover helium, but without adequate infrastructure in place to process, store and get the product to market, commercialisation can be problematic.

Luckily Las Animas is located near key downstream infrastructure, including the BLM pipeline, Ladder Creek gas gathering system and Cliffside helium storage. It is also within 150 miles of helium purification facilities and conveniently located for offtake partners.

Commercial Helium Consumers Nearby:

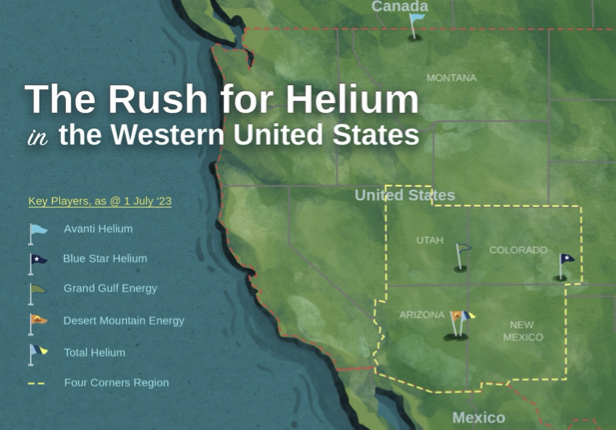

The Four Corners Helium Zone is widely regarded as one of the world’s best locations for helium production with key strategic offtake partners nearby, such as: Taiwan Semi- Conductor Co (The world's largest Semi-conductor foundry feeding Nvidia, Arizona), not to mention NASA, Air Liquide, Lockheed Martin, The US Defence Dept, Google, Amazon, General Electric et al.

The Team:

Heading USA Helium operations is Howard McLaughlin. Howard is an experienced US-based geologist with significant Helium expertise. He is the former Global Head of Exploration at BHP Billiton and has recent experience in US exploration & production operations. In addition, the new high-level appointment of Tim Rynott, the Founder, CEO and Exploration Geologist heading up Four Corners Helium, Colorado, also bolsters the team.

Australia

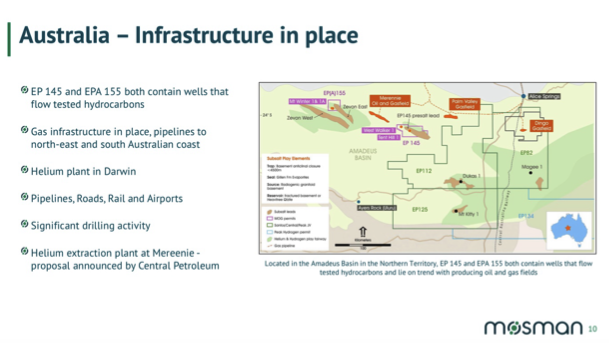

Aside from the recent helium acquisitions in the USA, Mosman has two key helium interests in Australia’s Amadeus Basin located in the Northern Territory. Wells in both EP145 and EP155 have previously flow-tested hydrocarbons.

EP155, Mount Winter, Amadeus Basin. Australia:

Currently, MSMN holds a 100% interest in the EP155 license, having signed a joint venture with newly listed Georgina Energy (GEX). The JV will mean that if GEX funds the seismic 2D study (they are preparing to begin this imminently), then MSMN’s stake will drop to 25%. Should they also fund an initial drill, MSMN will settle at a 10% interest.

GEX has been advised by its Indigenous Relations Consultant that the CLC ratification of the Traditional Owners approval of the granting process for the Mt Winter EP(A) 155 project permit is anticipated to be completed in December 2024.

This prospect also benefits from heritage infrastructure and is 10 km from the pipeline to the Darwin Helium plant and the Mereenie Helium extraction plant is also located nearby. The estimated in situ resource values are as follows: Helium 148bcf, Hydrogen 135bcf and Natural Gas 1.22tcf.

EP145, Mount Winter, Amadeus Basin. Australia

Until October 2024, the EP145 acreage was in a joint venture agreement with Greenvale Energy. However, given Greenvale’s recent poor fiscal form, the surge in helium prices and natural gas demand in the Northern Territory, and with a strong cash balance behind them, Mosman opted to step out of the JV and take back control of 100% of the project.

MSMN intend to pursue the required permits and conduct the seismic study independently with the aim that this will add significant value to the license and give them a firm negotiating position to secure a more favourable joint venture deal with a partner that has access to more funding and can move forward with the project swiftly.

The estimated in situ resource values are as follows: Natural Gas 440bcf, Hydrogen 26.4bcf and helium 26.4bcf

USA Hydrocarbon Projects

Prior to the pivot to helium, MSMN was best known as an Oil and Gas producer.

After the recent sale of its Stanley oil asset, it currently sees modest revenues from its three producing wells at Cinnabar. Mosman has a 75% working interest and operatorship in the project and has been producing since 2023. An updated Reserves report in 2023 records 2P reserves of 1.6 million BOE (100% net royalties). Production optimisation, JV or sale of the asset is currently being assessed according to the company.

Conclusion

Current estimates, based on the interim reports and dialogue with MSMN are that the company is sitting on a cash balance of approximately $3.5-$4m and has zero debt. This has been generated from the sale of the Stanley oil asset, oil revenues, warrant conversions, and a recent fundraise generating £1.5m.

The stellar rise from 0.01p to 0.08p earlier in the year was seemingly inspired by a real hope among investors that the company had turned a corner and was destined for better things. The new CEO, the BOD overhaul and the refocus on helium drove the narrative forward and was in turn supported by a rather shrewd low-cost, high impact acquisition in Las Animas.

However, in my opinion, the share price had much higher to run (with only just over £10m MCAP realised at the height of the rise). What I feel held it back was underlying worries of a further cash raise and the conversion of a significant amount of 0.025p warrants.

Having now conducted the £1.5m fundraise, placing worries have abated and the 0.025p warrants have been extensively churned. MSMN have also seen the 571m 0.15p warrants expire unconverted on the 2nd November, leaving only 428m 0.07p warrants (which should only be converted at a share price upwards of 0.12p). This means that many of the factors that stymied a rise closer to a fairer comparative peer value have dissipated.

With the fully funded five drill Vecta campaign scheduled to begin in December this year, a strong cash position and the potential for further helium acquisitions, could this be the turning point for Mosman Oil and Gas?

Content Contributed by Thom Hudson