£7M Cap Gold Producer eyeing $20M+ revenues in 2025.

The turnaround at Goldstone Resources continues as highlighted in this weeks Homase Mine update. The company are on track to start producing 1000oz pcm from January 2025. This would equate to revenues in excess of c.$22M with the company capped at just £7M

As gold takes a breather from its stunning run achieveing ATH's just shy of $2,800oz last month, Goldstone have reported this week that the turn-around at their producing Homase gold mine in Ghana continues with production increasing MoM and the company's 2024 annual production looking like it'll be some c.40% higher than that of 2023.

As discussed in recent blogs, Goldstone suffered a number of technical 'teething' issues post mine 'go-live' a few years ago that saw production fall well short of the company's aspirations. The likes of Covid and War certainly didnt help either!

Homase Gold Mine Update

The company reported that expansion works at Homase Pits 1 & 2 are progressing well with additional Heap leach pads becoming operational and earthworks for additional pads continuing as planned.

The Company's optimisation strategy at Homase includes building up to 48,000 tpcm of stacked and agglomerated ore facilitated by running two shifts, for a 24 hour operation. This increase is expected to facilitate production of approximately 1,000 oz doré per month from the beginning of 2025.

Homase Mine, Pit 2, with Pit 1 in background (left), Stacking of agglomerated ore continues on Cell 5 (right)

A Growth Story

Gold has shown a strong performance in 2024, reaching several new highs and gaining over 30% since the start of the year. Veteran mining Entreprenuer Rick Rule said recently he didn't buy gold because it was going to $2,700 but because it could be going to $9-10,000oz!

Obviously these are 'giddy highs' but with gold trading where it is right now, junior gold miners margins, such as Goldstone's are rapidly increasing and with a stable AISC each dollar rise in the gold price hits the bottom-line.

Whilst Goldstone have been producing gold, it's been nowhere near the capability of what can be produced from Homase as pointed out earlier in the article where we discussed historic issues.

With Goldstone now set to achieve target production of 1,000oz pcm on an anuual basis this would equate to some $20M+ in revenues at todays gold price. Obviously AISC (the cost to produce the gold) is the magic number and what investors will be looking out for in the numbers but at an industry standard AISC of around $1,350oz the margins are more than healthy. Of course, if gold continues its run it just gets better and better for producers and shareholders.

Organic Expansion

It's always been in Goldstone's 'game-plan' to expand the business and the company have plans to exploit the fresh-ore below the oxide cap where they are currently mining at Homase. Why? well because the gold here grades at more than 6g/t and tapping into that would dramatically increase production and lower overall cost.

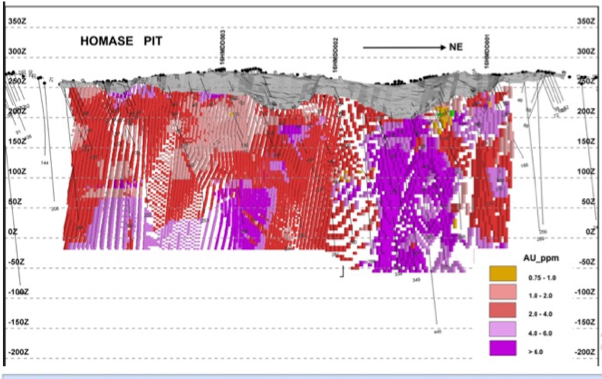

Purple areas show target gold with grades >6g/t

Then there is Goldstone's 100% owned Akrokeri Mine close by where the board believe the historic head grade mined was an average of 24g/t.

In summary, if the company can achieve their anticipated production targets starting Jan 2025, the company should be in a strong position to further expand organically with perhaps an acquisition or two thrown in the mix ‘it is the Company’s intention to build a portfolio of high-quality gold projects in Ghana, with a particular focus on the highly prospective Ashanti Gold Belt.‘