UK Listed Bitcoin Miner Vinanz Heading for a Main UK Market Listing - but you can buy it now !

As Bitcoin continues to rally to ATH's with no signs of it abating, UK listed Vinanz offers investors exposure to this sought after asset class via its Bitcoin Mining Operations and Strategy with a niche business model focused on diversification and growth

As Bitcoin smashes through $100K there is a little-known UK listed Bitcoin Miner that looks set to benefit.

Vinanz Limited is a Bitcoin mining company with regulatory jurisdiction in the UK whilst operating primarily in the United States and Canada, focusing on decentralized data facilities. The company does not own any data-centres and the overheads that go with them but rather operates through partnerships with third-party providers, such as Compass Mining, which manages its mining machines, helping reduce operational overhead.

The companies shares are currently listed on both U.S. OTCQB and London’s AQSE markets, Vinanz is positioned for growth in the Bitcoin mining space, with future plans to explore mining other cryptocurrencies, as well as ventures into decentralized finance (DeFi) and big data operations.

Main UK Market Listing

Whilst the companies UK shares are currently listed on the Aquis exchange and can be bought and sold today via most major brokers, the companies aspirations are to list on the main segment of the London Stock Exchange. Whilst Aquis has served its purpose allowing the company to raise early cash-flow, a main market listing will improve liquidity and facilitate institutional and other investment in Vinanz. The company hope to receive approval from the FCA by year-end.

A Niche Operating Model

The company differentiates itself by its niche operating model with an emphasis on scalability, regulatory adherence, and operational efficiency. By spreading its Bitcoin Mining operations across multiple states in North America, the company has no single point of failure in circumstances such as power outages and has a flexible approach to energy requirements including pricing, utilising energy sources across various states in both Canada (Labrador) and the United States (Indiana, Nebraska and Iowa).

The above essentially offers the opportunity for the company to develop a 'plug and play' approach to mining so in a scenario where say Bitcoin was un-economical to mine (not looking likely right now!), the company could wind-back operations until such time they wanted to expand again. This is a key differentiatior to the likes of Argo Blockchain who ran in to trouble when the Bitcoin price significantly pulled-back, in unison with un-precedented energy costs increases that occured. The company can essentially be re-active to the market.

Positioned For Growth

Vinanz Limited acquired the Bitcoin mining operations of Valereum PLC on its admission. This acquisition included 20 Bitcoin mining machines and approximately 4.76 Bitcoins. These machines are operational and located in Nebraska, managed under a hosting agreement with Compass Mining. The agreement has been transitioned to Vinanz as part of the acquisition.

This strategic move allowed Vinanz to establish a foothold in the Bitcoin mining industry while leveraging Valereum’s existing infrastructure to expand its operations.

The company have since made major strides in expanding their operations moset recent announcement here. In fact you can see just how quickly the company have been expanding their Bitcoin mining operations by reading a multitude of announcements here

In the company's half year report they reported a maiden profit of £175k, increasing its BTC holding to 13.85BTC and the number of mining machines to 300 with aspirations to increase this number to 1200 or more, near-term.

Whilst the company are steadily expanding their mining operations there is a second angle to their business strategy worth noting.

A Mini MicroStrategy

Many will be familiar with MicroStrategy a U.S. based technology company specializing in business intelligence (BI), data analytics, and cloud-based solutions. Founded in 1989 by Michael J. Saylor.

It's perhaps though most well known for its investment in Bitcoin. Starting in 2020, under the leadership of Michael Saylor, the company adopted Bitcoin as a treasury reserve asset. It is now one of the largest corporate holders of Bitcoin. The company's Bitcoin holdings are a central focus of its financial strategy and attracts attention from both tech and cryptocurrency communities.

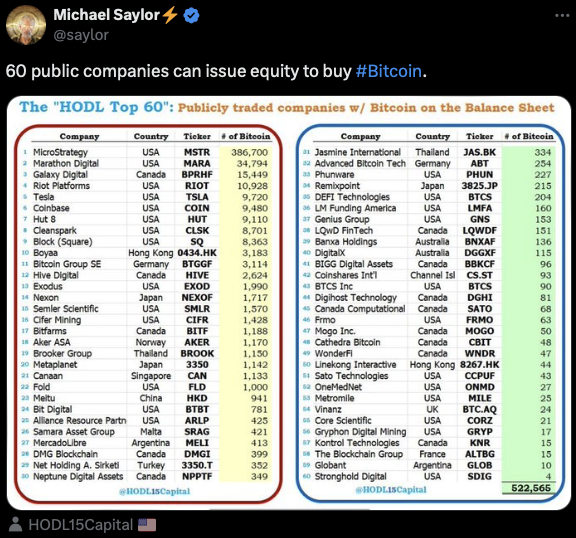

Vinanz plans to adopt a similar approach to MicroStrategy, whilst running the Bitcoin Mining side of the business the company plan to increase its Bitcoin holdings in effect becoming a European mini-MicroStrategy. In fact Micheal Saylor highlighted Vinanz in a recent tweet, citing the company as one who could issue equity to buy Bitcoin.

This two-pronged business strategy makes Vinanz an interesting and potentially highly lucrative investment opportunity. With Chairman David Lenigas and other Directors holding c.45% of the stock and other major shareholders accounting for another 20% there is only a c.35% of free-float.

Early-birds looking for UK exposure to Bitcoin and crypto-currencies in general with a compelling growth opportunity can buy the stock now under the ticker BTC.AQ or search your broker for Vinanz. Once the company becomes main market-listed, under its current plans, it'll be interesting to watch, especially if Bitcoin maintains anything near recent highs and/or the company receives similar attention to the likes of Argo Blockchain