Why Central Asia Metals Could Be a Hidden Gem for Investors

Trading around year lows, Central Asia Metals offers a compelling investment case when you consider commodity tailwinds, no debt and strong dividends

When it comes to investing, it’s not always the big, flashy names that deliver the best returns. Sometimes, the quieter, more overlooked players offer the most interesting opportunities. One such name to keep on your radar? Central Asia Metals (CAML), esepcially as its pulled back to year lows and not much higher than its 5 year low!

If you’re a retail investor looking to add a little diversity to your portfolio, here’s why this small-cap company might be worth a closer look.

What Does Central Asia Metals Do?

Central Asia Metals is a UK-listed mining company with operations in Kazakhstan and North Macedonia. They’re focused on extracting three key commodities: copper, zinc and lead. These metals are essential for modern industry, especially as the world transitions to greener technologies. Copper, for example, is vital for electric vehicle production and renewable energy infrastructure, while zinc plays a critical role in construction and battery technology.

Think of Central Asia Metals as a company that profits from the backbone of the green revolution—without the hype attached to some bigger players.

High-Level Investment Case

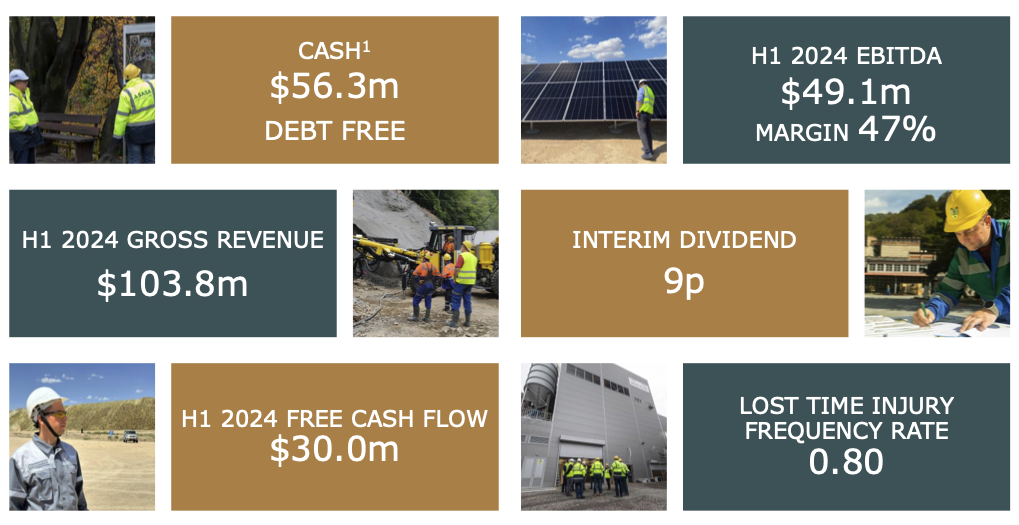

Stable Operations with Strong Margins

Unlike some miners that are constantly battling fluctuating costs, CAML’s operations are relatively low-cost. Their flagship project, the Kounrad copper dump in Kazakhstan, is an incredibly efficient operation, essentially "recycling" old copper waste that originated from the Kounrad open-pit copper mine and turning it into profits. This innovative process keeps costs down and margins high.

With an overall JORC resource of c.600,000 tonnes of contained copper and c.98,000 tonnes of remaining recoverable copper, Kounrad is well placed to continue producing copper until 2034. Latest 2024 copper production guidance comes in at 13-14k tonnes

CAML took 100% ownership of the Sasa underground zinc-lead mine in 2017. The mine is located in north-eastern North Macedonia. The company have been producing steady-state production with latest 2024 guidance of 27-29k tonnes of lead in concentrate and 19-21k tonnes of zinc in concentrate.

With solid reserves and resource the Sasa mine is well placed to continue production until at least 2039.

Solid Dividends

One of the biggest draws for retail investors is the dividends. CAML has a strong track record of rewarding shareholders with generous payouts. If you’re someone who likes a steady stream of income from your investments, this could be a big plus especially with a cracking dividend yield of 10.66%.

Commodity Tailwinds

With the global shift towards electrification, demand for copper is only expected to rise. Analysts predict long-term shortages, which could lead to higher prices—and higher profits for producers like CAML. Zinc, too, is benefiting from increased demand as economies worldwide ramp up infrastructure spending.

As stated, the copper market is expected to experience significant growth in demand over the coming years, driven primarily by the global energy transition. As countries accelerate decarbonization efforts, analysts predict a supply-demand imbalance, with demand potentially outstripping supply by the late 2020s. This is due to long lead times for new mining projects and declining ore grades at existing mines. These dynamics are likely to support higher copper prices in the medium to long term, making the metal an attractive investment focus.

The zinc market plays a vital role in construction, infrastructure, and galvanizing steel to prevent corrosion. Demand for zinc is expected to remain strong, supported by infrastructure projects and renewable energy initiatives, particularly as governments invest in sustainable development. However, the market faces challenges such as potential supply constraints from mine closures and disruptions. While prices have been volatile due to economic uncertainties and fluctuating industrial activity, the medium-term outlook suggests steady demand growth, particularly in emerging markets. Zinc’s importance in batteries for energy storage could also provide additional demand drivers in the future.

Geographic Diversification

Operating in Central Asia and Europe may sound risky at first glance, but CAML has proven its ability to manage geopolitical challenges. Plus, the diversification across two regions reduces the impact of any one location’s issues.

Undervalued ?

Despite its solid fundamentals, CAML is often overlooked by larger institutional investors. This means its shares could be undervalued, presenting an opportunity for retail investors to get in at a discount, especially with the company share-price trading around its 52 week low.

Risks to Consider

No investment is without risks, and CAML is no exception. Commodity prices can be volatile, and the company’s smaller size means it’s more exposed to market fluctuations than some mining giants. Additionally, political risks in its operating regions, though manageable, should be considered, however, the company has a strong track record in this regard

Bottom Line

Central Asia Metals offers an intriguing mix of stable operations, a shareholder-friendly dividend policy, and exposure to high-demand commodities. For retail investors looking to tap into the global push for electrification and infrastructure development, this small-cap miner could be a great addition to a well-balanced portfolio.

As always, do your due diligence, and consider how CAML fits into your overall investment strategy. But if you’re after a stock that quietly delivers solid results, appears to be undervalued, Central Asia Metals might just be the hidden gem you’ve been searching for.