EnergyPathways - An Investors View

A lot has happened since my last article on EnergyPathways PLC (Ticker: EPP) and if the past few months are anything to go by, it looks like the second half of 2025 will be action-packed.

A whirlwind start to the year tee’s up an action-packed H2 with news flow and investment stacked up ready for gas storage license approvals. With confident comms from the CEO of late and the project drawing the eye of mainstream media outlets, it looks to be an opportune time to invest ahead of the curve.

Company Overview

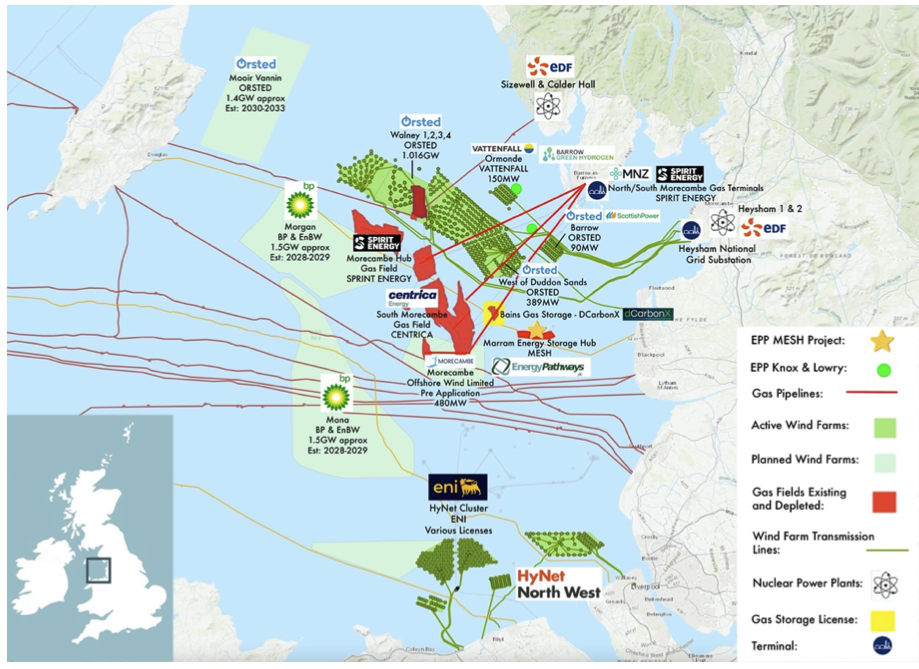

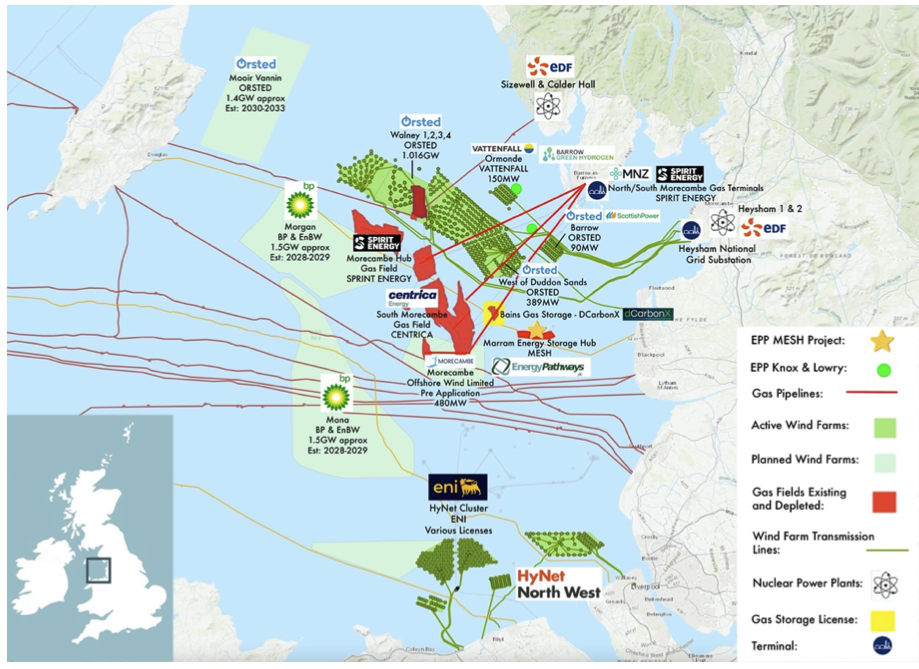

Listed on AIM in December 2023, EnergyPathways is a company looking to capitalise on the UK’s severe lack of energy storage and the government’s Net Zero focussed agenda by developing an energy storage project that can provide the UK with a nationally independent, secure and flexible gas supply, whilst leveraging the growing value loss from the UK’s wind power excess by utilising green hydrogen production and storage solutions.

MESH is designed as a fully integrated energy hub that links hydrogen, compressed air and natural gas storage with regional wind power using repurposed existing gas infrastructure.

As a “first-mover” in a multi-billion pound growth sector, EPP has positioned itself as an attractive infrastructure investment with potentially high-yield annual returns of 20% over a 25+ year project lifespan. With shareholder alignment demonstrated with circa 5.76% CEO “skin-in-the-game”, EPP looks to be a promising investment both short and long-term.

Key Highlights

-

The MESH project is an integrated energy storage hub combining natural gas, hydrogen and compressed air storage technologies that will have an overall storage capacity of up to 20TWh, equivalent to 7% of the UK’s current annual electricity demand.

-

400MW hydrogen and compressed air Long Duration Energy Storage (LDES). Potentially Europe’s largest LDES facility, providing multi-day power supply.

-

700MW low-carbon flexible power. Highly flexible future-proofed system for transition to carbon-free hydrogen power

-

Capable of heating 2.7 million UK homes over winter with gas storage to provide a secure and dependable energy supply to the UK grid.

-

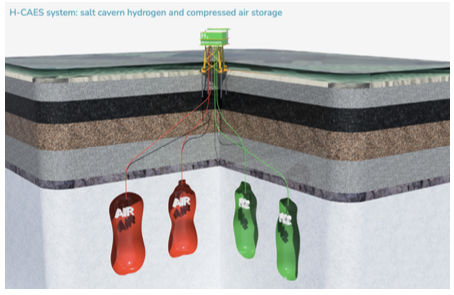

Revolutionary H-CAES compressed air long-duration energy storage (LDES) will diversify the energy storage offering further.

-

EPP own the intellectual property rights to the H-CAES compressed air long- duration energy storage (LDES) and plans to commercially exploit the technology beyond the MESH project.

-

State of the art Ai energy management system to be deployed.

-

100% owned, fully appraised Marram Gas Field containing a recoverable

46bcf gas.

-

With the addition of the Knox and Lowry Gas fields, recoverable gas will be

100bcf.

-

License Operatorship Approval was granted for Block 110/4a, which includes

the Marram Energy Storage Hub (MESH) by NSTA (North Sea Transition

Authority) December ’24.

-

The license Application Decision for Gas/Hydrogen Storage at the Marram

gas field is imminent having worked closely with the NSTA to restructure the existing license application to a “straight to production” license that will benefit the company logistically and financially moving forward.

-

The licenses for Knox and Lowry are currently in consultation with the government.

-

Phase 1 & 2 of MESH will provide between 500-600 million therms of gas storage with injection rates of 1.7m-2.0m therms per day at Marram.

-

The addition of the Knox and Lowry fields, at this stage, are estimated to triple this.

-

Hydrogen storage capacity at Marram is estimated to be 2.8TWh, the aim would be to triple this with the addition of the Knox and Lowry fields.

-

Recent in-house, no warrant/no broker cash raise of £743,000 with substantial BOD and cornerstone investor buying.

-

MOU signed for cornerstone investment with a Green Energy fund at multiples of the current SP (6p at time of writing)

-

Backup £5.1m Green Loan Facility in place to fund MESH beyond FID if required.

-

FTSE 100 Tier One partner talks for long-term gas storage and gas sales offtake agreements, as well as providing project-level debt finance.

-

FID (Final Investment Decision) scheduled for the end of 2025

-

First Gas production scheduled for H2 2027

-

First Gas Storage scheduled for as soon as 2028

-

EnergyPathways has formed a consortium of tier one energy companies to

develop MESH, comprising one of the world’s largest developers of wind power, one of world’s largest integrated oil and gas companies, a FTSE 250 global leading engineering consultancy and global market leader in industrial automation and industrial software.

-

Wood Group announced as Lead Engineering Partner in December 2024.

-

In October 2024, the Department of Energy Security and Net Zero (DESNZ)

invited EnergyPathways to participate in the Hydrogen Storage Business Model (HSBM) Design Group. This group comprises a select number of Tier- One companies that are at the forefront of the UK's energy transition.

-

Diversification across natural gas production and storage, as well as Hydrogen production and storage and compressed air LDES.

-

Requires no governmental or taxpayer funding due to its private sector backing.

What is MESH?

Situated 11 miles off the Lancashire Coast, EPP holds a 100% stake in the Marram Energy Storage Hub project (MESH) and is ideally located for energy storage with the highest population and industrial demand outside of London nearby and a comparative case study project in the HYNET Cluster adjacent. Also, as well as benefitting from high-quality geo-storage reservoirs, MESH is surrounded by an expansive 7-8GW of planned and existing offshore wind farms in the Irish Sea. The overall aim will be to provide the UK with a secure and reliable supply of natural gas and green hydrogen for over 25 years.

Let’s take a closer look at what’s involved...

The MESH project is a rather elegant concept and, in its first phase, will produce homegrown natural gas from the Marram field (Fully appraised, 100% owned, with 46bcf gas), for which it has just been granted an Operatorship license. As the gas flows, the subsea caverns will be emptied, allowing the reservoirs to be utilised for gas storage. The aim will be to store natural gas in phases 1 & 2 and green hydrogen in a latter stage of development alongside compressed air long-duration storage.

Where will the Hydrogen come from? Well, what makes this project so interesting is that EPP will take waste energy from nearby wind farms and convert it into Green Hydrogen using electrolysis. It will then be stored and sold to offtake partners along with the natural gas. The production and storage of green hydrogen is a major string to their bow, diversifying revenue streams and ensuring less exposure to natural gas price fluctuations.

Alongside gas and hydrogen, the H-CAES compressed air long duration storage facility will compress air and store it in subsea caverns. When energy is needed the air is released and subsequently expands to drive a series of turbines to generate electricity. It has proven to be an efficient and cost-effective method of long duration energy storage (LDES). Interestingly EnergyPathways own the intellectual property rights to the revolutionary H-CAES technology and plan to exploit the design beyond MESH, which could prove to be a very lucrative endeavour in itself.

MESH is also designed to be a fully zero GHG emissions facility and will be electrified by a combination of green energy sources, including solar, batteries and also energy from the same nearby wind farms from which they will be producing hydrogen. It will also utilise energy management AI to oversee energy loading, security and other key processes. With MESH being so close to existing late-life gas pipelines, gas processing facilities and offshore transmission lines, it can use these to readily connect new energy supply to the UK market via this existing infrastructure, not to mention exploit other “stranded” gas fields in the Irish Sea area. Overall MESH will have a gas storage capacity of 500-600 therms of gas and will be an equivalent size, if not larger than Centrica’s Rough storage facility, currently the UK’s largest gas storage plant. Once online, MESH will increase the UK’s gas storage capacity by approximately two-thirds, and it will be able to store energy equal to heating 2.7 million UK homes through the winter. As for Hydrogen storage, MESH will have a 2.8TWh capacity.

But it doesn’t end there. EPP has already applied for additional gas production and storage licenses for the Knox and Lowry gas fields, which, if successful, would increase the recoverable gas production from 46bfc to 100bcf and triple the project storage capacity to well over 45TWh or 1.5 billion therms, therefore making it the largest energy storage hub in the UK by some margin. The expansion would also increase Hydrogen storage three-fold. In addition, the H-CAES compressed air long- duration storage solution will create a multiday energy store, that far exceeds the current industry standard storage limit of only several hours, and once operational it will have the potential to be the largest LDES facility in Europe.

The project is currently concluding Pre-FEED activities (Front End Engineering Design). Final Investment Decisions (FID) is scheduled for the end of 2025. In addition, EPP has announced it’s in advanced discussions with several “Tier One” companies with the aim of forming a partnership consortium to take the project through to fruition.

One of these partnerships, with a “FTSE 250 Engineering firm”, has already been confirmed, with Wood Group being named as the project’s Lead Engineering Partner. A Global Oil and Gas major and one of the largest developers of wind power has also been mentioned as potential partners.

Interestingly, as the government has indicated, it will not be willing to invest in the interconnecting pipelines that feed the oil and gas industry (unless they are repurposed for the green economy), so as the Irish Sea infrastructure is decommissioned, many gas fields will become stranded assets. These extensive stranded assets off the northwest coast will be accessible by the MESH storage hub and that in itself provides a huge opportunity, with more homegrown gas production potential and energy storage options.

Why is MESH Needed?

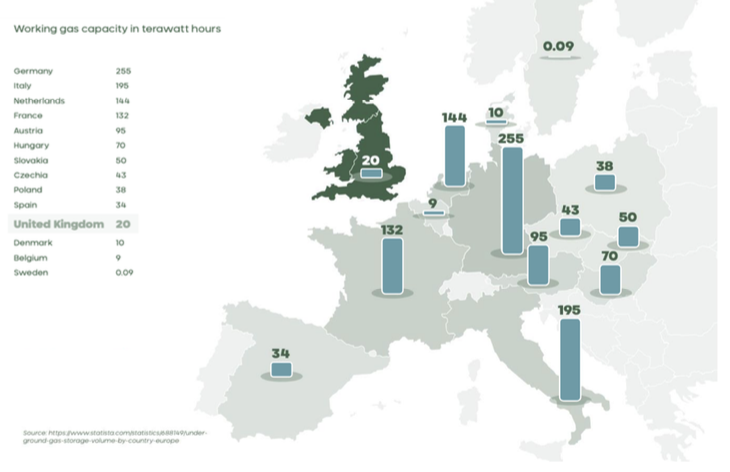

Currently, the UK’s working gas capacity is ranked 11th in Europe, behind the likes of Hungary and Slovakia and a mere tenth of the capacity of Germany and Italy.

As we have seen from recent geopolitical events, the need for energy independence is critical, and with recent headlines demonstrating the dire need for energy storage EnergyPathways appear to be in the right place at the right time.

The government are planning to invest billions into Net Zero projects, in particular Hydrogen storage, as part of their green agenda. But there is another key driver at the heart of this decision, and it comes down to pounds, pence and the government’s bottom line.

Every year, the government has to pay wind curtailment costs. This is because the government uses the Contracts for Difference (CfD) scheme to support wind energy projects. The CfD scheme guarantees a price for electricity generated by wind farms, wind farms like the ones surrounding the MESH project. Therefore, any wasted energy costs the government money. Currently, that’s a hit of £2bn a year and by 2030 it’s estimated to rise to £10bn a year.

How do they counter this drain on the coffers and the subsequent cost to the taxpayer?

The Clean Energy 2030 policy is focussed on streamlining decisions regarding projects like MESH, ensuring they are fast-tracked and the hurdles to get to production/market are removed or reduced. It’s in the government’s best interest to promote the conversion of excess wind power to stored hydrogen.

The stored energy can be used for a variety of applications, from heating homes to powering the Northwest Industrial Hub and the region’s fleet of hydrogen-fuelled public transport vehicles. In 2024, we saw nearby HYNET sign the first hydrogen offtake agreements with Northwest industrial partners Essar and Kimberley Clarke.

The wind curtailment costs are one of the reasons why the government is striving to streamline the route to production for projects such as MESH and the neighbouring HYNET cluster and stimulate both public & private sector investment in the industry. Suddenly, the interest in Hydrogen storage starts to make sense, and given the amount of money MESH could save the government and, consequently, the taxpayer, it could well be in line for significant government grants and investment. Although, I feel it is important to highlight that EPP have stated they will require no public funding due to their proven ability to attract private sector investment via the Green Energy Cornerstone Fund and the potential project debt finance investment from a FTSE 100 gas offtake partner.

The Team

CEO Ben Clube brings to the table extensive experience and a direct, no-nonsense style to proceedings. Aside from a background in Geology, Clube was the Executive Director and Chief Operating and Commercial Officer of FAR Ltd, an Australian Gas explorer, from 2012 to 2018. During his leadership, he propelled the company to a AUD$655m market cap (£334m), gaining FAR Ltd notoriety as striking the “world’s biggest gas discovery” in 2014. Under Ben’s management FAR Ltd was widely regarded as one of the most successful Australian oil explorers for over a decade.

He also has 20 years' experience as a finance executive, including a role as Senior Vice President of Finance at BHP Petroleum. He’s served on the boards of UK and Australian-listed energy and resource companies, and more recently, he formed a start-up company to develop sustainable energy solutions with reduced carbon footprint. Ben has a track record of completing company-transforming commercial and M&A transactions creating significant shareholder value. In short, he brings extensive capital markets expertise.

It would appear the CEO has a vision and wants to deliver value to EPP shareholders, as well as himself, having considerable skin in the game holding around 5.76% of the company.

Alongside Ben, the small, focused team brings together a depth of experience and competency and are held in high regard throughout the industry. Most recently we have seen the appointment of Max Williams as CFO, who has over 30 years of experience in the Energy and Natural Resources sector.

News flow and Near-term Catalysts

Some of what we can expect in terms of news flow in the coming weeks and months:

-

- Marram Gas Storage License Decision

-

- Tier One FTSE 100 Debt finance agreement

-

- Update on MOU with Cornerstone Green Energy Fund investment

-

- Tier One Wind Power Partnership

-

- Tier One Oil and Gas Partnership

-

- Tier One Engineering Partnership (Electrolysers)

-

- Tier One AI Energy Management Partnership

-

- Offtake Agreement: Gas Production

-

- Offtake Agreement: Gas Storage

-

- Offtake Agreement: Hydrogen

-

- FEED Plan Completion

-

- HAR3 Application

-

- Knox and Lowry Gas Production and Storage License Consultation Update

Risks

The Political Situation

The Mesh Project and EPP’s strategy as a whole is perfectly aligned with the current Labour government's Net Zero and Clean Energy goals. From the zero emissions electrification of the facility to the harnessing of renewable wind energy to create green hydrogen. However, it would be wrong to assume that EnergyPathways are, therefore, reliant on a Labour government for MESH to be a success.

The diversification of MESH through gas production/storage and hydrogen production/storage means that it truly has universal appeal, as does the fact it requires no public or taxpayer funding due to its private sector backing.

Phase 1 of MESH is centred on natural gas production, which has cross-party support, as does phase 2, which will incorporate gas storage. As mentioned earlier in this investment case, since the Russia/Ukraine conflict, it has become of critical national importance to increase the UK’s gas storage capacity and gain a greater level of energy independence. Energy independence after all, is national security.

For both gas and hydrogen storage, it was in fact, the Conservatives who initiated the policy in 2021 under Kwasi Kwarteng (See hyperlink below). It was also the Conservative government that initiated the CfD (Contracts for Difference) scheme to support wind energy projects. The CfD scheme guarantees a price for electricity generated by wind farms, wind farms like the ones surrounding the MESH project. Therefore, any wasted energy costs the government money. Currently, that’s a hit of £2bn a year and by 2030, it’s estimated to rise to £10bn a year. So, Green Hydrogen Production would be seen very favourably by any incoming administration as it would benefit the government with substantial savings.

If, at the next general election, we saw Labour ousted and either Reform or the Conservatives (or a coalition of the two) enter Downing Street, then in my opinion, the worst case scenario would be that there may potentially be fewer grants and incentives for zero-emissions electrification of MESH. However, the overall outlook for Gas production, storage and Hydrogen Storage would be much the same as it is of critical importance cross-party.

In the meantime, the Labour government will be championing projects like MESH, and should the project receive government funding, it will surely receive a fanfare of mainstream media attention.

https://www.gov.uk/government/news/government-hits-accelerator-on-low-cost- renewable-power

License Approvals

License Approvals

In December 2024, EnergyPathways were awarded License Operatorship Approval for Block 110/4a, which includes the Marram Energy Storage Hub (MESH) by NSTA (North Sea Transition Authority). It is now awaiting a Gas/Hydrogen Storage license for the same block. As part of a separate application, EPP is also in consultation with the government regarding gas production/storage licenses for the additional Knox and Lowry fields.

Block 110/4a (Marram) will enable EPP to create a gas storage facility equal, if not larger than Centrica’s Rough Storage facility. With the addition of Knox and Lowry, the facility will be triple the size.

It is then of great importance that these licenses be granted. However, EnergyPathways have an ace up their sleeve as in October 2024, the Department of Energy Security and Net Zero (DESNZ) invited EnergyPathways to participate in the Hydrogen Storage Business Model (HSBM) Design Group. This group comprises a select number of companies, including several Tier-One companies that are at the forefront of the UK's energy transition. It would be rather odd then, if the company helping design the country’s gas/hydrogen business model were then denied the opportunity to store gas and hydrogen at their facility. To add to this, EPP have been working closely with the NSTA to restructure the license application to a “straight to production” license that will benefit the company logistically and financially moving forward.

Currently, it has been well over 7 months since the application and the neighbouring Bains Storage Facility operated by DCarbonX (9km away to the west) was granted their license after a similar period of time. Therefore, it would seem likely that the license approval is imminent, especially as EPP require no funding from the government to proceed with the project.

CAPEX, OPEX and Financials

One of the key questions surrounding the MESH Project is: Where will the CAPEX funding come from?

The CAPEX required to get MESH through to full hydrogen and natural gas production and storage is projected to be circa £70-100m. This will enable the project to achieve an energy storage capacity of 20TWh, which is substantially higher than the UK’s largest storage hub: Centrica’s Rough gas storage facility in the North Sea. Interestingly, Centrica has announced that to continue to function, it will need a CAPEX investment of £2bn+ (presumably all or in part from the government), a not-insubstantial investment by any standards. As yet, this funding has not been forthcoming, and the facility is no longer filling its stores for this winter and is looking likely to be decommissioned.

As a comparison, MESH looks to be very good value for money, but should EPP also gain production and storage licenses for the additional Knox and Lowry assets, then the capacity of MESH as a whole would potentially triple and dwarf that of Rough threefold.

This is not taking into consideration the potential hydrogen and compressed air long- duration storage either. So, even if the project costs spiralled, MESH would still be a fraction of the cost of Rough. What then would be the more desirable investment for a public or private sector investor?

The company has already stated it is in talks with several tier-one partners and is also consulting with the government on the Hydrogen Business Model. EnergyPathways have an MOU for cornerstone financing from a prominent Green Energy fund and is in advanced talks regarding project-level debt financing from a FTSE 100 tier-one gas offtake partner. They have also made it very clear that they do not require government or taxpayer funding due to this private sector involvement. However, in my opinion the investment required will come from both public and private sector investment, mainly due to the government wanting to be seen to be investing in such a revolutionary project, and with regard to that public sector involvement, facilities like the National Wealth Fund and GB Energy would seem the most suitable fit for financial backing.

As for OPEX, EPP has raised £377,000 from converted warrants (equal to 3 months cash burn) and also, this month (April), conducted a strategic cash placing for key long-term shareholders in which the BOD bought approximately £67,000, this was done to fund activities through to license approval and the sign off of the Green Energy fund cornerstone investment (at multiples of the current 6p share price) which will be approved once the gas storage licenses are granted.

As a backup, last year EPP entered into a loan agreement with Global Green Asset Finance for a total of £5.1m. The loan facility is designed to support the MESH project through the FEED phase with a view to reaching FID at the end of 2025 if needed. So far only £100,000 has been drawn down as part of the initial loan agreement.

Conclusion

I see MESH as a key infrastructure investment with potential high-yield returns of 20%+ over a 25+ year lifespan of the project, a project that has been substantially derisked of late with EPP confirmed to be in discussions with the government’s DESNZ (Department of Energy Security and Net Zero) advisory committee regarding the hydrogen business model alongside major industry leaders. Also, the announcement of Wood Group as Lead Engineering Partner, confirming Tier one talks have, in fact, been going on and successfully brought to sign off. Another green light was the recent cash raise of over £700,000 and the drawdown of the Green Loan Fund and subsequent confirmation by CSM of the securing of £700m+ in bonds.

The MOU for cornerstone financing from another Green Energy fund and debt financing from a FTSE 100 tier one gas offtake partner has demonstrated further private sector appeal. This has quashed any doubts in terms of OPEX requirements through to FID and beyond. Also, the granting of an Operator License for Marram is a ringing endorsement from the NSTA and bodes very well for the approval of the storage license and the Knox and Lowry applications. It would appear that, despite sounding very ambitious, CEO Ben Clube is managing to achieve what he says he will and in a more or less timely fashion.

The big issue for any new or existing investor is the £70-100m CAPEX needed to get the project off the ground. As mentioned already, debt financing investment from a FTSE 100 gas offtake partner is in advanced talks and in my opinion, there could also be further funding from Tier One names already RNS’d by the company as potential suitors, as they will certainly have the capital to finance a project such as MESH. For instance, in the Irish Sea vicinity, there is ORSTED a huge wind energy producer (and in my opinion the most suited partner for EPP). There is also BP operating in the area (another contender for the partnership consortium in my book).

Private sector aside, the government has allocated tens of billions for projects such as this and, from their perspective, an investment in MESH at £70-£100m is a fraction of the outlay compared to Centrica’s £2bn+ CAPEX requirement. It would also end up saving the government multiples of their initial investment through the avoidance of wind curtailment costs over the lifespan of the project. A no-brainer, it would seem? And I think the current administration will want to be seen to be investing in such a “well-suited” project as MESH. However, CEO Ben Clube has made it abundantly clear that they don’t require any government or taxpayer funding to proceed, they just need the relevant license permissions. A rare win-win all round then?

Today EnergyPathways sits at a Market Cap of under £12m, is on the cusp of FEED activities and has a wealth of news purported to be waiting in the wings. Also, rather interestingly, there’s around 41% of the entire share issue not in public hands, so a small free float, hence why the SP can achieve the blistering rises seen in the last half of 2024.

With many funds and institutions divesting from fossil fuels entirely or allocating dedicated funds for Net Zero and Green Energy projects, I am sure EnergyPathways will become an attractive prospect for institutional investment once certain market cap milestones are achieved and with the aforementioned modest free float, it could be an explosive cocktail.

In my opinion, it’s an investment that offers significant upside if certain factors fall into place, namely the approval of gas storage licenses, tier one partnerships and debt financing, and there is, of course, always the chance of a buyout by a major before the FID later this year.

As we know, AIM and the small-cap arena is fuelled by sentiment as much as fundamentals (if not more) and projects like MESH garner a lot of media attention, such as the recent article in the Business and Money section of The Sunday Telegraph.

The flames of which will inevitably be fanned by the government to promote a “just” energy transition. MESH will help reindustrialise the North of England and stimulate employment and bring about the sort of feel-good success story the Labour government will champion at every turn, and it won’t cost them a single penny, and let’s be honest, Mr Milliband isn’t shy of a HiVis Jacket photo opportunity and projects like this will be his legacy.

Whatever your thoughts about Net Zero, from an investment perspective, MESH makes practical and economic sense. In terms of an investment, go where private and public sector money is being funnelled, and EnergyPathways seems to be very much in the right place at the right time.