Coinsilium: The UK's future MicroStrategy ?

Coinsilium is one of the first UK listed Blockchain/Web3 Industry pioneers that will also give investors exposure to Bitcoin via it's Forza! wholly owned subsidiary, mimicking that of MicroStrategy, but utilising an innovative approach of yield generation, converting into Bitcoin, which allows you to gain tax free exposure to Bitcoin in your ISA!

The regulatory landscape in the UK is currently somewhat challenging for a listed company that sees the opportunity in holding Bitcoin in treasury running alongside a core business, but that's exactly what Coinsilium are doing.

In fact, it's not dissimilar to that of Strategy (formerly MicroStrategy), Michael Saylor's renowned NASDAQ listed company that implemented a Bitcoin treasury policy in August 2020 and has outperformed every stock in the S&P 500 since, with a share price gain of some c.2,500%

As of May 2025, over 200 companies and institutions globally have adopted a Bitcoin treasury strategy, holding Bitcoin on their balance sheets as a reserve asset. This group includes public and private companies, ETFs, funds, and government entities. either independently or alongside a core business.

It's a growing trend and for good reason and it just so happens Bitcoin, as I write, is challenging a new all time high.

Bitcoin by design with its finite supply is 'designed' to increase in value, love it or hate it, It's becoming a recognised global store of value and an inflation hedge in a Geopolitical climate of fiat currency debasement.

As of May 2025, the United States government has initiated steps to incorporate Bitcoin into its national reserves, essentially silo'ing Bitcoin - if that's not bullish!

Eagle-eyed investors may have spotted that AQUIS listed company, 'The Smarter Web Company' has 10-bagged in little over a month. Why? The company is a web design agency at heart but its decision to store Bitcoin in treasury, receive payment in Bitcoin and its recent purchase of Bitcoin has attracted attention of speculative investors that want exposure to Bitcoin via a listed company, at an early stage.

Why not just buy Strategy ?

It's a good question and the answer is threefold:

-

Strategy is established and re-cycles money into Bitcoin via issue of debt/equity etc when it trades at a premium to its NAV (Net Asset Value). They call it 'accretive dilution'. It's a pretty simple model, find more money and buy more Bitcoin. Strategy's valuation has matured however and so you're not really early to the party as opposed to say new companies such as Coinsilium that will follow a similar (but not exactly the same) model and that leads us on to 'differentiation'

-

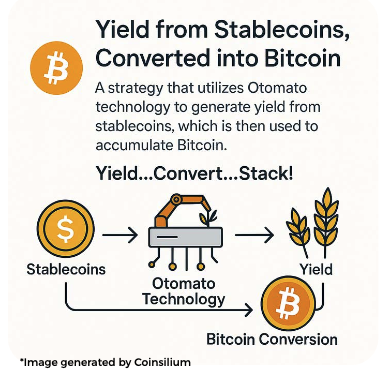

Differentiation: Coinsillium's model is essentially, Yield, Convert, Stack. So rather than just issue debt/equity to buy more treasury Bitcoin (which by the way, they can still do), the company will leverage its Web3 expertise incorporating Defi yield generation, to make it's crypto work, utilising yield generation strategies including Otomato’s, an automation platform for Web3, they call it, Bitcoin Treasury 2.0

-

Tax Efficiency: Stocks listed on the Aquis Stock Exchange Growth Market—such as Coinsilium—qualify for ISAs and SIPPs. This means UK investors can gain exposure to Bitcoin in a tax-efficient way, unlike direct cryptocurrency purchases which fall outside these wrappers. It's a unique and often overlooked advantage, offering potential gains within a sheltered investment environment.

So about Coinsilium...

Core Business

Before we take a look at Forza!!, the heart of Coinsillium's Bitcoin treasury strategy, there is a core business worth noting.

Coinsilium is a Crypto Investor, advisor and venture builder at the forefront of Web3 and AI convergence, what is that?

Web3, if you don't know, is essentially the next evolution of the Internet. I'll not go into massive detail here but just know that it is decentralized, user-controlled, and built on blockchain technology with the aim of making the Internet more open and accessible.

For example, say you are an artist or writer, you may sell your work and receive payment in tokens, tokens that may be stablecoins or can be converted back into stablecoins etc. Another example would be the Metaverse, immersive virtual spaces with digital economies. It's hard to visualise now but it's coming!

Along this theme, Coinsilium has an active portfolio of digital investments ranging from AI initiatives to DeFi (decentralised finance applications). The portfolio is a product of straight forwards equity and token investment by Coinsilium into projects like Yellow Network, Greengage, Otomato and others. It also has an advisory services portfolio whereby Coinsilium has an entitlement to receive 'success-case' rewards such as Bitcoin, Crypto or notably project tokens, the latter which can be very lucrative on wider adoption or success of the project, or a combination of both.

Yellow

Yellow is a project of significant note and one the company is very excited about as an early investor, investing US$200,000 in the project.

The Yellow Network (“Yellow”), is a Layer-3 decentralised clearing network for cryptocurrency trading infrastructure, in which the company holds a vested interest via a Simple Agreement for Future Tokens (SAFT). In fact, since the Coinsilium investment, Yellow announced a USD 10 million seed round led by Chris Larsen, Ripple Co-Founder, at a valuation exceeding USD 200 million — a significant uplift from Coinsilium’s entry point.

As reported just a week or so ago in this news release a significant return on that investment could be close given the Yellow token launch is projected to happen within the next two months.

Coinsilium basically has its foot well in the door of the Industry working with big names and have a number of influential strategic advisors such as Kevin Follonier host of an influential podcast and the likes of James Van Straten, a rising 'thought-leader' in Bitcoin and digital asset strategy and a respected senior analyst at CoinDesk, a prominent crypto-focused media company.

The core business alone contributes significantly to the current company valuation but the 'icing on the cake' and where what I call 'speculation valuation' could really take hold, is in how the company will manage and grow its Bitcoin Treasury via Forza!, so let's talk about that.

Forza! - Bitcoin Treasury

This is the main event of this blog and for good reason—it could well be a considerable driving force behind Coinsilium's valuation going forward, especially when you consider that similar small cap companies have surged in value, largely on the strength of a Bitcoin treasury strategy. But I reckon Coinsilium could trump these with its additional yield optimisation layer and the broader implications for Forza!—which I would speculate could well be spun off at some stage as a ‘pure-play’ entity in its own right.

That’s purely my own speculation, but it’s not without basis. With Coinsilium’s current market cap sitting around £10M and Forza! already holding 15 Bitcoin with an ambition to grow this rapidly, it’s not hard to imagine a scenario where Forza!’s standalone value—especially when factoring in its yield-generating strategy—could exceed that of Coinsilium’s entire portfolio. That would be a compelling case for a future spin-out, particularly in a market that’s starting to assign premium valuations to focused Bitcoin treasury plays.

Of course, it’s too early to get ahead of ourselves, but for investors thinking strategically about where future value could be unlocked, the idea is at least worth keeping on the radar.

Forza! is a Gibraltar- registered company and wholly owned subsidiary of Coinsilium, and has been established to manage the Group’s cryptocurrency treasury and strategy.

The primary reason for locating in Gibraltar is the clarity of the regulatory landscape, in contrast to the ongoing regulatory challenges in the UK. As a wholly owned subsidiary of Coinsilium, Forza! operates independently and within a clear framework—enabling Coinsilium, as a public company, to provide performance updates on Forza! directly to the market with full transparency for UK investors.

Yield, Convert, Stack

At the heart of Forza!'s strategy to build a Bitcoin treasury is the process: Yield, Convert, Stack. Forza! will deploy a range of strategies to generate yield from its crypto assets including, for example, automated stablecoin deployment into curated DeFi protocols using platforms such as Otomato. Otomato is a non-custodial Web3 automation tool that leverages AI-driven agents to optimise returns across DeFi protocols. This is just one example of how Forza! intends to make its assets work before converting the yield into Bitcoin and systematically building its treasury.

The yields can then be converted from stablecoins back into Bitcoin and held in treasury. It's a recursive process and allows the company to balance Bitcoin holdings with yield opportunities to meet the overarching goal of increasing its Bitcoin treasury holdings over the longer-term, like Strategy.

This is the 'Differentiator' we spoke about when discussing Strategy earlier, it's how you obtain the cash to build your Bitcoin and Coinsilium's approach allows the company to adjust its Bitcoin holdings as opportunities present themselves but as previously explained the long-term strategy is to build the Bitcoin holding.

The company is also well aware of risk too and their strategy will be to manage the treasury in a risk adjusted manner, reducing exposure to Bitcoin price volatility.

The Wheels are in Motion

The company announced on the 15th May an oversubscribed fundraise, raising £1.5M. Following the raise the company has since announced an ‘Initial Bitcoin Purchase Plan’ and ‘Allocation to Forza!’

The company intends to move Coinsilium’s 5 Bitcoin from its reserves into Forza!, alongside a minimum planned purchase of a further 10 Bitcoin funded from the fundraise.

This will prime Forza! With an initial 15 Bitcoin holding on top of which the company will add to as further opportunities arise.

Investment Case

Before we discuss this, it would be prudent to acknowledge that investing in any small cap company carries risk and one that is heavily involved in crypto could be viewed as even higher risk, however, the company has a core business in what is is expected to be an exponential growth market, independent of its crypto/treasury holdings.

Investors here in the UK cannot gain exposure to crypto derivatives under FCA rules meaning you can really only buy spot Bitcoin/Crypto or Strategy. Coinsilium changes this, with its clever set-up, you or I can invest in the company (which has a distinct core business, and high potential one at that), whilst quietly enjoying the exposure to the Bitcoin in treasury which will continue to grow as they yield, convert, stack, not to mention gain exposure to other crypto projects along the way that you or I wouldn't necessarily understand but could generate significant yield and returns either by staking or token value appreciation.

Given what we are seeing with other small cap companies, employing Strategy's Bitcoin treasury approach (as mentioned earlier), Coinsilium could well follow suit especially as it has an interesting mechanism to generate Bitcoin others don't and provides UK investors with exposure to Bitcoin FX free, through our own investment ISAS/trading accounts and importantly, Tax Free in Stocks & Shares ISAS.

It’s quite possible that as the rest of the world follows the US and other countries in building strategic Bitcoin reserves, the UK will eventually do the same. When that moment comes, it’s likely that many more players will flood into the space. But as noted earlier, the speculation around a potential spin-out of Forza! gains weight when you consider that it’s already operating with a clear strategy—accumulating Bitcoin and optimising yield—well ahead of the curve.

The regulatory environment may still lack full clarity, but it hasn’t stopped companies like Forza! from getting on with it. That’s where the real opportunity lies: in being early, before the herd arrives. In time, Forza! itself could be spun out of Coinsilium and become its own beast—an independent, focused player in one of the fastest-growing niches in digital finance.

Now, this is purely my speculation—but it just seems like the kind of strategic move a company like Coinsilium could be thinking about.

If Forza! were to be spun out and become its own beast, that could potentially mean a significant payday for Coinsilium investors—whether through a new shareholding in Forza! or even a one-off dividend, who knows. Either way, picking up Coinsilium shares today gives you exposure to something you can’t really get elsewhere. You just need to be a Bitcoin bull, I guess!