Blencowe Resources Research Note

A fast emerging graphite miner with their Orom Cross projects in Uganda. At a markedly lower Market Cap than similar graphite peers, Blencowe provides an early bird investment opportunity for those wanting exposure to graphite over the coming years.

Key Highlights

- Near, mid and long-term Graphite investment opportunity

- Huge 2-3 billion tonne estimated graphite resource

- JORC Resource of 24.5m tonnes @ 6% TGC (just 2% of overall est. resource)

- Robust Economics (PFS) US$482M, 49% IRR, US$62M Capex

- Low US$499/t full operating cost FOB port

- 21 year mining license with full environmental and other approvals including community engagement in place to commence mining

- Production forecast 2025 as graphite deficit kicks in

- First ‘Asset Level’ partner transaction to fund DFS and potentially Project sign-posted for Q4/22

- Strategic Chinese partner for bulk testing with a view to closing binding off-takes

- Low Market Cap Vs peers offering significant return potential for early investors

Junior resource stocks at beaten down lows, time to buy?

The last two years or so have been a rollercoaster on markets with the pandemic wiping trillions off equity valuations only to stage an immense V shaped recovery aided by QE and hit new all time highs.

As main markets pulled off an immense bull run, junior resource stocks and AIM stocks in general stagnated not really following the market up. With the realisation of the ‘piper has to be paid’ and inflation ballooning, not helped by the war in Ukraine, markets have again pulled back to near pandemic lows. This has further depressed higher risk stocks such as AIM and junior resources.

This has lead in my opinion to some of the most compelling valuations of such stocks that has been seen in many years. As an example, Asiamet resources a popular retail copper stock once traded at a £100m market valuation and now trades at less than 20% of that valuation today. There are countless other examples of junior resource stocks in particular trading at similar discounts to their all time highs.

Why is that? Well there hasn’t been any risk appetite and sentiment has been so poor that the higher end of the risk market has been obliterated. Any company failing to deliver during that period will have also been singled out for ‘special treatment’ in the form of share price destruction!

Opportunity ?

The good news is markets are cyclical and risk appetite will return and when it does, investors who can single out companies in the right sectors, with the right projects and importantly a Management team that can deliver could be in for portfolio changing returns.

As investors, especially in nano-cap stocks we may not be out of the woods yet with more pain to come but if we are entering the later stages of ‘doom and gloom’ and depressed markets, now could be the time to select companies that provide opportunity and start positioning.

One such company I have identified is Blencowe Resources.

About Blencowe

Blencowe are developing their 100% owned Orom Cross graphite project in Uganda. The company hold a 21 year mining lease awarded in 2019. The company also had an interest in a nearby nickel sulphide project with the aim of expanding the companies battery metals exposure.

The company have since terminated their interest in this project given the exceptional economics that were delivered in the graphite project PFS and a particular approach from a potential Chinese strategic partner. This makes sense, personally I don’t like to see junior resource companies trying to juggle multiple balls given that developing one good project requires focus and of course cash!

On the latter, the company recently had an £800k investment at 5p from RAB Capital with a further strategic investment from RAB, Jangada and JUB Capital of £750k at 4p (corner-stoned by Jangada), The company are cashed up nicely into 2023 as they progress the DFS, their strategic partnership and plan for production.

CEO Mike Ralston mentioned on a recent investor call that all future ‘significant’ project capital requirements will come from project/asset-level investment and that any further capital raises (equity) required for on-going corporate expenses would be small and strategic thus limiting equity dilution.

This indicates that the up-coming DFS itself and associated programme will have a funding partner and the company is hoping to have this funding in place by end of calendar year.

Orom Cross Graphite Project

The 100% owned Orom Cross graphite project is located in Uganda. Uganda is a top-tier mining destination in Africa with comparatively low royalties and taxes.

The project is a substantial graphite deposit estimated at 2-3 billion tonnes with a current defined JORC resource of 24.5m tonnes (6% TGC) representing just 2% of the overall estimated resource.

Economics

The company in 2022 completed metallurgical testing and a PFS with the PFS exhibiting robust economics as follows:

- US$482M Post Tax NPV

- Initial Capex $62M

- Average 101,000tpa 97% graphite concentrate over LOM

- 14 year initial mine life

- US$1.1Bn FCF, US$1.398Bn EBITDA over LOM

- Significant operating margin of US$800/t +

Product

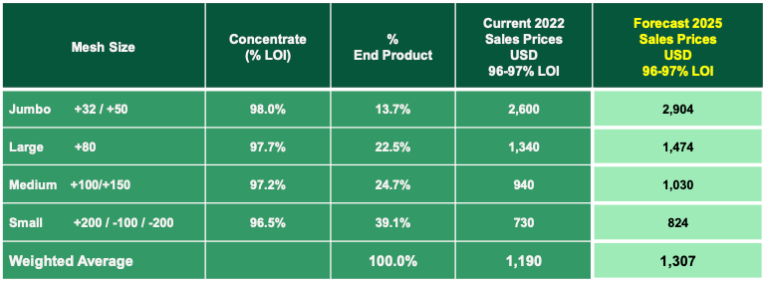

The following table from the company presentation shows the distribution of graphite flake sizes showing that Orom Cross has a nice blend of different mesh sizes with suitability for a variety of end products such as expandables and of course the EV battery sector once the concentrate is up-scaled from 97% to 99.9% purity.

Graphite end product is extremely important when looking to secure off-take contracts and that’s why Blencowe have initiated their bulk testing programme with their strategic partner.

Initial test-work performed by Blencowe has shown high purity graphite concentrate can be produced (as seen in the above table) and this makes the process of up-scaling to the 99.9% EV battery SPG grade product more achievable and ultimately lower cost.

The BMI estimate that 100 new graphite mines will be required by 2030 to meet EV demand but only 10-15% of those could make the grade, Blencowe hope to be one of them!

ESG

Environment, Social and Governance is becoming a key consideration for investors going forwards as companies increasingly need to prove compliance to secure funding and investment for their projects and even to secure down-stream off-take agreements as recipients themselves need to prove their own compliance.

Blencowe are very well placed in this regard given that power for the plant will come from hydro-electric power on the local grid. Using low impact machinery and equipment will reduce the mining footprint at Orom Cross and Blencowe are also looking at tailings and other processing options that are more environmentally friendly.

Forward Plan

What I like about the Blencowe proposition is, not only does the company have an excellent project in a sector that will be and is ‘hotting up’, the company have communicated a clear and credible forward plan to take the project through its final stages of de-risking, through development and ultimately to production.

The company had originally planned to build a pilot plant next year to produce product for off-take evaluation and validation (as part of the DFS) that would then make securing finance a lot more achievable.

However, as communicated in recent RNS, an approach from a potential strategic Chinese partner has slightly ‘changed the game’ and resulted in the company changing tack whereby they will now supply 100 tonnes of raw material to be shipped to China for bulk testing where a pilot plant already exists. This will produce 6 tonnes of 96% concentrate that can then go into SPG and Expandable testing to up-scale the concentrate to 99.9% purity.

The resultant product will then go to various OEM’s and is expected to result in full binding off-take contracts (subject to successful testing). Test-work in Canada and Perth has already confirmed smaller scale operation, the idea of the bulk testing programme is to confirm scale.

This programme is one part of the wider 2023 DFS programme which is pretty detailed and as such will see regular news-flow throughout 2023 with completion by end of year allowing for a ‘decision to mine’ to be taken.

One thing I have learnt over the last few years, especially with junior mining companies is that said companies need to have a credible plan to actually turn desk-top work into reality. Blencowe have demonstrated they have a plan and are likely in my opinion to ‘leap-frog’ other junior graphite peers to achieve mine build 2024 and production 2025 just as the graphite deficit will likely be biting!

Management

A credible plan needs a credible team to deliver it and this is often where junior resource companies can fall down. Not so with Blencowe, they have an experienced board. Mike Ralston CEO is a chartered accountant with 25 years experience of business development having raised over A$300m in debt and equity for various projects. Mike has been involved in developing at least three mining companies through to production and has held various executive positions in junior resources.

Cameron Pearce, Executive Chairman and founder of Blencowe is also a mining veteran having over 20 years experience and holding senior positions in various listed and private companies.

Iain Wearing a mining engineer is COO and has over 30 years experience in the resources sector with particular focus on Africa.

Collectively the team have excellent experience (and importantly contacts) to push Blencowe forwards, all with strong track records and this comes across also in the regular communication with the market. You can read more on BIO’s here and additional members of the Blencowe team. Management is one, if not the most important factor I consider these days when looking at potential companies to invest in whether that be short or longer-term.

It’s also worth noting that the board have been building a solid shareholder register, something CEO Mike said he would do and this is evident from the current holdings of RAB Capital, JUB Capital and recently Jangada, with RAB and JUB maintaining their % holdings in the most recent raise (which did not go out to the general market either). This adds to Managements credibility with the three shareholders now accounting for some 27% of shares in issue.

Graphite – the new Lithium?

There has been plenty of commentary on the EV battery sector and associated sectors such as Energy Storage. Electrification seems to be the future for now and the key minerals that are required are rapidly coming into focus.

So far a lot of the noise has been around lithium and rightly so. Car manufacturers specifically have been fretting about sourcing the mineral with the likes of Elon Musk muting buying mining companies to secure supply! Lithium prices have exploded due to the anxiety around sourcing it but there are many other minerals that are critical (at least for the foreseeable) in creating batteries.

One that is often overlooked is graphite which in actual fact makes up c.50% of the battery being the anode part of the battery. All lithium-ion battery combinations require graphite in the anode. In fact Elon Musk was famed for saying that EV batteries should be called ‘nickel-graphite’ batteries.

You may be surprised to know that today the majority of graphite demand is not batteries but other uses such as expandables, flame retardants, thermal sheets the list goes on. However as the world adopts electric cars and other battery based products (my golf electric trolly has one!), batteries are set to become the main driver for graphite demand and by some margin! This will lead to a deficit which is starting to emerge and graphite basket prices have already started creeping up.

Another consideration is that synthetic graphite is manufactured directly in China, however the process is carbon intensive and dirty which means that we will see more natural flake graphite being required to then up-scale to spherical graphite required by batteries to lower the carbon intensity.

What that means is that more quality natural flake graphite projects around the world will be required to feed into the impending demand up-lift with a lower carbon intensity. This is where the likes of Blencowe are well positioned.

A ‘bun fight’ for important minerals such as graphite could ensue given the supply/demand dynamic, its no co-incidence graphite now appears on the US and Europes critical minerals lists.

An eye on Risk

As with any investment it’s worth noting risks and at this stage I see two key risks worth noting:

Funding – Obtaining funding is always a key risk for junior mining companies, especially with current market sentiment. That said, the Orom Cross project is large-scale, high quality, exhibits excellent economics (PFS) and the team running the company have done it all before. The company have indicated they aim to have a non-equity initial funding solution to progress the project in place soon.

Off-take – the company will need to demonstrate they have a high-quality product to sell to achieve binding off-take contracts. Initial met test-work has shown a high quality product and the bulk test-work and SPG testing programme aim to prove the high quality product at scale so binding off-takes can be achieved.

Conclusion

So before I highlight all the fluffy bits and why those invested could be sitting on significant returns we need to be aware that small cap companies in general carry high risk and that macro-events can dramatically change the land-scape for any investment so don’t be throwing the kitchen sink in, manage your risk !

Now back to business…

So hopefully in this brief research note I’ve helped you understand a bit more about the Blencowe proposition.

Many commentators, and myself included believe that the ‘era of graphite’ is upon us with an impending deficit already filtering through to an up-tick in graphite pricing. As reality bites, we could see graphite pricing going on a sustained run similar to the likes of lithium.

Investors that can now weed out graphite companies with quality projects that are either in production or near-term producing like Blencowe could be in for some huge gains.

Back to Blencowe…

Blencowe remarkably sits at just £8m market cap which is significantly behind UK and Australian peers, despite the fact the company has made rapid progress this year delivering a JORC resource, successful metallurgical testing and a robust project PFS.

I would say although a bit further behind, Blencowe are a similar proposition to Black Rock Mining who have achieved financing and off-take and whose market cap has this year achieved in excess of £100m. This shows the potential uplift in valuation Blencowe could achieve.

What sets Blencowe out from a number of lower value peers however is that it has a highly credible plan for getting to production with recent communication sign-posting a strategic project level investment could be coming imminently that would remove short-term project funding risk.

It’s no co-incidence in my view therefore that Blencowe have now attracted three strategic investors to the register that have also been happy to top up the companies funding pot when required and at market price.

With graphite potentially on the cusp of a big run due to the impending deficit, Blencowe rapidly progressing the Orom Cross project potentially leap-frogging peers, with a strong experienced management team (that regularly communicate with the market) and a boat load of news flow to come, I think it’s a good buy down here whilst the rest of the market capitulates !