Orcadian Energy Research Note

With the UK’s renewed focus on North Sea Oil & Gas, Orcadian Energy is set to be at the forefront of a lower carbon and ‘greener’ approach to Oil & Gas development with its flagship Pilot field development-ready sporting 79MMbbls of 2P reserves and a significant oil in place total of 263MMbbls.

Key Highlights

- Flagship North Sea Pilot field 2P reserves of 79MMbbls – development ready

- Additional North Sea licenses taking overall resource to 160MMbbls

- Additional un-risked prospective resource of a further 143MMbbls

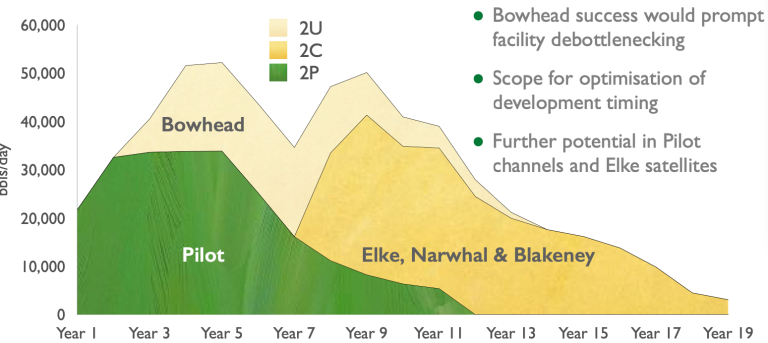

- Potential across resource of up to 50k bopd, c.30k bopd from Pilot field

- OGA supportive of Orcadian’s low emission development plan

- Pilot field development emissions will lie in lowest 5% globally

- Pilot field NPV10 $640m at $60/bbl, NPV10 breakeven of c. $39/bbl

- Renewed Focus on North Sea Oil & Gas by UK Government with a dedicated task force to support North Sea development projects.

North Sea Oil comes back into focus !

I doubt you’ll have missed the endless commentary on the current energy crisis brought about by a combination of the pandemic and war in Ukraine. The UK and if fact most of the world has plodded along with a heavy reliance upon countries like China and notably Russia for key resources including Oil and Gas.

If it’s not broke don’t fix it, the problem is it’s breaking and countries around the world are scrambling to reduce their reliance upon other countries that may hold them to ransom, or worst cut off supplies full stop.

The UK is one such country and in fact is a leader on the world stage when it comes to diversifying its energy and moving towards more renewable energy. One thing the UK and other countries can’t do right now and for the foreseeable future is easily reduce their reliance upon fossil fuels such as Oil and Gas. So if there is a dependency on such energy, where better to look than your own back yard, that’s where Orcadian come in…

So lets talk about Orcadian then…

About Orcadian

Orcadian are a relatively new entrant to the market having IPO’d at 40p back in 2021 so you’ll not likely have heard of them and a scan on social media reveals there isn’t much chatter on the company right now.

The company are progressing their licenses which I will go into briefly further on in this note but notably their flagship asset the Pilot field is development ready with a significant 79MMbbl 2P resource in the North Sea with additional contingent and prospective resources that would allow the company to grow its Oil and Gas business organically.

Given what’s happening with the UK energy strategy right now as I discussed earlier, the timing couldn’t be better for a junior with such development ready resources and growth potential in my view.

Management

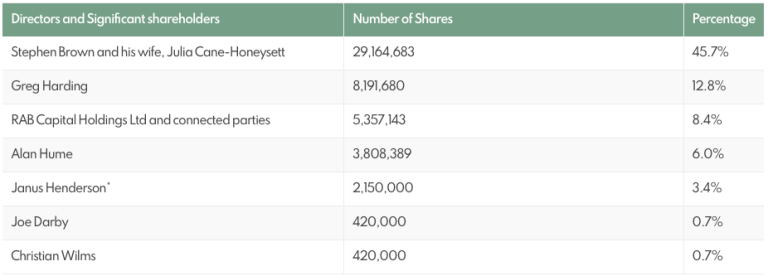

As with any companies we like to see who is running the company and if possible meet them. I had the pleasure of meeting up with CEO Steve Brown and CFO Alan Hume recently to hear more about their background and of course plans for Orcadian. One thing I really like about the Management team is their ‘skin in the game’ and by that I mean their shareholding and alignment with investors.

You can see from the above that Directors hold in excess on 60% of the stock and what I like is its not just one Director with a meaningful holding.

You can read up further on the team at the Orcadian website. Steve Brown the largest shareholder has over forty years experience in Oil and Gas with experience at the likes of BP and Petrofac, FTSE big boys.

Projects & Licenses

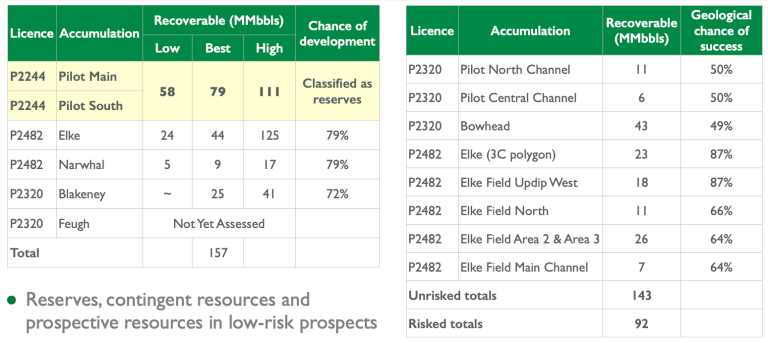

The key projects and licenses span reserves, contingent and prospective resources and are as per the info-graphic below taken from the company website.

The primary focus is on the Pilot field because it’s development ready and would bring first cash flow that would then allow additional licenses to be further appraised and hopefully developed, the key here though is Pilot is fully appraised (with several reservoir penetrations and tested wells) and is development ready with 79m barrels of oil sitting there waiting to come out subject to financing.

It’s worth discussing at this point the nature of the oil in the Pilot field. the oil is more viscous ie heavy and as such requires a slightly different technical approach for extraction. I am by no means an Oil and Gas expert so I’ll regurgitate from the company presentation but basically a Polymer flooding process is used to extract more viscous oil. This process essentially thickens the water used to push out the oil.

This process has been proven off-shore on the Captain field in the Central North Sea by Chevron. Again, you can read more about this process on the company website.

The Pilot project sports some robust economics with an NPV10 of $640m at $60bbl and a break even of around $39bbl. This is based upon the production plan which uses an FSPO (Floating Production Storage and Offloading) vessel , two WHP’s and a floating wind turbine!

Capex is not insignificant at c.$1bn however a large chunk of this is the FSPO, c.60% and funding this component has various options including lease-back approaches moving that chunk of Capex commitment elsewhere.

Of course Oil todays trades far higher c.$100 barrel so the economics are materially enhanced at todays oil price and exceed $1bn NPV. A further 78MMbbl of contingent resources at Elke, Narwhal & Blakeney licenses give an $458m NPV10 at $60bbl.

The following graphic from the company website gives a flavour of the likely production profile with Pilot the confirmed reserves yielding c.30k bopd a key takeaway being the longevity and organic growth potential on offer.

Spear-heading greener Oil & Gas production ?

Just because the UK wants to and needs to re-establish North Sea Oil & Gas production it doesn’t mean doing so with disregard to emissions. Orcadian’s approach will be at the forefront of cleaner Oil & Gas production in fact the Pilot field development would put the emissions within the lowest 5% globally, this has been derived by using the Stanford University dataset.

This is brought about by operating a shorter field life (helped by the use of the Polymer approach), lower fluid handling, process and power generation optimisation and the use of renewables such as wind turbines with highly efficient back-up gas power when needed. The combined effect is an 80% reduction in emissions.

Valuation Disconnect – It’s pretty big!

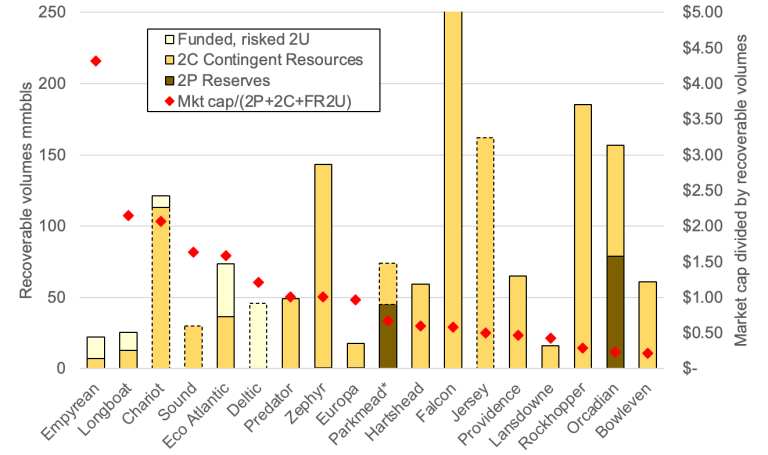

Here is the interesting bit! Because Orcadian is new to the market, it seems many haven’t picked up on the current valuation in relation to its reserves, resources and comparisons to other junior Oil & Gas peers. The junior market is often a ‘bun-fight’ for popularity and you see some Oil & Gas favourites sporting some considerable valuations with just contingent resources that require extensive appraisal to be converted to reserves. That’s fine but what if you find an out-lier or new play that potentially blows them out of the water when you stack up the sum of the parts – I think Orcadian is just that.

I sourced the below chart which is derived from analysis at the start of the year. It’s based upon resources with a fairly straight forward mapping to Market Capitalisation. At this stage I urge you to verify the data as its dated and some companies may have moved forwards since the start of the year but it shows a compelling valuation disconnect for Orcadian based upon overall resource. It’s not necessarily apples and apples because there are other things to consider like cost of extraction, but on an overall resource basis it’s interesting.

Dataset as at Jan 2022

But pay attention to the 2P resources, these are proven and probable reserves which significantly de-risk the valuation further. By any measure, looking at this data Orcadian in my opinion looks disproportionately and incredibly cheap and a Market Cap of 2-3x current level wouldn’t look out of place and that’s before any further news/developments.

Next Steps

So, what can investors get excited about from here on? Well I’d say the first thing is the current valuation before we discuss potential news-flow, by any measure I look at, it looks cheap (again my opinion) but moving forwards we can expect an updated CPR, progress on the FEED (Front-end engineering design), farm-in partners either another oil company or contractor alliance, possible news on FSPO contract, a resulting finance package and final FDP approval.

Given the company have proven reserves financing options for the initial Pilot field will be flexible and the Management aligned with shareholders will seek the less dilutive approach possible.

Perhaps the key thing to consider here is that a year ago Oil & Gas financing wasn’t going to be so easy and I personally may have avoided the sector – the game has changed, North Sea Oil & Gas projects are going to happen, it’s in the Governments Energy Security plan and a task-force has been established to ensure such projects can proceed.

Longer-term the company will be focused on expanding reserves, converting contingent resources into reserves and drilling low risk prospects on licenses close to existing infrastructure.

An Eye on Risk

As with any investment we need to be aware of the risks particularly with micro cap companies.

Technical

When I first read through the presentation and chatted to Steve I was concerned about Oil Viscosity, as I said Im no expert by a yard mile but once Steve explained the process and that Chevron have proven up the polymer process at the Captain field my concerns were alleviated but it’s worth acknowledging any technical risks.

Funding

This topic appears as a risk on pretty much any research note I write and rightly so. If you asked me a year ago about raising finance to develop an Oil & Gas project I’d have been pretty wary but as I’ve said previously, the game has changed, North Sea Oil & Gas is now a part of the UK energy security strategy and is a must-have.

To that end this risk seems somewhat mitigated not withstanding the significant economics that across the project portfolio yield over $1.4bn NPV at $70bbl – oil trades today at over $100. It’s useful to look at the forward curve though and I believe this sits at $80+ for the foreseeable especially given Russias Oil has been largely taken out of the market. Some analysts forecast $150 oil coming.

Despite the overall project finance requirements being punchy, there are lots of options on the table as to how this could be structured.

Conclusion

So before I highlight all the fluffy bits and why those invested could be sitting on significant returns we need to be aware that investing in micro cap companies in general carries high risk so don’t be throwing the kitchen sink in, manage your risk !

Now back to Orcadian…

So at £26m Market Cap and looking at peers with less resource let alone booked reserves I can’t come to any other conclusion that on paper the company is sitting at a hugely discounted valuation.

Some peers with similar resources or lower reserves are sitting at 4x Orcadian’s valuation today, Zephyr just one example and this is before any further news flow developments.

With a development ready project that should produce up to c.30k bopd rising to c.50k bopd if follow-on prospects are proven up and a new impetus on developing North Sea Oil & Gas assets, with a Management team more than aligned with investors, astute retail investors could get in before material news lands and bigger players come to the table because I think it’s only a matter of time !