Georgina Energy Research Note

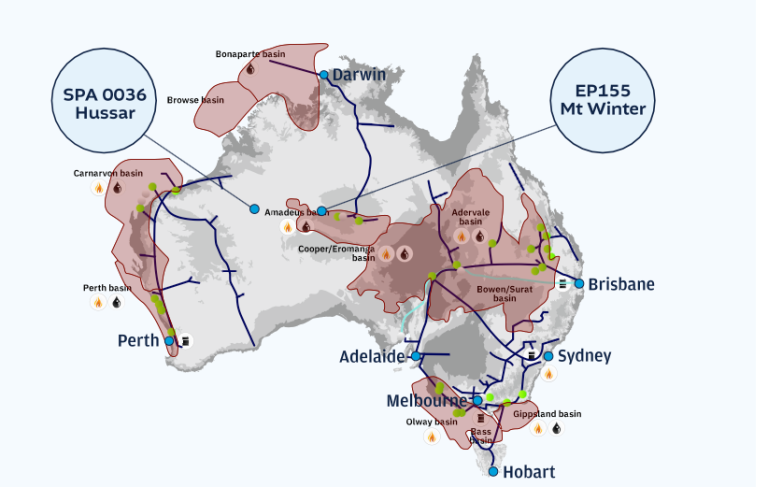

Georgina Energy (LSE:GEX) Georgina Energy comes to the London Market with the aim of being one of the top four global producers of helium and hydrogen. The company is a development play looking to develop two projects in the highly prospective Officer & Amadeus Basins in Australia

Key Highlights

- Rare Helium & Hydrogen Investment Opportunity

- Tier 1 Project Locations with proprietary access to proven, unparalleled large scale Helium & Hydrogen Resources in Australia

- Hussar Project considered to be one of the most potentially significant resource basins in Asia Pacific region due to its significant Helium, Hydrogen, Oil & Natural Gas potential

- Hussar has the required elements to yield net attributable 2U Prospective Resources of 155 BCFG Helium & 173 BCFG Hydrogen with a potential combined in-situ value of US$55 billion

- Mount Winter Prospect hosts un-risked 2U Prospective (Recoverable) Resources of c.148 BCFG of helium and c.135 BCFG of hydrogen, and c.1.22 TCFGE (Trillion Cubic Feet Equivalent) of hydrocarbons.

- Mt Winter project (targeted Heavitree formation) has 100% success drill rate with very high helium and hydrogen concentrations (up to 9% Helium 11% Hydrogen)

- Combined Helium Resource of c.303BCF (over 40% larger than peer Helium1/£70M Market Cap)

- Helium a rare commodity with unprecedented short supply globally

- Skilled Management Team with a wealth of commercial experience

Helium in Vogue

Helium companies are receiving a lot of attention right now and rightly so.

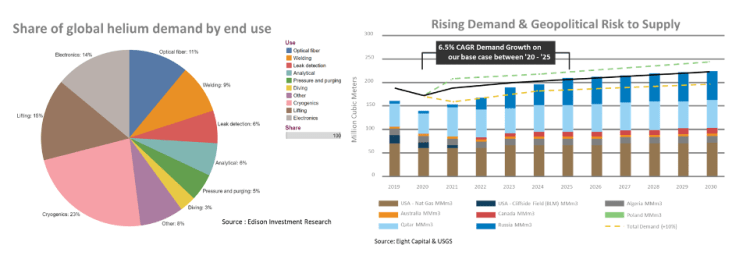

Helium has numerous applications. It’s widely used in cryogenics for cooling superconducting magnets in MRI machines and other medical equipment. It’s also used in the aerospace industry for purging and pressurising fuel tanks, in electronics manufacturing for cooling semiconductors, in welding processes, and even in scientific research. Its use in MRI Scanners and Cryogenics accounts for some 30% of its overall usage.

Helium is a non-renewable element and with global reserves rapidly depleting it will rely upon further discoveries whereby it’s commonly extracted as a by-product of natural gas extraction.

Helium is challenging to extract and transport (‘the escape artist’) and is commonly converted into liquid form however there is a time-frame of some c.30 days or so, whereby if it’s not delivered can evaporate if not insulated sufficiently to prevent ‘boil-off’

So with global reserves depleting (the US, Qatar and Russia controlling the largest reserves) and with political tensions further impacting supply concerns, Helium Exploration and Development companies such as Georgina Energy look to be a good place to get some exposure.

About Georgina Energy

Georgina comes to the UK market by way of an RTO in July 2024. The company are planning to develop proven helium/hydrogen and natural gas resources in Australia.

The two projects, Hussar and MT Winter sit within proven basins where historic drilling at nearby wells in the Amadeus basin, drilled in 1980s, achieved a 100% drill success rate, revealing very high Helium concentrations (up to 9%)

Un-like other helium plays, Georgina consider themselves to have significantly de-risked exploration (both targets are seismically defined and have been historically drilled for oil and flowed high pressure gas).

The company plan to drill and develop two separate wells (re-entering/side-tracking to deepen the wells) with the aim to extract the resources and sell them at the well-head.

This approach differentiates Georgina and will reduce capital costs as they sell directly to off-takers who will be responsible for the storage, refining and transportation. In fact the company has already executed an MOU with Harlequin Energy, experts in this field.

Ultimately, given the potential size of the resources, Georgina aim to be one of the top four global Helium & Hydrogen producers.

Management

As with any investment, the Management team is a key consideration. You can have an outstanding project in an outstanding jurisdiction but if the Management team can’t execute or don’t have the commercial ‘nouse’, you may not see any return on your investment!

CEO, Anthony Hamilton

Anthony has a wealth of experience in the Oil & Gas sector and is one of the founders of Georgina Energy. Anthony has taken projects from discovery to production in both the oil and gas and mining space.

Finance Director, Mark Wallace

Mark is also a founder of Georgina. He is a chartered accountant with over 25 years of experience in the financial markets. Mark has extensive experience in funding for the development of production and operational assets across numerous commodities.

Technical Director, John Heugh

John has over 50 years of experience in oil and gas geology with multiple successes and will be leading the technical/engineering approach at both projects for Georgina.

‘skin in the game’

At this point, it’s worth highlighting that both Anthony and Mark as founders have sunk over £2.5m into Georgina. This is a major plus point from an investment point of view as the market always likes to see Directors with ‘skin in the game’, and a significant amount at that!

Helium Market – A Scarce Resource

Significant market changes, including the shutdown of the U.S. Helium Reserve and the geopolitical risk to the producers in eastern parts of the globe, have driven an explosion of interest in exploring for and developing helium reserves.

Helium is experiencing unprecedented demand due to short supply globally with end usage growing rapidly particularly in high-tech sectors.

The global market for this non-renewable resource is set to increase, even by a conservative estimate, at a compound annual growth rate (CAGR) of over 6.5 percent by 2025 (source: Eight Capital & USGS)

I’ve written a few blogs on the graphite market and much like graphite, helium pricing is not particularly transparent with most pricing contracts negotiated individually and subject to NDA’s.

The United States Geological Survey (USGS) estimates however recent pricing contracts for helium of anywhere between $300/mcf to $800/mcf, much depends on individual circumstances such as extraction, logistics and storage but pricing can typically be around 100x current US natural gas pricing.

So we know we need helium and the market demand is growing YoY, the supply has flat-lined and bar a trip to the moon to extract more helium (no joke, the moon has an abundance of it) how will the demand/supply gap be met? We’ll need to discover more of it and of course that’s where Helix Exploration fit in!

The Projects

Hussar (Officer Basin)

Georgina holds a 100% interest in the Hussar project license EP-513.

The company were granted the license in October 2023 to focus on the helium, hydrogen and natural gas potential.

The Hussar Project is considered by independent consultants to be one of the most potentially significant resource basins in the Asia Pacific region due to its significant Helium, Hydrogen, Oil & Natural Gas potential.

Independent consultants confirmed that Hussar has the required elements to yield net attributable 2U Prospective Resources of 155 BCFG Helium & 173 BCFG Hydrogen with a potential combined in-situ value of US$55 billion (He US$350/MCFG, H US$2.65/kg).

Not only does Hussar host large helium and hydrogen resources there is significant natural gas potential, Net attributable 2U Prospective (recoverable) Resources of 1.73 TCFG of Natural Gas with a potential in-situ value of US$5.24 billion.

The plan at Hussar is to drill a deeper well (via re-entry) in December 2024. Hussar is seismically defined and the company recently flew a 3500km2 AEMPTP arial survey which identified a significant gas anomaly on top of the target structure which is much larger than that seen on a 2D seismic survey conducted 40 years ago. This is particularly exciting!

MT Winter (Amadeus Basin)

Georgina has the right to earn-in an interest of 75% of the MT Winter prospect with the potential to reach a 90% interest. Georgina, via its subsidiary is the Manager and has Operatorship of MT Winter.

The Mount Winter Prospect hosts un-risked 2U Prospective (Recoverable) Resources of c.148 BCFG of helium and c.135 BCFG of hydrogen, and c.1.22 TCFGE (Trillion Cubic Feet Equivalent) of hydrocarbons.

The Mt Winter-1 well was drilled in 1982 targeting Oil to a depth of 2,650m TD but did not penetrate the subsalt Heavitree formation where the hydrogen, helium & natural gas reservoir targets sit.

All 3 previously drilled wells that penetrated the Heavitree formation however, encountered high concentrations of helium (up to 9%) and hydrogen (up to 11%)

MT Winter like Hussar is another potentially significant helium, hydrogen and natural gas resource.

The plan for MT Winter is to complete further seismic and then re-enter/side-track the existing well, penetrating the sub-salt Heavitree formation and develop the helium, hydrogen and natural gas

Potentially Significant Global Helium & Hydrogen Resource

Georgina’s Hussar and MT Winter prospects combined offer investors exposure to potentially globally significant helium and hydrogen resources with an additional potential resource of c.3TCF of natural gas.

In the case of helium, the combined projects resource potential is c.303BCF, to put that into context that’s some 42% larger than Helium1 (Market Cap £70M)

An eye on Risk

As with any investment it’s worth noting risks and at this stage I see two key risks worth noting:

Well Development Success

There are no guarantees that the company will be able to develop the wells and confirm commercial helium/hydrogen, however the company have spent a lot of time and fully costed the well re-development programme with fall-back development options (such as side-tracking) planned and the expectation is that the company will find helium concentrations of potentially 5% or more, which is market leading.

Funding

Funding is always a risk to consider, however investing in helium is hot right now due to the market dynamics and Georgina’s successful listing raising £5M shows there is market appetite. In addition, the companies plan to sell at the well-head reduces capital requirements further down the road.

Conclusion

So hopefully in this brief research note we've helped you understand a bit more about the Georgina Energy proposition.

The investment play here as we see it is a follows:

Investors can gain non-binary exposure to two high-impact drills with both projects hosting very large resource potential.

The Management team ticks the boxes having decades of combined experience and success in the sector with the board having a significant amount of ‘skin in the game’

Georgina’s approach to sell gas at the well-head reduces capital costs and potentially fast-tracks them to production and generating cash.

Given the potential size of the resource, the helium/hydrogen concentrations c.5-10x higher than typical producers and the companies ambition to be one of the top 4 global producers, at just £11M Market Cap, and with the drill-bit to start turning this year, investors could see significant upside, especially if Georgina follows in the footsteps of peers such as Helix Exploration and explorer Helium1 (£70M Market Cap)!