Afritin Mining Research Note

Afritin are the only pure-play UK list Tin mining company with one of the largest tin mines in the world located in Namibia, Africa.The company achieved first revenues in November 2020 with a phased development plan that is targeting over $100m in annual revenues 2025.

Key Highlights

- Leading Tin investment opportunity

- One of the worlds largest Tin Mines – Uis Tin Mine Namibia

- Additional Tin projects

- By-products Tantalum, Lithium and potential REE offer additional upside

- Low first quartile C1 cash cost

- Nameplate Phase 1 production achieved November 2020

- Phase 2 production plan expected to achieve over $100m in annual revenues

- Strong Tin market dynamics benefiting from green-energy narrative

- UK’s only pure-play listed Tin investment opportunity

Tin hats off !

As the title says, with interest in junior resources picking up, particularly those that fit with the ‘green-energy investing’ narrative, we should be able to take our ‘tin hats’ off and prepare for what could be a very rewarding resources bull market!

Now as I have said before, you are going to have to pick right, my focus is strongly on base and industrial metals, battery metals and PGM’s (Platinum Gold Metals group) commodities.

Now when I say pick right, what I mean is, junior resource stocks that have larger/tier1 deposits, have a favourable macro tail-wind and perhaps most importantly are near-term cash-flow generative.

The focus for me is transition to growth and riding the bull market .

You can see what I mean by this by looking at two examples I like to use Jubilee Metals Group (JLP) and Sylvania Platinum (SLP). Both companies that have and are experiencing a strong re-rate as they have transitioned to cash-flow generation and are organically growing.

This doesn’t mean I will rule out early-stage opportunities but they’d have to be offering a stark value proposition and forward potential where I can see value creation from an early entry and not just be riding the commodity euphoria with no real hope of actually ever achieving anything. These are highly speculative.

I think those that fit the green-energy narrative though with a clear roadmap will lead the pack such as copper, nickel, graphite, aluminium etc but due to stimulus, weaker dollar/ inflationary pressures most commodities should see a nice uplift assuming favourable supply/demand dynamics remain in play.

So before we look at Afritin, the subject of this research note, Tin is a metal I had over-looked until I saw some commentary on social media regarding recent moves in it’s price. A little dig-deeper reveals why that is happening and I’ll discuss that a bit later in my section on the Tin Market.

So lets talk about Afritin then…

About Afritin

Afritin are the only ‘pure-play’ tin mining option on the London market with two tin projects the Uis tin project in Namibia and the Mokopane project in South Africa.

The company listed on AIM in 2017 and remarkably have achieved first name-plate production in just a couple of years – I like a company that deliver rather than dither!

I’ve not had the opportunity to speak to Management yet but the board look to have a lot of experience between them notably CEO Anthony Viljoen founder and Director of Bushveld Minerals and Roger Williams Non-Exec of Sylvania Platinum a company I mentioned earlier in this note. For a full read-up on the board which is clearly set-up well have a look at the company presentation

Given the market back-drop for Tin, the accomplished Management team and scale of the projects, the company look well placed to expand their projects organically from free cash flow with the added benefit of by-products such as tantalum and lithium both being growth markets.

I like a company with a growth story and scale and that is not juggling too many balls, one or two projects is optimum and best utilises precious cash. You’ll see other examples like this I have written notes on such as Goldstone, Horizonte and Contango

I tend to avoid junior companies that have too much in the portfolio (mostly to generate lots of news-flow!) – just focus the cash on projects where the value will be generated and expand later!

So the projects…

Uis Tine Mine – Namibia

The Uis tin mine is historically the largest hard rock tin mine in the world with previous operation of 1500 tonnes tin concentrate per annum. The project is located in North West Namibia, a mining friendly region in the Tin province of Africa.

The project has a JORC compliant maiden mineral resource of 70mln tonnes equating to 95k tonnes of contained tin, 6k tonnes of tantalum and 450k tonnes of lithium oxide resource, which is globally significant. The maiden JORC includes a high portion of Measured and Indicated resource.

The resource only covers one of 12 existing pits so further resource definition scope is significant with exploration upside. The company have reported they are running concurrent exploration programmes targeting higher grade resource with lower strip ratios (lower cost) notably looking at targets within 5km of the current processing plant.

As previously mentioned the company have already achieved Phase 1 production of 60 tonnes per month (63.9 tonnes in November higher than targeted).

The project will be developed in two phases, Phase 1 – initial production and staged ramp up, Phase 2 – a much larger scale project looking to produce 5000+ tonnes per annum.

Phase 1 gradually increases production capacity by increasing tin, tantalum and lithium recoveries and resultant concentrates. Phase 1 should generate a long-term profit margin of 25%. That’s solid margin and free cash flow which will only increase should tin prices continue their ascent. Note that the C1 cash cost is lower quartile and decreases as they move through the stages ranging between $13000/t and $5,300

The phase 1 project economics are robust and as the development plan is achieved over four further distinct stages, the phase 1 economics sport a $122m NPV with a 60% IRR. It should also be noted this is just based upon measured resources which equate to a 26 year LOM, factor in indicated and inferred resource and likely a much longer mine-life.

Note also that the Capex requirements to get to stage 5 of phase 1 are also staged and the plan from the company is to service this organically from cash-flow although there would be an argument to consider a debt facility should tin prices continue upwards.

Remember though this is just Phase 1, the potential for phase 2 would take the company to a new level with revenues exceeding $100m per annum for say a 5k tonne per annum operation and margins increasing to targeted c.40%. Even this however could be increased should market demand dictate – the key here is the overall scale of the resource! A BFS will be completed for Phase 2.

The company already benefits from a 100% off-take agreement (80% of value on delivery) with Thailand Smelting and Refining Co Ltd which is an initial one year agreement with an option to extend, this secures cash flow for 12 months worth of production.

The by-products of tantalum and lithium offer additional upside and after initial metallurgical test-work further test-work is in progress to evaluate forward potential. The lithium-oxide grades are high and could potentially tap into a premium market.

Mokopane Tin Project

Included in this note for completeness is the Mokopane Tin project located in the South Africa, Bushveld Complex. A smaller scale but interesting project with two of four exploration targets drilled to date. A scoping study has been completed for a lower tonnage operation in the lower quartile cost with an impressive 34.6% IRR. The additional targets however could offer additional scale.

Clearly the Uis flag-ship project will be the companies near-term focus and rightly so given its stage and scale. The company will also be in the position to expand their portfolio as opportunities arise aiming to become the Tin Champion of Africa!

The Tin market…

Tin, the forgotten battery metal?

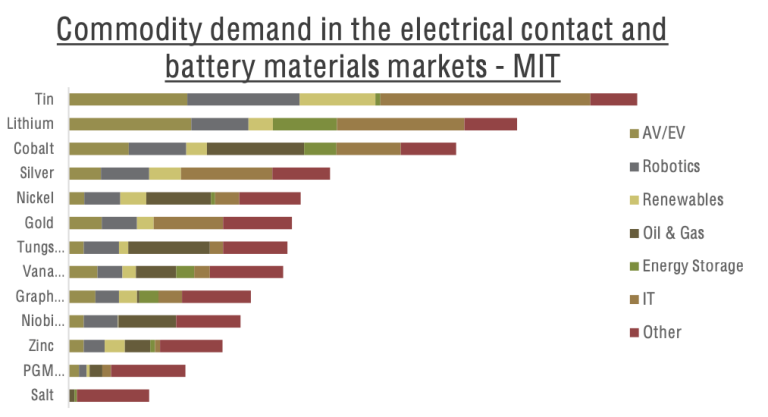

You may be surprised to learn that tin already plays a role in battery technology but could be set to play an even larger role in future, discussed further on. Tin also fits the ‘green-investing’ narrative well with key applications in renewable energy and carbon-reduction technologies.

Tin – Its key Uses and Drivers

Electronics – Tin plays a major role in electronics and the semi-conductor industry where it’s used in circuit boards (solder) and copper-tin connectors. In the ‘connected’ world and the ‘internet of things’ tin plays a major role as the glue that joins them together.

The digital revolution and the emergence of 5G will propel the development of more and more smart-devices and technology which will in turn drive more usage of tin.

Lead-Acid Batteries – tin is key component in lead-acid batteries in cars, particularly the more powerful ones that utilise start-stop technology.

Until combustion engine cars are completely phased out and off the road this will be another driver for tin.

Other Uses for tin span a multitude of industry and technology including robotics, energy storage, IT and tin plating.

Tin demand has historically increased with various technological advances, 5G being a prime example.

Green Energy and Renewables

Aside of robust fundamentals, tin will play a key role in green energy and renewables.

Solar and Wind – solar cells that uses copper-tin connectors including cell advancements that require more tin to harvest heat energy. Renewable energy infrastructure.

Hydrogen – potential use in hydrogen economy – tin catalysts that split water in sunlight

Electric Vehicle – charging infrastructure

Lead-free Solder – climate change and regulation driving the increase in lead-free solder thus in turn increasing the usage of tin.

Electric Vehicle Batteries

Tin will benefit from advanced lithium-ion batteries and could have a significant role to play in the next generation of lithium-ion batteries too which have been much discussed recently. In the hunt for higher performance and range, early Chinese prototypes are using Tin/Silicon based anodes. More on this here

It’s early days and development of such batteries will be more costly in the short-term and require a significant up-lift in charging infrastructure and grid power. It’s certainly one to keep an eye on though. Until then, graphite anodes will be the dominant force and you can read about my high-purity battery grade graphite investment play Armadale Capital here.

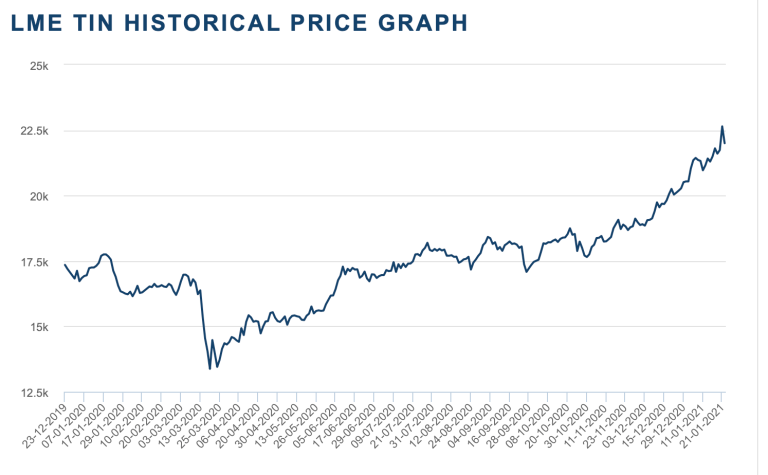

Basically all of the above make a compelling case for tin’s future and the market seems to be picking up on this given recent price increases seen on the LME

Two-year LME Tin price. Notably Tin is starting to break out over the longer five year period.

Market Fundamentals

Tin is predicted to be the metal most positively impacted by the development of future technologies and the ‘Internet of Things’

The International Tin Association predict that demand for Tin could triple by 2050 with the tin price having already recovered to pre-covid levels.

Research by the Massachusetts Institute of Technology (MIT) projects that tin (relative to market size) could be the metal with most to gain from the various applications shown in the chart above due, in part to its use in soldering.

Bloomberg reports that LME Tin stocks have been depleting with only 975 tonnes inventory in late January. China’s metal exchange was healthier with c.8000 tonnes of stock however China’s net imports in 2020 were down 25% due to increasing Indonesian supply constraints meaning China may have to look at other supply chains.

All in all it’s creating an interesting supply dynamic that could positively impact upon Tin prices further especially given the market is in a structural supply deficit and the metal is projected to see increasing demand from the above applications.

An Eye on Risk

As with any investment we need to be aware of the risks particularly with small cap companies. Risks to be aware of are as follows:

The company are now revenue generating which is a good thing and the CEO states the company are in a strong financial position. This is comforting but as with any early stage revenue generating company the management of early cash flow will be key given the company have a modest debt c.£2.5m however they ended the financial year with a similar cash position and that was pre revenues.

Secondly, Africa is always a risk consideration however the company are operating in what appears to be a stable mining region with all necessary permits in place.

Lastly the liquidity of tin, its a less liquid commodity than say nickel or copper and price swings can be greater however the current trend is firmly up with a supply deficit in place and a very positive demand outlook – but one to be aware off as would affect margins to the downside – equally though would be significant to the upside!

If you are a relative newbie too investing come back here after you have read the note and read my blog on Managing Risk and Exposure

Conclusion

So before I highlight all the fluffy bits and why those invested could be sitting on significant returns we need to be aware that investing in small cap companies in general carries high risk so don’t be throwing the kitchen sink in, manage your risk !

Now back to Afritin…

Afritin ticks my boxes for a number of reasons as you will see from previous research notes.

The Management team is well structured and has a wealth of experience which adds to confidence when investing my money. The fact they have delivered first production within two years of listing also shows they are capable and delivery focused.

The scale of the asset is huge being one of the largest tin mines in the world. I like scale and a growth story as the share price should follow as they execute.

The market back-drop for Tin looks very attractive with the Uis tin project providing excellent leverage to the metal.

The company has developed a clear staged growth strategy in sensible phases and stages allowing it grow organically and within five years could be producing revenues of over $100m per annum at todays tin prices. Should tin experience further upside and it looks promising then we can see the leverage opportunity.

As an example if tin were to follow a similar path to palladium’s recent monster run over 200% up in just two years then the upside would be huge and we have seen what has happened to Eurasia Mining with their large palladium projects!

I also like the fact there are plenty of share price catalysts ahead, regular production and plant optimisation updates, the Phase 1 further four stage deliverables, test work results on the tantalum and lithium, exploration activities and Phase 2 BFS. Management have been good at keeping the market updated too, reading back through RNS.

Lastly and perhaps most surprising is that the company today trades at a Market Cap of just £25m. That’s less than some junior exploration companies on AIM with no defined resources or project de-risking such as drilling, permitting, feasibility studies whatsoever, yet Afritin has achieved all of this, has that value baked in and hit Phase 1 production bringing in revenue!

So at £25m Market Cap (a remarkably low valuation by comparison to peers in my opinion), a large-scale producing tin project in what could be a developing tin bull market, with clear share price/valution catalysts and offering investment exposure to the only pure-play UK listed tin company, its a thumbs up from me!