Goldstone Resources Research Note

Goldstone is in my opinion a hidden gem! They have two gold projects in close proximity in Ghana and on strike of one of the worlds largest producing gold mines.

Key Highlights

- Highly prospective Gold projects in Ghana

- Projects sit within 6km of AngloGold Ashanti’s Obuasi 70m oz Gold Mine

- Phase 1, 14,400oz pa production start H2 2020

- Phase 1 Capex debt funding secured H1 2020

- Phase 1 Project IRR of 382% based on $1800 oz gold price

- Shallow open pits free dig mining simple heap leach operation

- High-grade deposits at the old underground mine include 18.23 g/t, 24 g/t and 51.2 g/t

- Significant exploration and production expansion upside

- Two largest shareholders combined 49.8% holding are gold mining veterans and engineering specialists

Venturing into Gold

Up until recently, I hadn’t really focused much on the gold market. I’ve mostly been focused on base metals particularly copper and nickel given the move to electrification, their underlying uses in industry and supply/demand outlook.

But given gold’s recent move, the general economic climate and global fiscal policies I’ve decided I want gold in the portfolio! For me I see two benefits, one, gold offers a level of hedge i.e. protection against a ‘risk-off’ market and two, the general view that gold could be in for a more prolonged bull run. The two of course are related, but not entirely.

I’ll be having a look a bit more into gold companies in general going forwards but for now I’ve settled on a small cap gold company that offers me near-term production with potentially huge forward potential.

Anyone that follows me knows I like to invest in smaller cap companies that can offer materially higher upside. With that of course comes higher risk but thats the point of research, ay!

About Goldstone

So Goldstone’s primary focus is to recommence production at its Akrokeri-Homase Project (AKHM) in Ghana. The project contains two historic gold mines: the high-grade 24 g/t (recovered grade) Akrokeri Mine and the Homase Open Pit, a shallow 2.85 g/t oxide deposit.

The company have acquired extensive exploration and development data which they have been analysing and the intention going forwards is to re-open the Akrokeri mine and extend the Homase open pit, the latter to start early production which will bring in early and significant cash-flow as soon as H2 2020.

A point worth noting is that recent analysis by Goldstone from the acquired data has revealed what they believe to be high grade quartz venis up to 51 g/t Au. Even with my limited gold background I know these grades are huge and this is particularly exciting.

Even more so when you consider that both projects sit on strike and within 6km of one of the worlds largest producing gold mines, namely AngloGold Ashanti’s 70m oz Obuasi Mine!

The board believe (and they have solid credentials) that once they kick off phase 1 production and bring in early cash-flow they can further develop and explore the assets, self funded to a point where they envisage becoming a mid-tier gold miner.

Just before we move on to briefly cover the projects its worth highlighting one of the key factors that have attracted me to Goldstone, its shareholder register!

Bill Trew holds 29.8% via Paracale Gold Ltd (an investment company he set-up with billionaire backing that focuses on late stage exploration and development) including 1.6% personal holding. Bill has a wealth of experience in gold mining and also founded MAED Ltd, a specialist project management end engineering company that have designed and constructed 23 of the worlds leading gold mines! Bill is non exec chairman of Goldstone.

An additional MAED connection is the team that Bill used to build Oxus Gold where Bill also held a CEO position both over-seeing construction of three new gold mines, under budget and on time. Bill brings this team with him. That’s some serious experience on the table and shareholder aligned!

The second largest shareholder BCM Ltd hold a 20% interest and is Africas largest private contract miner with over 60 years experience and involvement in 70 mining operations globally. Angela List is a director at BCM and holds a non exec director role at Goldstone also. Clearly this is another testament to Goldstone’s projects.

Finally, the company CEO is Emma Priestley who also has an impressive CV and is a chartered mining engineer and charted mineral surveyor.

So a little more on the projects…

Homase (90% interest)

Homase is where the Phase 1 programme will begin and the project area sits just 12km along strike from the Anglo Ashanti mine. Homase previously produced 52,000 oz from one open pit with a final recovered average grade of 2.5g/t.

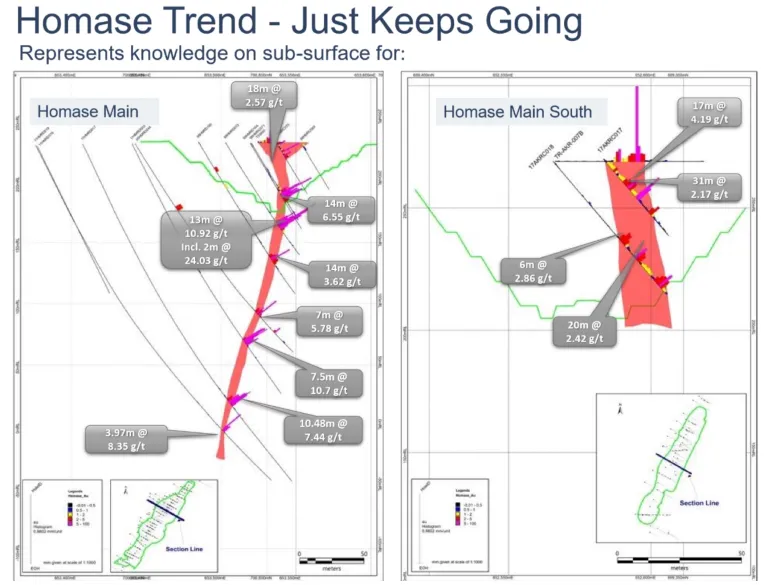

Goldstone’s historic work has defined an initial JORC compliant resource of 600,000 oz Au at 1.77g/t. However further work since has already expanded on this resource. and with some impressive results.

An initial scoping study was completed based on a 72,000 oz five year phase 1 plan, producing 14,400oz pa with an AISC of $850 oz with just an initial $6m Capex. At a $1300 gold price the initial project produced an IRR of 144%. A revised DEP in July 2020 however has materially increased the IRR to 382% by using a higher gold price ($1800) and factoring in reduced up-front capital.

The project Capex figure has been materially reduced to $3m from the original DEP by targeting one of three initial pits first (whilst still maintaining the target production) and deferring build of the elution plant, electrowinning and gold room.

Then via cashflow re-investment the company will build out these elements. What this means is that initially the company will produce gold in carbon (un-refined metal) and sell on the international market at a discount to gold spot or send onto a nearby third-party to process.

The company have raised the $3m Capex and as such are fully funded for phase 1.

This really is only the start for Homase though, with the aim to bring in initial cashflow, as the project area itself is highly prospective and as mentioned earlier, on top of the JORC resource there is significant exploration upside with historic trenching indicating further very high grade mineralisation including 15.0 metres @ 6.31 g/t Au which includes 4.5 metres @ 18.23 g/t Au

GoldStone’s recent soil geochem programme coupled with the review of historical data has identified a > 8km gold-in-soil anomaly, the Homase Trend. This extends both to south and north of the pit and contains the 4km resource zone which remains open at depth and along strike

So the Homase project area itself could offer some nice surprises to come as further exploration work kicks off.

If that wasn’t already impressive enough for a £10m cap, read on…!

Akrokeri (100% interest)

So this is where the story gets a little more interesting. Akrokeri was also a previously producing mine operating from 1904-1909 at which point the mine was closed due to an ingress of water. In that time it had produced 75,000 oz of gold at a recovered average grade of 24 g/t. As mentioned previously, goldstone’s recent work has identified high grade quartz veins of up to 51 g/t – huge!

The Goldstone board believe that due to the ingress of water a mine cleanup was never executed and assuming mining was halted abruptly (and all resource wasn’t mined) the mine can be refurbished to make safe and restarted.

Furthermore, the board believe the mined head grade could have been greater than the 24 g/t. In addition they plan to open up the mineralised zones for underground exploration. Obviously there are a few assumptions here to be aware of but somewhat mitigated by the level of expertise Goldstone have!

Clearly, sitting within 6km of Anglo Ashanti’s ‘monster’ gold mine and on the same geological trend makes this project and license area extremely prospective, given grades previously achieved. In fact, this could offer blue-sky potential!

Why Gold

So Gold is a little more tricky to understand than what I’m used to i.e. the likes of Nickel and Copper, base metals, as previously mentioned. They are a bit more straight forward (to me at least) as they are industrial led and you can get a handle on the demand/supply dynamic more easily,.

For example Nickel is running very low inventories with few mining projects coming to market yet demand from stainless steel and the impending EV battery market is expected to be strong and the latter to cause a major demand uplift.

That’s why I like Horizonte Minerals and you can read more about that in my research note on that here

Anyway back to gold…

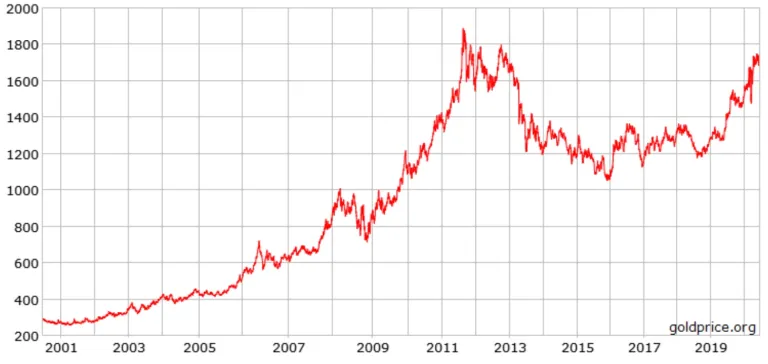

Digging around a bit, you’ll find some conflicting views on gold, some believe we are in for a sustained bull market and some believe its a bit toppy! It’s difficult to say personally, without a full understanding of every driver so its wise to take both views on board when looking at investing in gold.

That said, gold is seen as a safe haven and certainly reacts positively in times of economic and political uncertainty and we are certainly in that climate right now but the question is will we be over the coming years? Quite possibly, since some seem to think that the forward impact of COVID-19 could push equity markets into a more sustained down-turn, even a depression and we’ll be sitting in a low interest rate environment for a long time, not to mention the fiscal policy around the dollar – thats all good for gold.

Essentially, and this goes back a long way in history, if the Sh*t hits the fan and your assets de-value whether that be stocks, property whatever, gold is gold and it could be the last bargaining tool a man has in his hand if he wants to feed the family!

This is all a bit dramatic I know, the world isn’t going to an end but I certainly see a bull argument for gold.

To the flip side, looking at the chart above some could say over the last 20 years, gold has had a strong run and could be about to peak. But if you look at the driver for the gold price rise around 2009 it was probably linked to the fall-out from the financial crisis. If we are in for another rocky ride there is an argument for gold to hit new levels all-together with a repeat performance.

Who knows but personally I like the idea of having some gold in the portfolio as a hedge especially if we are heading for a ‘bubble burst’ and picking a junior gold mining company that could see a lot of short-term upside as a producer but has long-term low cost (high grade) potential fits the bill for me and Goldstone stacks up.

Conclusion

So before I highlight all the fluffy bits and why those invested could be sitting on significant returns we need to be aware that investing in small cap companies in general carries high risk so don’t be throwing the kitchen sink in, manage your risk !

Now back to business…

So hopefully in this brief research note I’ve helped you understand a bit more about Goldstone. We are certainly in uncertain times, so having some gold in the portfolio could be a good idea.

If gold were to pull back (I don’t think it will), there are still some healthy margins on offer for low cost producers with high grade deposits so it’ll come down to seeking them out.

Back to Goldstone…

What has attracted me to Goldstone and is somewhat unique in the small cap investing space is the combination of near-term production and cashflow (that already makes the company look very cheap at the current share price in my opinion) and the potential blue-sky exploration upside at both Homase and Akrokeri projects, the latter potentially being an exceptionally high grade multi-million ounce resource.

Couple this with the fact the companies largest shareholders are key players in the gold mining space, one has to draw the conclusion that they have a fairly good idea of what they are sitting on and this is only further backed up by the projects locality to one of, if not the, worlds largest gold mines.

I’ve only seen one other junior gold company go from sub £10m cap to £400m+ and that is Greatland Gold which due to my inexperience, an opportunity I sadly missed. I do believe however, Goldstone could offer a similar opportunity and it’ll of course depend on exploration results, but the signs are good and I believe nicely risk mitigated by the phase 1 production at Homase which in my opinion values the company at a few multiples anyway.

As the company say ‘old mines never die, they are merely sleeping…’