Alkemy Capital Research Note

Alkemy Capital is set to create the UK and Europes first lithium hydroxide proccessing hub via its wholly owned subsidiary Tess Valley Lithium

Key Highlights

- Europes first Lithium Hydroxide processing facility

- UK based facility to supply UK & Europe battery grade Lithium Hydroxide

- Staged production ramp up starting at 24k tpa up to 96k tpa

- Lithium demand to grow 600% over next decade

- China a major lithium producer will need all domestic lithium production to meet their own 2060 carbon neutral plan

- Site location at Wilton International Chemicals Park powered by renewable energy

- First production of 24k tpa as early as 2024

- Robust projected economics $1bn NPV at 24k tpa, $3.8bn at 96k tpa

- Greenfield investment opportunity at ground floor level

Lithium – it’s not going away anytime soon !

Global electrification is in the spotlight and so is how it’s sourced, delivered and applied to every day applications from cars planes trains and automobiles to powering homes, offices, industry and literally anything else we rely on for power.

Lithium at least for now is at the heart of this revolution and it’s why lithium has been sky-rocketing recently. There are alternatives emerging particularly Sodium-ion chemistries but for now it’s lithium all the way ! You can read more about a company I have researched AMTE Power who are utilising both technologies to produce batteries here but this note is about Alkemy and their first mover advantage in the UK to supply the UK and Europe with lithium hydroxide which is going to be critical if Europe wants to keep up with the global electrification and carbon neutral narrative and reduce reliance upon China.

So lets talk about Alkemy then…

About Alkemy

Alkemy Capital is main market listed on the LSE and has completed a reverse take over transaction of Tees Valley Lithium. Alkemy holds 100% interest in Tees Valley Lithium, the company set-up to create the UK and Europe’s first Lithium Hydroxide processing hub. Alkemy is therefore an investment company, with its main focus being Tees Valley Lithium.

As of writing the company is valued at £5m Market Cap with 6m shares in issue. Directors hold c.57.5% of all issued share capital leaving a modest free-float. Chairman Paul Atherley holds 3m shares (50%)

Management

At this point it’s worth briefly talking about Management.

Paul Atherley is the Chairman of both Alkemy and Tees Valley Lithium. Many will know Paul from similar roles at Berkley Energia and Pensana. Paul’s extensive capital markets and resources experience has seen both companies achieve in excess of £100 Million market cap, with Pensana tagging £300m recently given the rare-earths narrative.

Paul has brought institutional support to his endeavours along with the Angolan Sovereign Wealth fund investment to Pensana with Pensana only recently securing an additional £10m investment from M&G Investment Management.

Having followed both companies and kept up to date by way of their excellent investor communications which is essential in the junior market, I have no doubt Paul will attract similar interest to Alkemy/Tees Valley Lithium, especially given the UK’s drive for greener energy and investment in the sector promised.

Of note also is the recent appointment of John Walker as CEO of Tees Valley Lithium. John has over 30 years of experience in the mining and advanced materials processing industries and looks to be a perfect appointment given is his track record.

The Management team is set to grow further and we can expect further announcements in due course.

Given Alkemy’s focus is essentially on its 100% owned subsidiarry Tees Valley Lithium we’ll talk about that from here on in to get to the ‘meat’ of the investment case in Alkemy.

Tees Valley Lithium

In a nutshell, TVL has been set-up to form Europe’s first battery-grade lithium hydroxide processing hub here in the UK.

The company will be based at the Wilton International Chemicals Park with an agreement already in place with Sembcorp Industries to provide power, reagents and utilities at the site. What’s interesting about the site, according to the company presentation is that the site is powered by 100% renewable energy.

Wilton will also be established as an international processing hub by way of the Teeside Freeport this is all part of the UK Governments ‘levelling-up’ strategy – you can read more on this at the Governments website – Teeside Freeport Open for Business

So what will the company do?

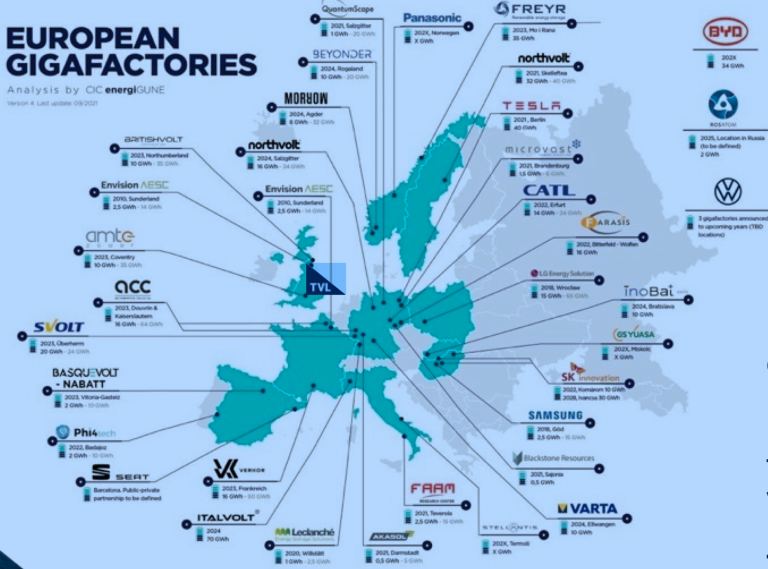

TVL will produce battery-grade lithium hydroxide from its UK processing hub with the intention of supplying a number of Gigafactories across the whole of Europe. There are numerous Gigafactories planned as can be seen from this interesting info-graphic produced by TVL.

Interestingly you can see AMTE Power’s planned Gigafactory referenced, another of my recent investments which you can come back and read about later here

Now what is interesting and as the company have highlighted is that there is currently ZERO lithium hydroxide production capacity in Europe. In fact, you guessed it, China controls 90% of the world’s lithium hydroxide supply!

With tensions mounting and the realisation at how the western world is exposed to Russia and China in terms of reliance upon resources whether that be Oil and Gas or raw materials such as rare earths and green energy metals, countries like the UK could be going hammer and tongs to back new initiatives such as is the topic of this research note.

Production Plan

So we know what the company are planning to do and how they will go about it logistically, what do the numbers look like?

Well the company are planning a staged ramp-up to 96k tpa of battery grade lithium hydroxide. Interestingly this would only meet 15% of projected European demand by 2030!

Well could China fill the gaps? Well according to the company no, China would need all of its domestic lithium hydroxide production if it wants to meet its own 2060 Carbon Neutral plan and who knows with tensions as they are could they could ‘turn off the taps’?

Reliance on China must be a major economic and strategic concern for the western world.

Before I cover the companies projected economics, it’s worth touching upon their processing strategy.

Lithium Processing

The company are positioning themselves to be a processor of lithium sulphate as opposed to spodumene concentrate. The primary driver for this is the cost and carbon footprint to the source mining companies.

TVL will handle the chemical side of things processing an intermediate lithium sulphate product as opposed to lithium spodumene concentrate that would avoid a miner shipping up to 97.5% waste!

This in-itself will dramatically reduce the miners carbon foot-print and costs. An example of a lithium mining company that plan to produce sulphate is ASX listed AVZ Minerals who have one of the largest lithium projects in the world.

By using this process African and Australian lithium mining companies as an example, can also broaden their reach to European premium-priced markets.

It’s a ‘win-win’ for the miners and for TVL with a rapidly emerging European market that has no domestic/local lithium hydroxide supply!

The Numbers…

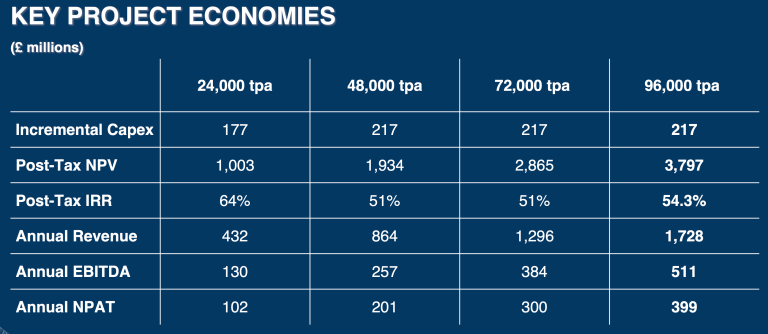

The key project economics presented below are based on initial forecasts by the company and should be viewed as such. As per the recent RNS announcement of 16th March, a Class 4 feasibility study has been commissioned with ‘Wave’ ‘Wave is a leading consulting firm in the battery and tech metals sector, with extensive upstream and downstream lithium processing experience‘

The study is due to be delivered next Month, the company are not hanging around – ‘The Study will also become the basis for the finalisation of approvals, as well as the next stages of detailed engineering development and major equipment procurement.’

The company forecast an initial 24k tpa operation ramping up to 96k tpa (remember this would only account for 15% or Europe’s supply needs by 2030) with production starting, if all goes according to plan, as early as 2024.

The figures are pretty impressive, it would be interesting to see what Government grants/initiatives, if any, could contribute to the Capex as part of the UK’s agenda in its levelling up programme.

Mining companies with tier 1 projects exhibiting a 25%+ IRR can generally get financed so the numbers above if verified look particularly attractive. The class 4 feasibility due next month should be a stake in the ground.

An Eye on Risk

As with any investment we need to be aware of the risks particularly with micro cap companies.

Technical

The company plans to use a renewable electrochemical process route to create lithium hydroxide from lithium sulphate. This will depend upon lithium miners producing the intermediate lithium sulphate. Given this approach will dramatically reduce a miners costs and carbon footprint this shouldn’t be an issue and as already highlighted the likes of AVZ are already using this approach.

In addition, due to the high cost of lithium, other competing battery chemistries could emerge such as sodium-ion based. That said this seems a long way off for at least higher energy short burst based batteries as opposed to energy storage where sodium-ion looks to be a more viable near-term solution, however lithium is still the front runner here too.

Funding

The company will need to raise £177m Capex for the stage 1 operation. There are no guarantees the company can raise this money however a successful feasibility study should help mitigate this and with a compelling 64% IRR the project looks attractive to potential funders.

Couple this with Atherley’s track record in raising finance and the various grant/funding schemes that may be on offer by the UK Government, this risk looks further mitigated.

The company could also issue ‘green debt’ for example a bond based instrument as part of the financing which will appeal to ESG funds and investors.

If you are a relative newbie too investing come back here after you have read the note and read my blog on Managing Risk and Exposure

Conclusion

So before I highlight all the fluffy bits and why those invested could be sitting on significant returns we need to be aware that investing in micro cap companies in general carries high risk so don’t be throwing the kitchen sink in, manage your risk !

Now back to Alkemy…

So at just £5m Market Cap Alkemy does really look like a compelling entry level to me when you consider they should have in excess of £1.5m in cash following the raise on re-admission. Couple this with what looks to be a set of exceptional economics (to be confirmed by the feasibility study over the coming weeks) and the emphasis the UK will be putting on the development of the Teeside Freeport and green energy companies such as TVL, the downside risk looks out of kilter with the potential upside.

If Atherley brings the same level of interest to Alkemy/TVL as he has done with Pensana Rare Earths then a market cap in the 10’s of millions could come pretty quick as the news flow ramps up!

Have a read through of the new TVL presentation here and decide for yourself.