Rome Resources Strengthens Mont Agoma Potential — With Kalayi Drilling Continuing to Deliver

Results of recent geological interpretation work conducted at its Mont Agoma prospect within the Bisie North project has identified new, high-priority exploration zones for tin and copper, providing a clear framework for future exploration and drill targeting, whist drilling at Kalayi continues to return high-grade tin intersections

Rome Resources Strengthens Mont Agoma Potential — Kalayi Continues to Deliver

Mont Agoma Interpretation Identifies New High-Priority Targets

Rome has released an encouraging update from its Mont Agoma prospect, part of the broader Bisie North project in the DRC. The company has announced an improved geological understanding, clearer targeting, and multiple new high-priority zones for future drilling.

The company’s latest work — including detailed trace element and stratigraphic analysis — has refined the geological model at Mont Agoma. Crucially, Rome has now identified consistent marker horizons associated with mineralisation. In simple terms, this gives the exploration team a much better roadmap for where to drill next. Rather than broad, conceptual targeting, the company now has more precise, data-driven drill targets, increasing the chances of expanding the resource efficiently.

Two standout areas have been highlighted:

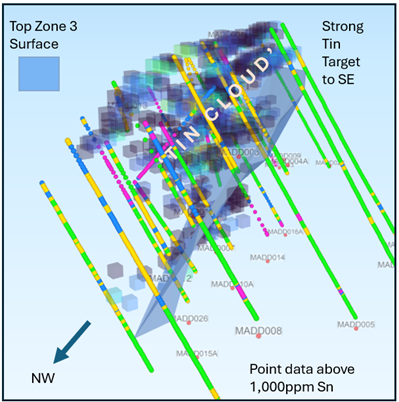

- A southeastern zone with elevated tin potential (Fig 1)

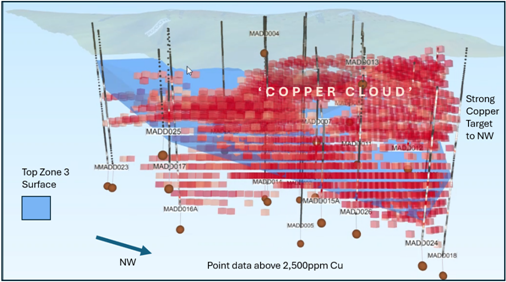

- A northwestern zone showing strong copper signatures (Fig 2)

Fig 1. Tin 'cloud' plot showing prospective tin zones southeast of the current deposit

Fig 2. Copper 'cloud' plot showing prospective copper zones northwest of the current deposit

Both zones are largely untested, meaning there is genuine exploration upside still ahead. The interpretation confirms that mineralisation at Mont Agoma is geologically predictable and remains open in multiple directions. Rome has already delivered a maiden resource, having multiple additional drill-ready targets within the same system supports future resource growth as part of the broader Bisie North exploration strategy.

Mont Agoma is increasingly shaping up as a potential second growth engine alongside Kalayi — and that diversification matters.

Kalayi Continues to Deliver

Rome has initiated a further drill programme at Kalayi with the aim of confirming high-grade tin continues at depth, below the maiden MRE.

While Mont Agoma builds the longer-term runway, Rome’s recent XRF results from Kalayi has already demonstrated strong initial drilling success.

Eight holes have been completed to date with the majority confirming multi-metre high-grade tin at depth.

Highlights:

- Kalayi hole KBD023 encountered 2m @ 8.30% tin from 74 metres depth and 5m @ 0.48% tin from 86 metres.

- Kalayi hole KBD021 encountered 2m @ 2.23% tin from 181 metres depth and 2m @ 2.33% copper from 107 metres.

- Kalayi hole KBDD025 encountered 11m @ 3.43% tin from 60 metres depth including 6m @ 5.14% tin from 65 metres depth.

- Kalayi hole KBDD027 encountered 4m @ 7.50% tin from 75 metres depth.

- Kalayi hole KBDD024 encountered 3m @ 2.64% tin from 116 metres depth

Geological Context: Comparison with Alphamin's Mpama North Mine

The Mpama North Mine (operated by Alphamin) lies approximately 8km to the south of the Bisie North project and represents a strong geological analogue for Kalayi. At Mpama North, the Main Vein of the Mpama Mine is reported as being between 2 and 22 metres in thickness, with an average tin grade of 4.35%.

Several recent intercepts at Kalayi fall within the reported thickness range of the Mpama North Main Vein and include multi-metre intervals grades above 3% tin, with high-grade zones exceeding 5% tin. The continued intersection of such grades in the deeper drillholes supports the Company's structural interpretation and reinforces confidence that high-grade tin mineralisation persists at depth below the maiden MRE

Moving Forwards

At kalayi, Rome is delivering, multi-metre intervals grading above 3% tin with some zones exceeding 5%. In the current tin price environment where tin is trading at c.$US50,000/t and building on the MRE, these initial results are an exceptional outcome for Rome.

In parallel, Mont Agome is shaping up to be a significant additional value driver for Rome with the identification of new high-priority drill targets and highly prospective undrilled zones ahead of further drilling shortly at Mont Agoma.

All in all, Rome's is on track for what could be a significant upgrade to its maiden resource estimate expected in Q2. With macro tailwinds and the urgency for securing non-Chinese critical minerals, Rome is increasingly well placed to advance the project beyond MRE and either secure a project partner or potentially agree an outright sale for one or both of its projects.

From neighbour to necessity, could Alphamin need Rome?