Coinsilium: Institutionally Aligned & Positioned for Growth

Approval of GM resolution to increase headroom marks a pivotal development in Coinsilium’s evolution as a Bitcoin-aligned public company, equipping the Company with the tools needed to pursue larger-scale initiatives and capitalise on a rapidly maturing digital asset market.

In little over two months, Coinsilium has stamped its mark in the market as a serious player in the Bitcoin treasury space. You can read more about Coinsilium's business and the establishment of Forza (Gibraltar) Limited (“Forza!”), a dedicated, wholly-owned treasury management subsidiary incorporated in Gibraltar, in our previous article: Coinsilium: The UK's future MicroStrategy?

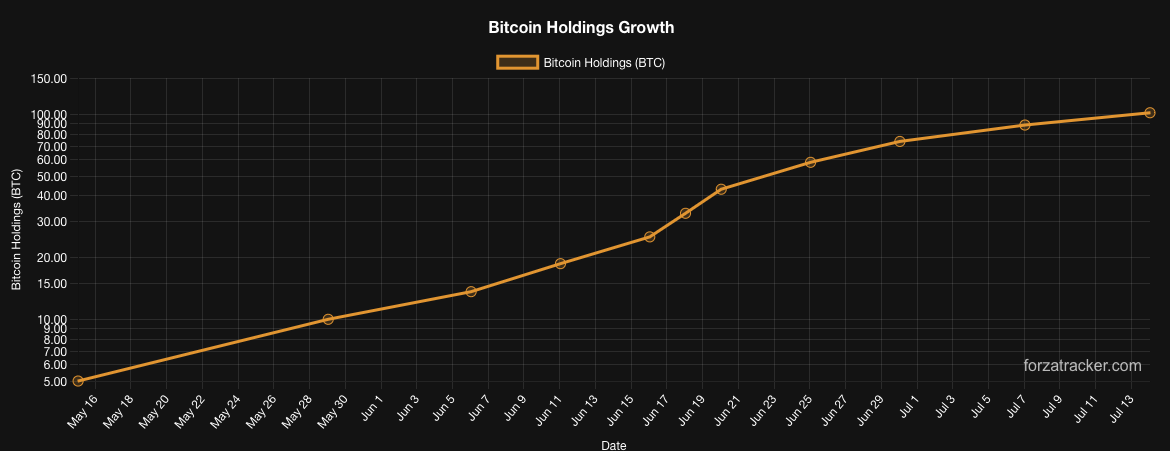

The company has hit the ground running since announcing their intention to establish a Bitcoin treasury, having raised gross proceeds of £11.62 million since mid May with the company having increased its initial 5 Bitcoin holding to 112 Bitcoin as per the latest announcement here

Image Credit: Forzatracker.com

Coinsilium has set out a clear strategic plan backed by their Bitcoin Treasury Policy . The strategic plan and treasury policy have been designed to align investment in Coinsilium with the expectations of institutional stakeholders. This includes topics such as Regulatory Compliance, Governance, Risk Management and Custodianship. You can read more on these important considerations in our previous article: Bitcoin Treasury Stocks - Backing the right horse

Coinsilium has stuck to its plan which is to accumulate Bitcoin in a disciplined, controlled and transparent manner, deploying the cash raised sensibly as opposed to going 'all-in' with each raise just to accumulate the fastest. Of course, there is nothing wrong with an aggressive accumulation strategy but the first horse out the block doesn't necessarily win the race and as Metaplanet are demonstrating, some diversification around the core treasury business can bring faster growth longer term.

The Next Chapter

Coinsilium announced last week that the resolution to increase headroom was approved at the General Meeting. This is a pivotal moment for the company giving them the tools needed to pursue larger-scale initiatives and capitalise on a rapidly maturing digital asset market.

The resolution grants the Board authority to issue new ordinary shares, free of pre-emption rights, for both cash and non-cash consideration up to an aggregate of 600 million shares in each category.

So, the increased headroom allows the company to issue equity for cash as it has already done and gives the company a war chest for further Bitcoin purchases. Importantly, it allows the company to demonstrate to institutions that it has further buying power and can accommodate larger investment amounts in a single raise, say for example if an institutional investor wants a decent chunk of a raise.

Additionally, the company has made provision for issuance of equity for non-cash initiatives, what's that?

"We believe the flexibility to issue equity for non-cash consideration also introduces strategic optionality—whether in the context of entering partnerships, or consolidating treasury-related capabilities. These opportunities, if judiciously pursued, could enhance the Company’s long-term reserve position and accelerate its trajectory as a Bitcoin-aligned public company."

Essentially this allows and perhaps signals an intention that the company has other initiatives planned or at least being considered. This provides optionality in a fast-moving digital assets space and potentially allows Coinsilium to execute on other initiatives quickly if required.

Metaplanet Example

Most will have heard of Metaplanet, but if you haven't, Metaplanet was originally a hotel development business in Japan. The company pivoted in early 2024 and rebranded as Japan's first publicly listed Bitcoin Treasury Company, following the “MicroStrategy playbook” to shift focus entirely to BTC accumulation.

Metaplanet has also diversified its business whilst maintaining the Bitcoin treasury as its primary asset. The treasury is focused on accumulation and generating yield (growth in Bitcoin holdings per share). Metaplanet has come up with some interesting Capital Markets derivative instruments to achieve this including issuance of zero-coupon bonds and selling 'put' options on Bitcoin (the right for an option holder to sell Bitcoin at or below a strike price). Metaplanet make money from these option premiums.

Metaplanet also bought the exclusive rigths to Bitcoin Magazine Japan, the localized edition of the global Bitcoin Magazine. In fact, it has a number of other Bitcoin related initiatives in-flight and have demonstrated that from the establishment of a Bitcoin treasury there are a number of avenues to bolster accumulation of Bitcoin, the heart of its business and strategy.

Coinsilium

As mentioned earlier, the passing of the resolution now opens the doors for Coinsilium to expand the business alongside its treasury and using a potential fly-wheel approach could convert returns from its investments/stakes in any potential partnerships/acquired business's back into Bitcoin if they wished).

As an example Coinsilium could:

- Create Bitcoin-backed Financial Services

- Invest in/acquire Bitcoin infrastructure & Saas

- Acquire stakes in the Crypto Media and Content Ecosystem

- Invest in/acquire stakes in further Web3/Decentralised protocols/projects

The list goes on and these are just some examples we've picked out. The point is, the company has resources now and has established a framework that will give them optionality. It's also worth noting that un-like other similar companies, the company and its management has decade long experience in the blockchain and Web3 industry, critical to growing the business.

Conclusion

Coinsilium has, and continues to execute in-line with its Bitcoin treasury policy and strategic plan. The company maintain a disciplined approach to building the treasury whilst navigating market volatility.

The company is focused on investors, establishing a strong community and running regular Live Spaces on X, with the latest one here

The passing of the resolution as explained in this article, positions the company for its next phase of growth—better capitalised, more institutionally aligned, and strategically equipped to scale.

Importantly, the management team has the right skills and business acumen to execute their strategy, now operating from a solid base and ready for the next chapter!